Integral Ad Science (IAS): Reassessing Valuation After a 22% Three-Month Share Price Rebound

Integral Ad Science Holding (IAS) has been quietly grinding higher, with shares up about 22% over the past 3 months as investors reappraise its role in ad verification and connected TV.

See our latest analysis for Integral Ad Science Holding.

That recent 22% 3 month share price return has helped repair some of the damage from a softer year to date and slightly negative 1 year total shareholder return, suggesting momentum is quietly rebuilding as investors reassess growth and risk.

If IAS has you rethinking the digital ad space, it could be worth seeing which other high growth tech and ad focused names are standing out in high growth tech and AI stocks.

Yet with IAS delivering double digit revenue growth, faster net income gains, and trading only slightly below analyst targets despite a steep intrinsic discount, investors may be asking whether this is a mispriced compounder or whether the market is already baking in the upside.

Most Popular Narrative: 2.9% Undervalued

With Integral Ad Science Holding last closing at $10.28 against a narrative fair value of about $10.59, the story leans modestly in favor of upside and rests heavily on how durable its growth and margins prove to be.

Ongoing product innovation, particularly in AI driven optimization, contextual targeting, and fraud detection, allows IAS to monetize new service lines and extend premium pricing, which supports top line revenue growth and improved gross margins.

Curious how steady double digit growth, rising profitability, and a richer future earnings multiple all combine into that fair value? The narrative leans on ambitious revenue scaling, margin expansion, and a premium valuation usually reserved for category leaders. Want to see the exact assumptions behind that call and how sensitive the outcome is to even small changes in those inputs? Dive deeper to unpack the full valuation blueprint.

Result: Fair Value of $10.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could be derailed if key platform partners internalize verification capabilities, or if tougher privacy rules blunt IAS’s data advantage.

Find out about the key risks to this Integral Ad Science Holding narrative.

Another Angle on Value

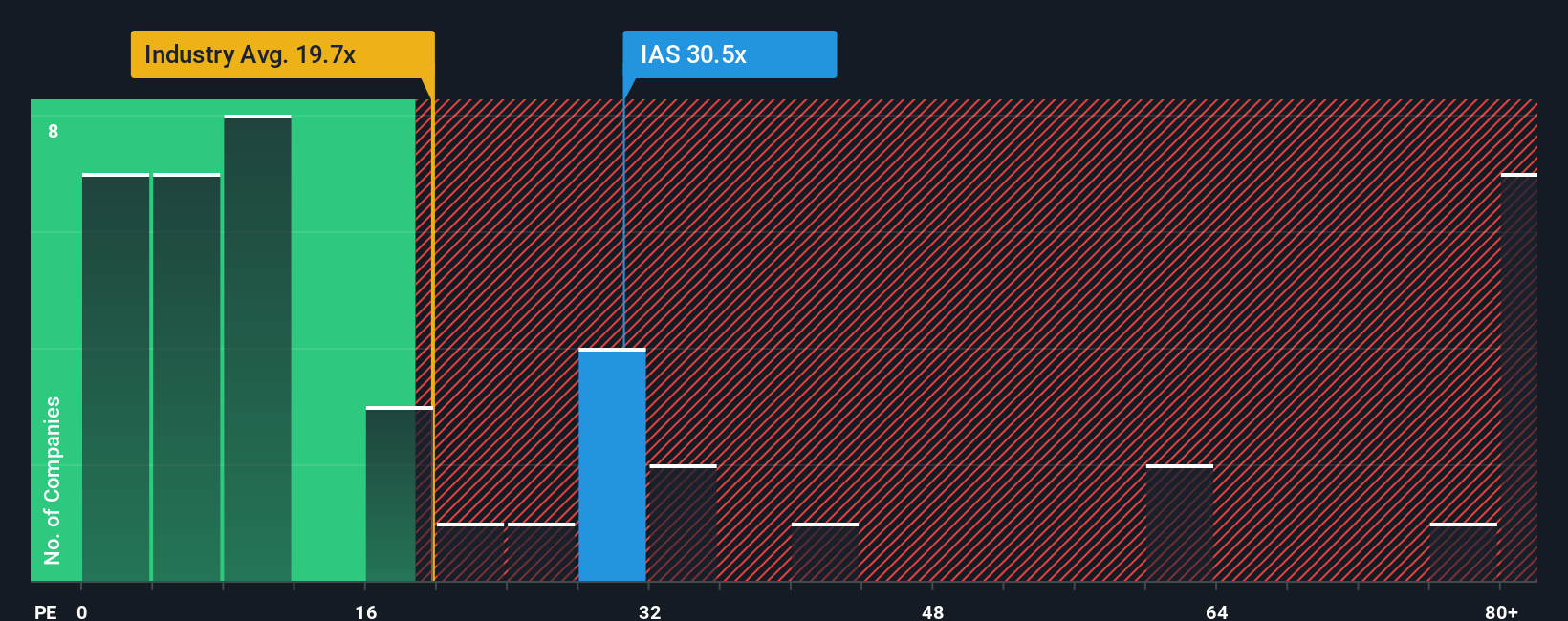

Looked at through its earnings ratio, IAS screens as pricey. The shares trade on about 36.9 times earnings, more than double the US Media industry at 15.9 times and well above a 20.2 times fair ratio, which hints that sentiment already prices in a lot of future success.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Integral Ad Science Holding Narrative

If you see the story unfolding differently, or simply want to stress test the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Integral Ad Science Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at just one opportunity. Use the Simply Wall Street Screener to uncover fresh ideas that could reshape your portfolio before the crowd catches on.

- Capitalize on powerful secular themes by scanning these 25 AI penny stocks that could benefit most from the rapid adoption of intelligent software and automation.

- Lock in income potential by reviewing these 13 dividend stocks with yields > 3% that may offer more reliable cash returns than simple price appreciation alone.

- Position yourself ahead of the market by evaluating these 913 undervalued stocks based on cash flows where prices still lag behind the underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報