Erie Indemnity (ERIE): Assessing Valuation After a 30% Share Price Pullback

Erie Indemnity (ERIE) has quietly lagged the broader market this year, with the stock down about 30% year to date even as revenue and net income continue to grow at midsingle to low double digit rates.

See our latest analysis for Erie Indemnity.

That weak year to date share price return sits in sharp contrast to Erie Indemnity’s solid multiyear total shareholder return, suggesting investors are reassessing how much they are willing to pay for its consistent but unspectacular growth profile.

If Erie’s muted momentum has you thinking about where capital could work harder, this could be a good moment to explore fast growing stocks with high insider ownership.

So with a sharp pullback, solid earnings growth, and no clear analyst anchor on valuation, is Erie Indemnity now trading below its true worth, or is the market simply pricing in slower future growth already?

Price-to-Earnings of 23.2x: Is it justified?

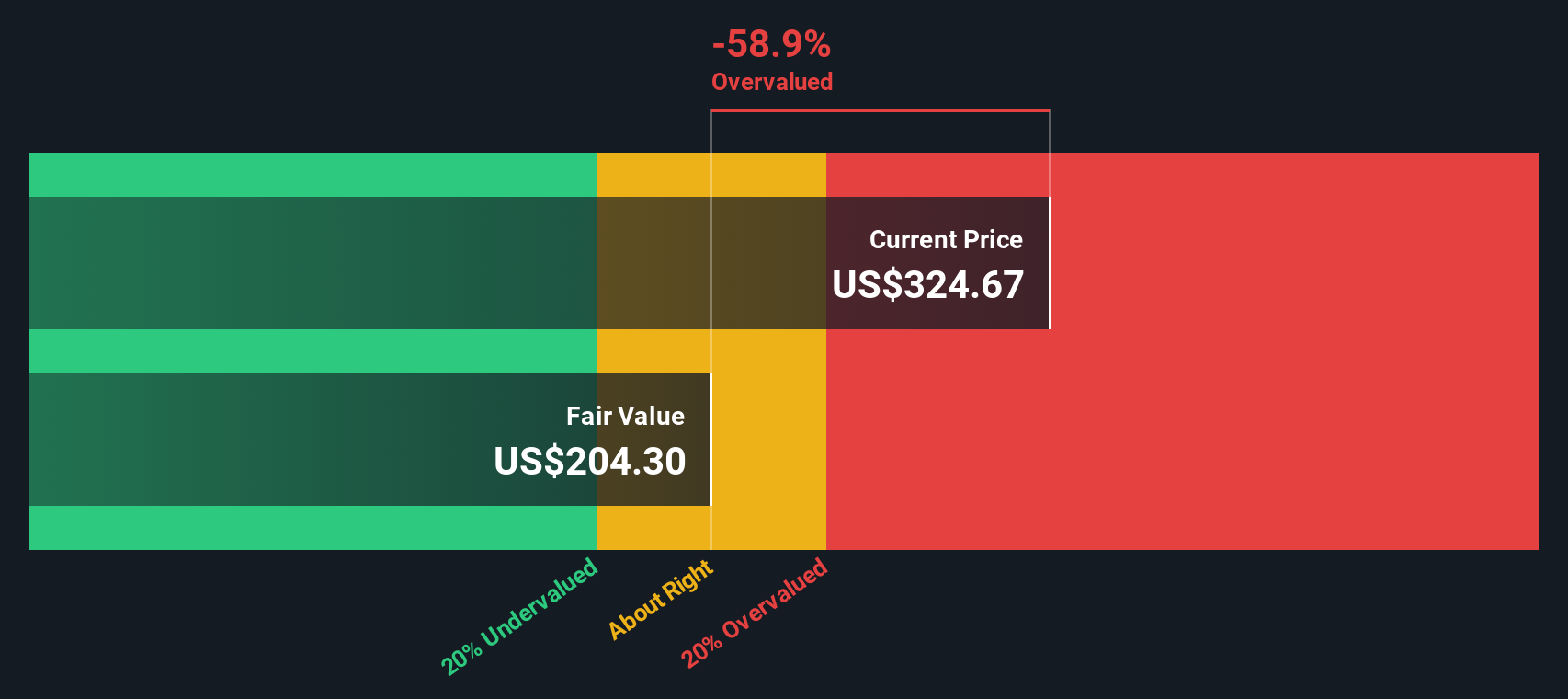

At roughly $287 a share, Erie Indemnity trades at a 23.2 times Price to Earnings multiple, a level that screens as expensive versus fair value and peers.

The Price to Earnings ratio compares today’s share price to the company’s per share earnings, a common way to judge how much investors are paying for current profitability in insurance and other steady earners.

In Erie’s case, the market is assigning a premium multiple despite earnings that, while solid, are forecast to grow at a more measured pace than the wider US market. This implies investors may already be paying up for that quality and consistency. Relative to an estimated fair Price to Earnings of 15.1 times, there is a sizable gap that could narrow if sentiment cools or growth expectations ease.

Against the broader US Insurance industry average of 13.6 times, Erie’s 23.2 times stands out as a pronounced premium. This signals that the shares are richly valued compared with sector norms and the level the market might eventually gravitate toward.

Explore the SWS fair ratio for Erie Indemnity

Result: Price-to-Earnings of 23.2x (OVERVALUED)

However, investors should watch for slowing policy growth or margin pressure from rising claims costs, either of which could quickly justify Erie’s recent valuation reset.

Find out about the key risks to this Erie Indemnity narrative.

Another View on Value

Our DCF model points to a fair value of about $221.51 per share, which suggests Erie Indemnity is trading above what its long term cash flows might justify. That pushes against the idea that a quality premium alone can support today’s price, or it may indicate that the market sees something the model cannot.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Erie Indemnity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Erie Indemnity Narrative

If this perspective does not quite match your own, or you prefer hands on research, you can build a personalized view in just a few minutes. Start with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Erie Indemnity.

Ready for more high conviction ideas?

Before you move on, give yourself the chance to spot your next winner with the Simply Wall Street Screener, where focused ideas can sharpen your edge.

- Capture potential mispricings early by running your filters against these 906 undervalued stocks based on cash flows and zeroing in on companies whose cash flows signal upside the market has not fully priced in.

- Position for the next wave of innovation by scanning these 26 AI penny stocks and pinpointing businesses turning cutting edge artificial intelligence into real revenue growth.

- Lock in dependable income streams by reviewing these 13 dividend stocks with yields > 3% and targeting companies offering attractive yields backed by sustainable payout ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報