ASX (ASX:ASX) Valuation After ASIC’s Extra Capital Charge and Governance Overhaul

ASX (ASX:ASX) is back in focus after ASIC hit the exchange operator with an extra A$150 million capital charge, which is tied to a sweeping governance and risk management overhaul.

See our latest analysis for ASX.

The latest ASIC action has come on top of a tough run for the stock, with a 1 year total shareholder return of around negative 20 percent and a deeply negative year to date share price return, signaling fading momentum as investors reprice governance and execution risks.

If this kind of regulatory reset has you rethinking where you look for opportunities, it might be worth exploring fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

Yet with revenues still growing, earnings in the black, and the share price sitting below analyst targets, investors now face a key question: is ASX an undervalued turnaround play, or is the market already discounting its future growth?

Most Popular Narrative: 19.5% Undervalued

With ASX closing at A$52.09 against a narrative fair value of A$64.72, the valuation case leans positive and rests heavily on structural growth drivers.

Expansion and demand in high margin technology and data offerings driven by appetite for analytics, connectivity, and market information from both domestic and global market participants provides opportunity for recurring, diversified non transactional income, supporting overall margin expansion and earnings stability.

Curious how moderate growth, easing margins and a richer future earnings multiple can still justify a higher fair value than today? The narrative leans on steady revenue compounding, disciplined profit assumptions and a valuation framework that treats ASX more like a durable infrastructure play rather than a cyclical trade, but the exact mix of these levers might surprise you.

Result: Fair Value of A$64.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising technology and compliance costs, alongside persistent execution risk around CHESS and broader modernization, could quickly erode the upside in this more optimistic narrative.

Find out about the key risks to this ASX narrative.

Another Angle on Value

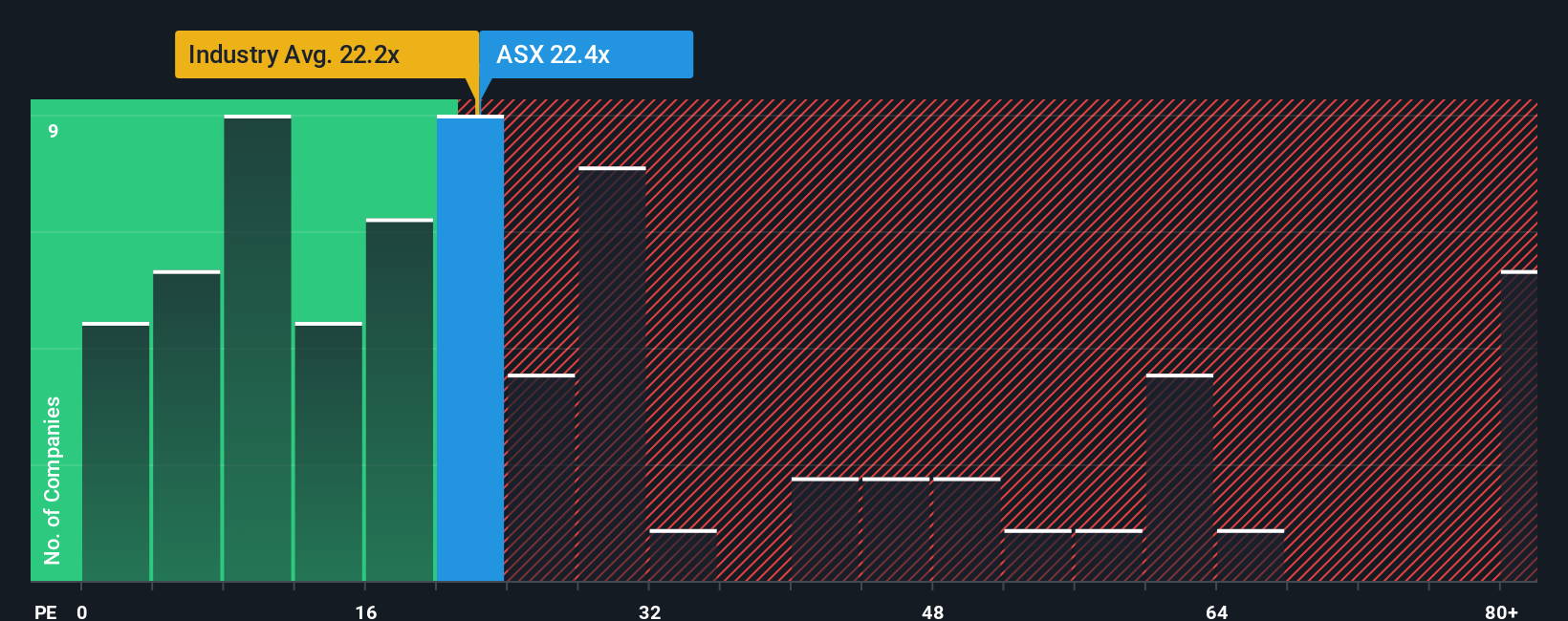

On earnings, ASX looks less forgiving. It trades on a 20.1x price to earnings ratio versus a 15.5x fair ratio, even if it is roughly in line with the Australian market and cheaper than many peers. Is the market overpaying for safety, or underestimating longer term risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ASX Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your ASX research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall St to work and build a shortlist of stocks that match your strategy, instead of waiting on the sidelines.

- Explore rapid innovation in automation, smart infrastructure, and next-gen computing by starting with these 28 quantum computing stocks that are positioned to reshape entire industries.

- Support your portfolio’s cash flow potential with these 13 dividend stocks with yields > 3% that pair current yields with underlying business strength.

- Identify potentially mispriced opportunities by filtering for these 913 undervalued stocks based on cash flows where current prices differ from long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報