Has the Market Mispriced FedEx After Its Cost Cutting and Automation Push in 2025?

- Wondering if FedEx is quietly turning into a value opportunity after years of being a market workhorse? You are not alone, and that is exactly what we are going to unpack here.

- After a relatively modest 1.7% gain over the last week and 5.1% over the past month, FedEx is up 2.5% year to date and about 1.6% over the last year, but still sits on a hefty 77.7% gain over 3 years that has reshaped how many investors see its risk and reward profile.

- Recent headlines have focused on FedEx's cost cutting, network optimization and strategic investments in automation and logistics technology, all aimed at boosting efficiency and protecting margins in a competitive shipping landscape. At the same time, the company continues to be a bellwether for global trade sentiment, so any shift in macro optimism or concern tends to ripple quickly through its share price.

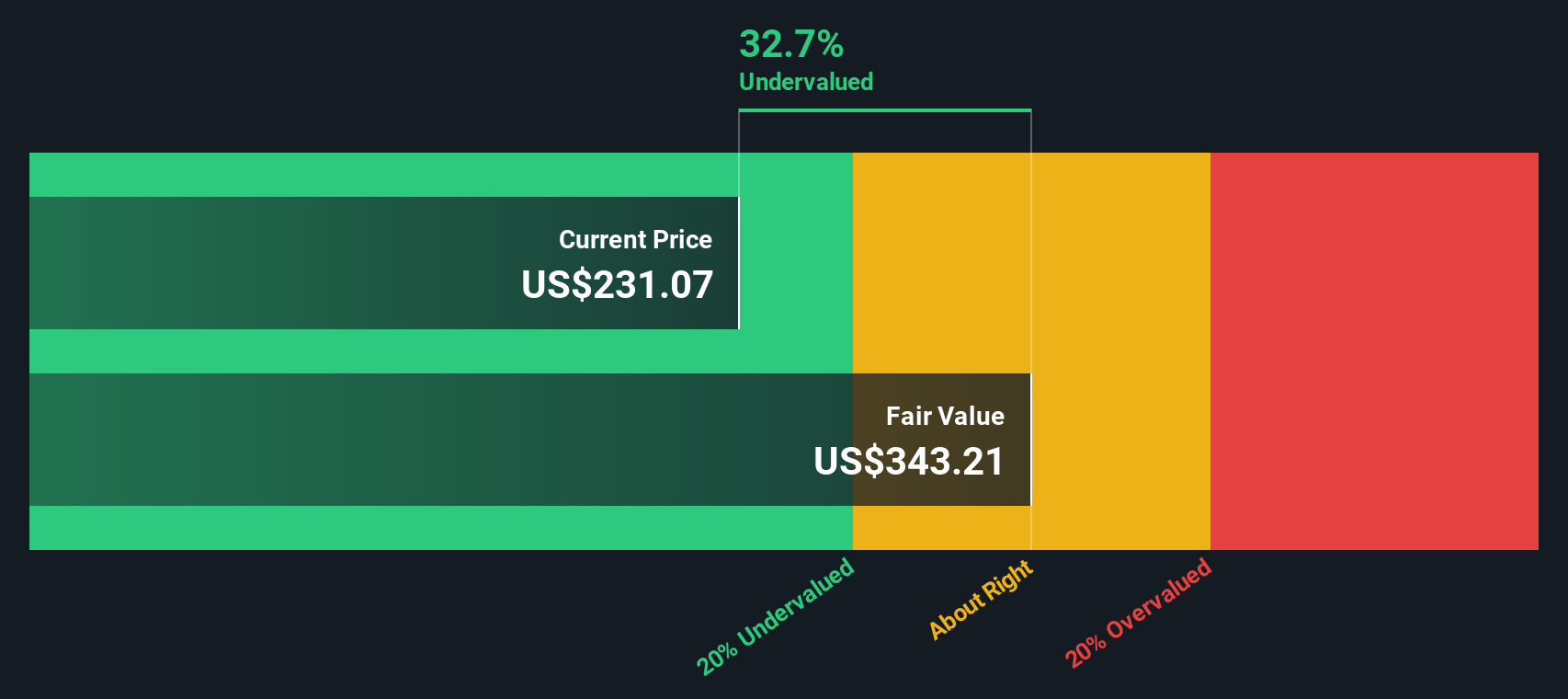

- Right now FedEx scores a 4/6 on our valuation checks, suggesting it screens as undervalued on most but not all metrics according to our valuation score. In the next sections we will walk through the key valuation approaches we use, before finishing with a more nuanced way to think about what the market is really pricing in.

Approach 1: FedEx Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today in $. For FedEx, this approach starts with last twelve months free cash flow of about $2.6 billion and then factors in analyst expectations and longer term extrapolations.

Analysts currently see free cash flow rising to roughly $4.6 billion by 2028, with Simply Wall St extending that trajectory out to 2035 using gradually moderating growth rates. Those future cash flows, plus an assumed value beyond the explicit forecast period, are all discounted back to today under a 2 Stage Free Cash Flow to Equity framework.

