Coinbase (COIN): Assessing Valuation After a Multi‑Year Rally and Recent Share Price Pullback

Coinbase Global stock: recent performance snapshot

Coinbase Global (COIN) has been drifting lower, with the stock down about 12% over the past month and roughly 22% in the past 3 months, even as revenue continues to edge higher.

See our latest analysis for Coinbase Global.

Zooming out, Coinbase Global’s latest pullback, including its recent 1 day share price return of negative 6.37%, comes after a powerful multi year rally that has delivered a 3 year total shareholder return of over 600%. This suggests near term momentum is fading even as the longer term narrative around crypto adoption and onchain activity remains firmly on the table.

If Coinbase’s swings have you rethinking where growth could come from next, you might want to explore other high growth tech and AI names using our high growth tech and AI stocks as a starting point.

With Coinbase Global shares now well below analyst targets but still up sharply over three years, investors face a key question: is recent weakness signaling an undervalued entry point, or has the market already priced in future growth?

Most Popular Narrative: 34.7% Undervalued

With Coinbase Global last closing at $250.42 versus a narrative fair value near $383, the current slump is framed as a sizable disconnect in expectations.

The company's leadership in building trusted, compliant infrastructure has resulted in partnerships with major financial institutions (e.g., BlackRock, PNC, JPMorgan, Stripe, Shopify), positioning Coinbase as the preferred onramp for institutions entering the digital asset space, likely driving institutional trading volumes and custody revenues higher over time.

Want to see why this narrative backs a much higher price? It is built on a combination of expanding revenues, resilient margins, and a bold future earnings multiple. Curious which assumptions carry the most weight in that equation, and how they transform today’s trading platform into a potential future profit engine? Dive into the full narrative to unpack the numbers behind that valuation call.

Result: Fair Value of $383.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slipping spot trading volumes and rising competitive fee pressure could quickly undercut revenue growth assumptions and challenge confidence in this positive valuation trajectory.

Find out about the key risks to this Coinbase Global narrative.

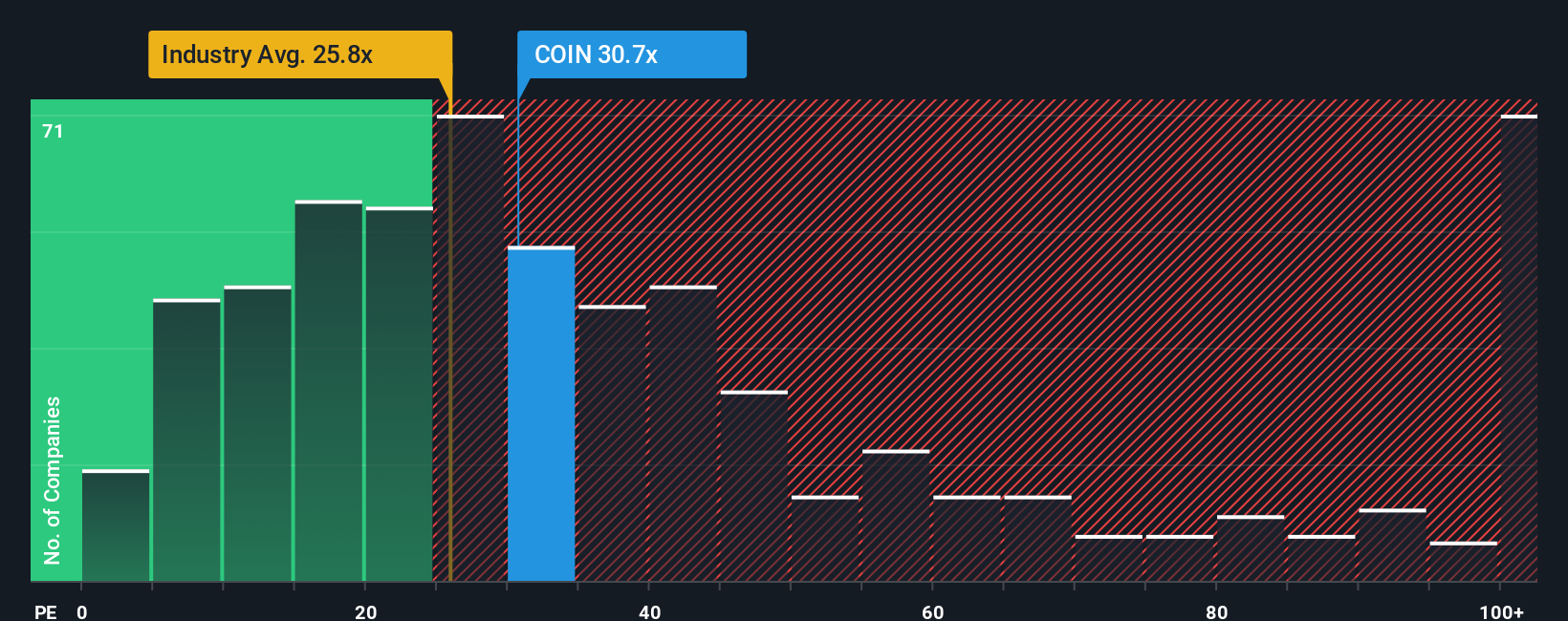

Another Take on Value: What Earnings Ratios Say

Our earnings based view is less enthusiastic than the narrative fair value. COIN trades at about 21 times earnings versus a 25 times industry average and a 22.3 times fair ratio, hinting at only modest upside and real execution risk if growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coinbase Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coinbase Global Narrative

If you see Coinbase differently or want to stress test your own assumptions, you can quickly build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Coinbase Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at Coinbase, you could miss out on other powerful setups, so use the Simply Wall St screener to uncover your next edge today.

- Target potential multi baggers early by scanning these 3627 penny stocks with strong financials that already show strong underlying financials instead of chasing hype after the move.

- Capitalize on the AI boom by focusing on these 25 AI penny stocks where innovation, growth momentum, and scalable business models are already lining up.

- Lock in reliable cash flow potential with these 13 dividend stocks with yields > 3% that pay attractive income while still leaving room for capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報