US Undiscovered Gems to Watch in December 2025

In the current landscape, major U.S. stock indices like the Dow Jones and S&P 500 have recently retreated, influenced by unexpected unemployment data and shifts in Federal Reserve interest rate policies. Despite these broader market challenges, small-cap stocks often present unique opportunities for investors seeking growth potential in under-the-radar companies. Identifying promising stocks requires an understanding of how these smaller companies can navigate economic fluctuations while capitalizing on niche markets or innovative solutions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Ponce Financial Group (PDLB)

Simply Wall St Value Rating: ★★★★★★

Overview: Ponce Financial Group, Inc. is the bank holding company for Ponce Bank, offering a range of banking products and services with a market capitalization of $397.85 million.

Operations: Ponce Financial Group generates revenue primarily from its thrift and savings loan institutions, amounting to $96.25 million.

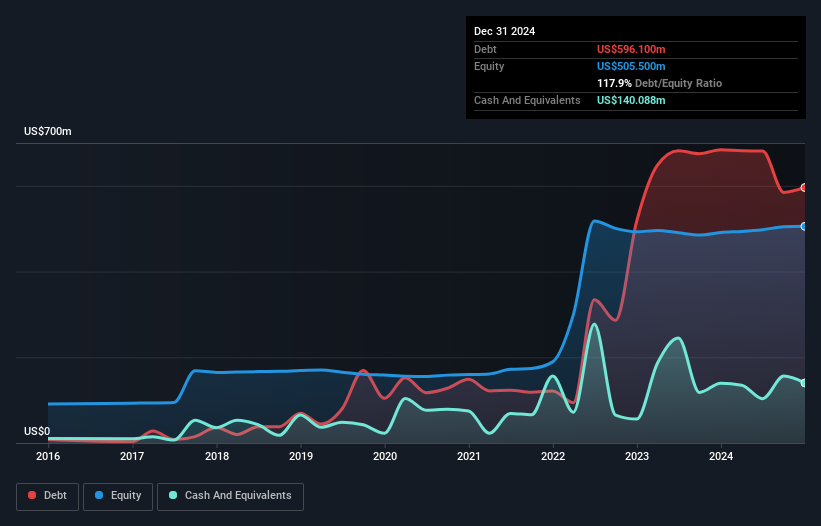

Ponce Financial, a nimble player in the banking sector, boasts total assets of US$3.2 billion and equity of US$529.8 million, highlighting its robust financial standing. With total deposits at US$2.1 billion and loans amounting to US$2.5 billion, it maintains a healthy balance between liabilities and lending activities. The bank's net charge-offs for the recent quarter were notably reduced to $200,000 from $896,000 last year, showcasing improved credit management. A sufficient allowance for bad loans at 105% further underscores its prudent risk management approach while expanding its community presence with a new branch in Upper Manhattan signals strategic growth ambitions.

Unity Bancorp (UNTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Unity Bancorp, Inc. is a bank holding company for Unity Bank, offering commercial and retail banking services, with a market capitalization of $565.02 million.