On this basis, the model estimates an intrinsic value of about $351.54 per share. Compared with the current share price, this implies the stock is roughly 20.0% undervalued according to the DCF, indicating that the market may not be fully reflecting FedEx's expected cash generation in its current price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests FedEx is undervalued by 20.0%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: FedEx Price vs Earnings

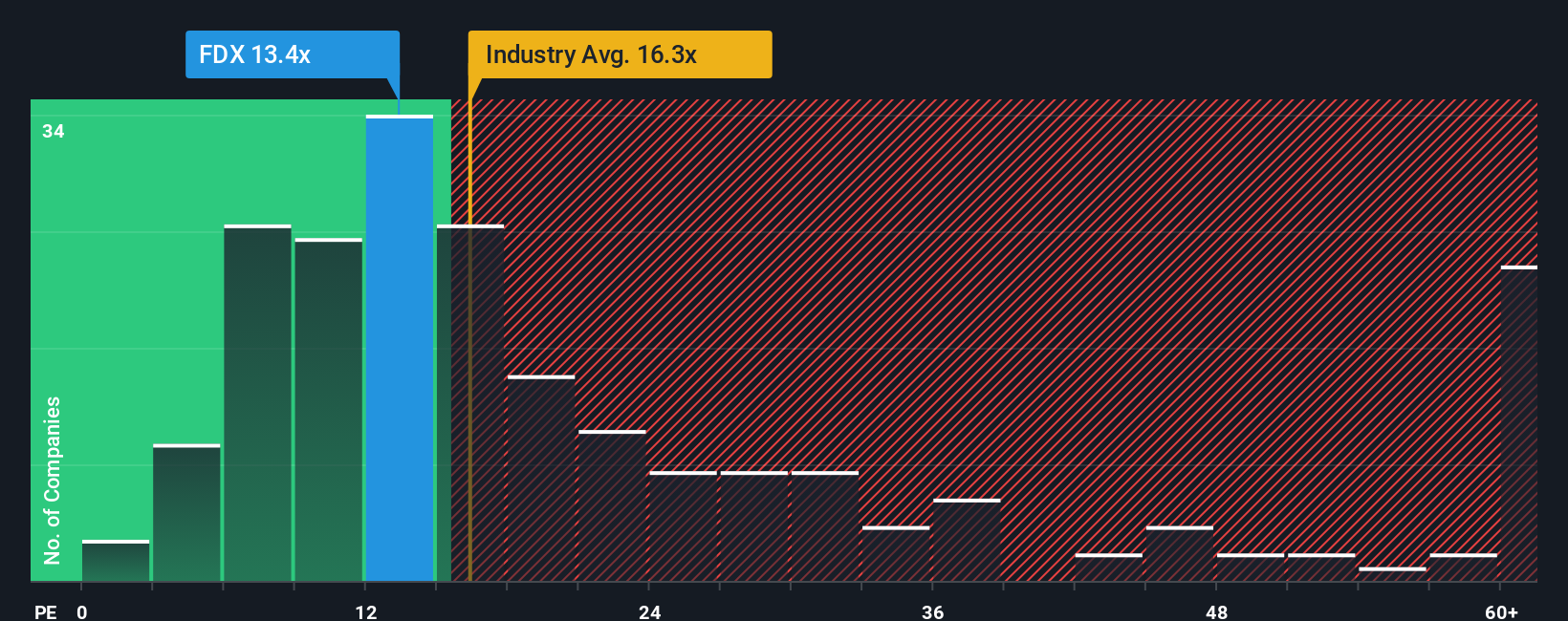

For a profitable company like FedEx, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. In general, companies with stronger growth prospects and lower perceived risk tend to justify higher PE ratios, while slower growth or higher risk usually deserves a discount multiple.

FedEx currently trades on a PE of about 16.1x. That is slightly above the Logistics industry average of around 15.9x, but meaningfully below the broader peer group average of roughly 20.9x. To move beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio framework, which estimates what PE multiple a stock should trade on given its earnings growth outlook, profitability, industry, size and risk profile.

For FedEx, this Fair Ratio comes out at about 19.4x, suggesting the shares could warrant a higher multiple than the market is currently assigning. With the actual PE sitting below this level, the multiple based view is consistent with the DCF work and indicates the stock may still have valuation support.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FedEx Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of FedEx’s story with a concrete forecast for its future revenues, earnings and margins and then translate that into a fair value you can compare to today’s share price.

On Simply Wall St’s Community page, Narratives let millions of investors document how they think FedEx’s cost discipline, network optimization and freight exposure will actually play out in the numbers. Each Narrative becomes a living bridge between a business thesis, a financial model and an eventual decision about whether Fair Value sits above or below the current Price.

Because Narratives update dynamically as new earnings, news and guidance are released, you can see how the market’s collective expectations shift over time, from the more cautious view that FedEx is worth closer to $200 per share through to the optimistic case closer to $320. You can then decide which version of the future you find most credible before acting.

Do you think there's more to the story for FedEx? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報