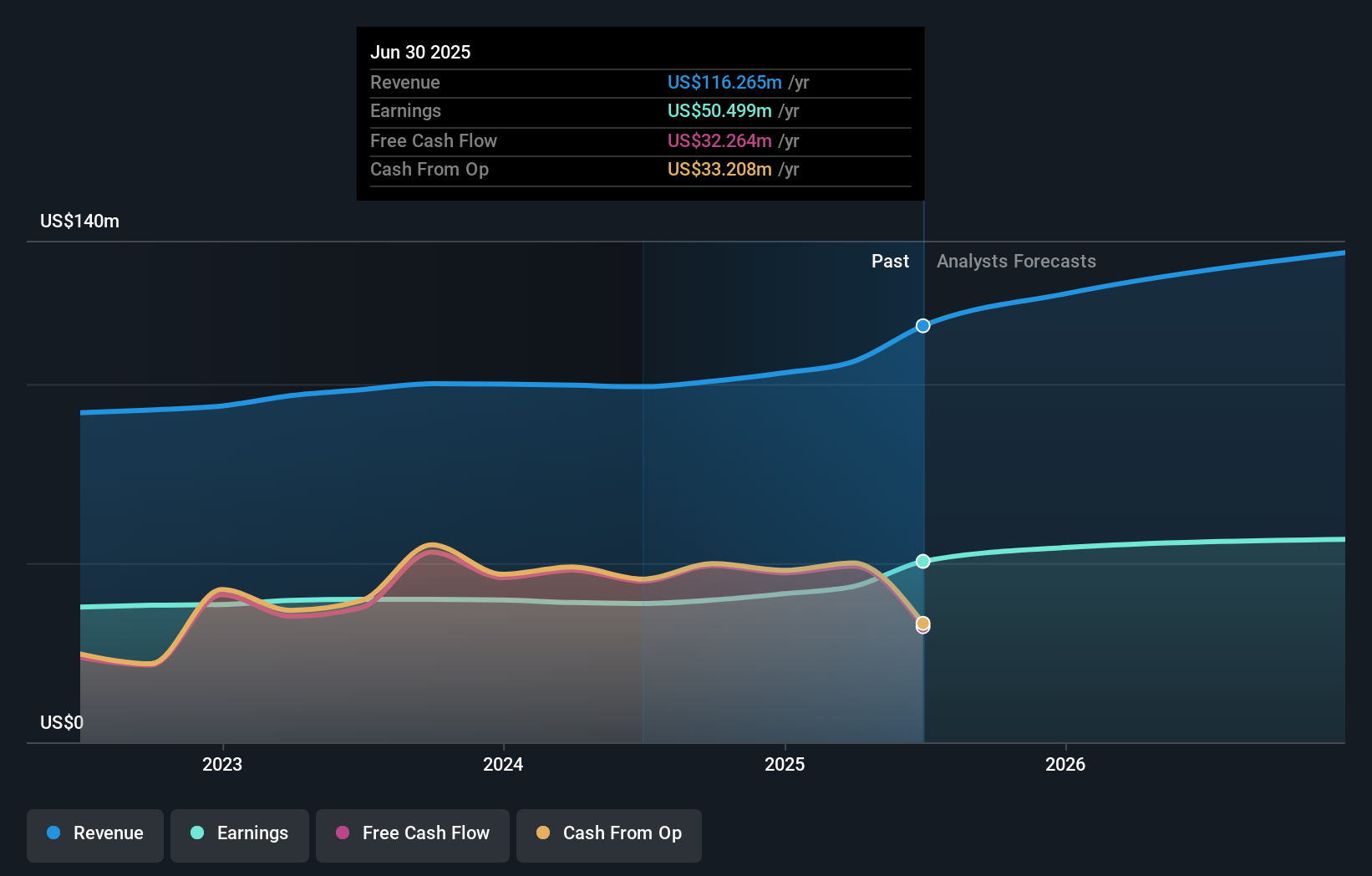

Operations: Unity Bancorp generates revenue primarily through its commercial banking segment, which accounts for $121.97 million.

Unity Bancorp is making waves with a robust financial position, boasting total assets of US$2.9 billion and equity of US$334 million. The bank's earnings growth of 35.9% over the past year outpaces the industry average, supported by a net interest margin of 4.2%. With deposits totaling US$2.3 billion and loans at US$2.4 billion, it maintains an appropriate level of bad loans at just 0.9%. The company has demonstrated strong financial health with sufficient allowance for bad loans (145%), while trading at an attractive valuation, estimated to be 53% below its fair value estimate.

- Get an in-depth perspective on Unity Bancorp's performance by reading our health report here.

Understand Unity Bancorp's track record by examining our Past report.

CompX International (CIX)

Simply Wall St Value Rating: ★★★★★★

Overview: CompX International Inc. is a company that manufactures and sells security products and recreational marine components primarily in North America, with a market capitalization of approximately $300.19 million.

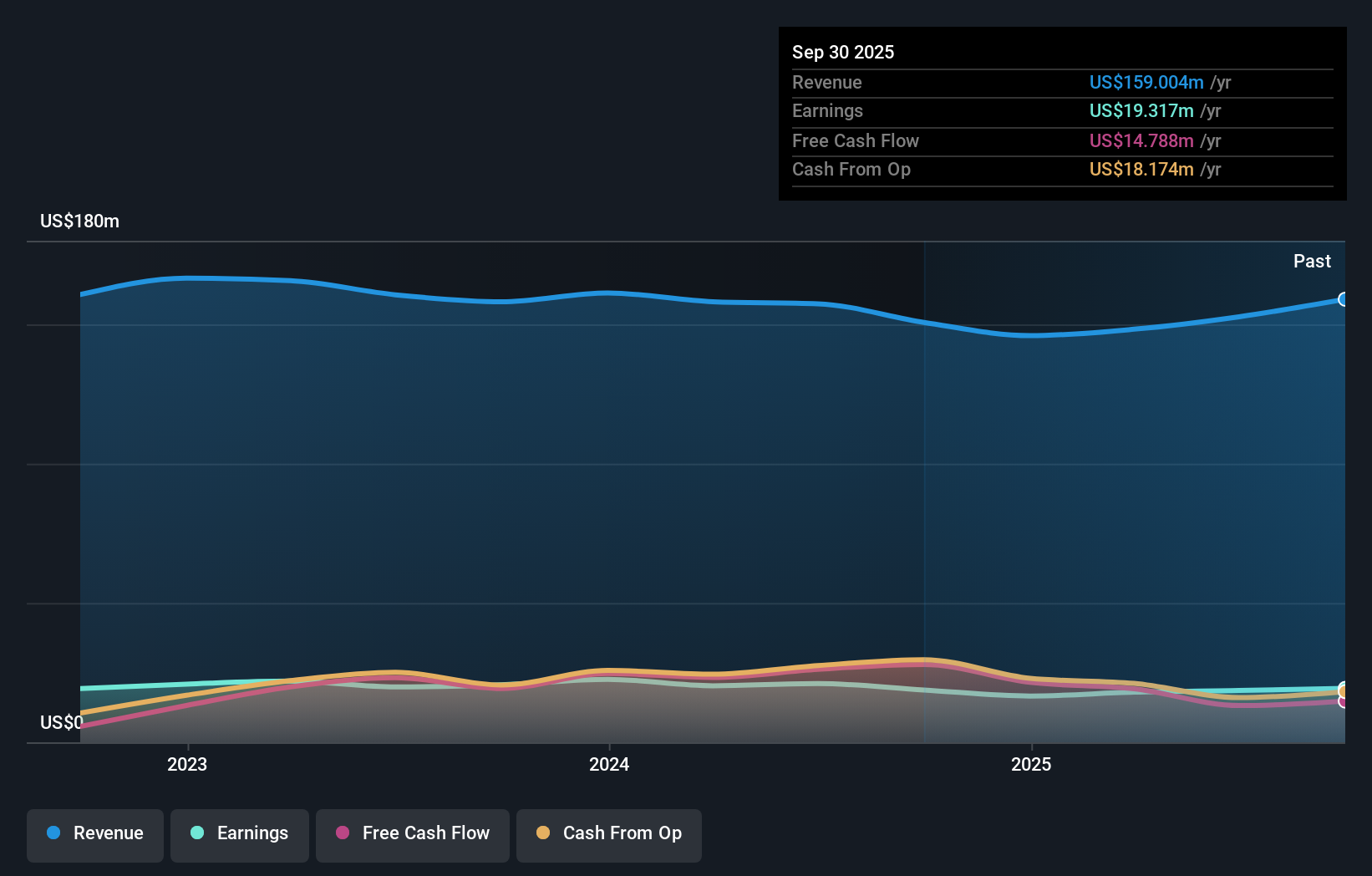

Operations: CompX International generates revenue through two main segments: security products, contributing $121.76 million, and marine components, with $37.25 million in sales.

CompX International, a nimble player in the commercial services sector, boasts a debt-free status for over five years, enhancing its financial stability. The company trades at 19% below its estimated fair value, suggesting potential upside. Recent earnings growth of 2.9% slightly outpaced the industry average of 2.8%, indicating competitive performance. In Q3 2025, CompX reported sales of US$39.95 million and net income of US$4.22 million, improving from last year’s figures by US$6.28 million and US$0.74 million respectively; basic earnings per share rose to US$0.34 from US$0.28 a year ago—highlighting steady progress in profitability and shareholder returns with consistent dividends declared at $0.30 per share.

- Click to explore a detailed breakdown of our findings in CompX International's health report.

Explore historical data to track CompX International's performance over time in our Past section.

Turning Ideas Into Actions

- Discover the full array of 293 US Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報