CoStar Group (CSGP): Rethinking Valuation After Google Tests Direct Homes‑for‑Sale Search Listings

CoStar Group (CSGP) slid after reports that Google is testing homes for sale listings directly in search results. This move could reshape how buyers find properties and how platforms compete for traffic.

See our latest analysis for CoStar Group.

That headline risk has landed on an already weak tape, with a 90 day share price return of minus 27.45 percent and a one year total shareholder return of minus 12.83 percent, signaling fading momentum despite solid revenue growth.

If this Google test has you rethinking exposure to real estate platforms, it might be worth scanning for other opportunities via fast growing stocks with high insider ownership.

Yet with shares now trading at a discount to Wall Street targets despite double digit revenue and profit growth, is CoStar an undervalued compounder on sale, or is the market already discounting years of platform risk?

Most Popular Narrative Narrative: 30.7% Undervalued

With CoStar Group last closing at $63.75 against a narrative fair value near $91.94, the story hinges on aggressive growth and margin expansion assumptions.

Market and regulatory trends continue to increase the need for transparency, fee disclosure, and real-time data, solidifying CoStar's role as a trusted industry standard and enabling sustainable pricing power, which should help further margin expansion.

Want to see what kind of revenue trajectory and profit ramp this narrative is baking in, and how steep the future valuation multiple really is? Read on to uncover the assumptions driving that upside gap.

Result: Fair Value of $91.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on Homes.com scaling efficiently and competitive responses from Zillow and others not eroding pricing power or margin expansion.

Find out about the key risks to this CoStar Group narrative.

Another View: Rich on Sales, Even if the Story Looks Cheap

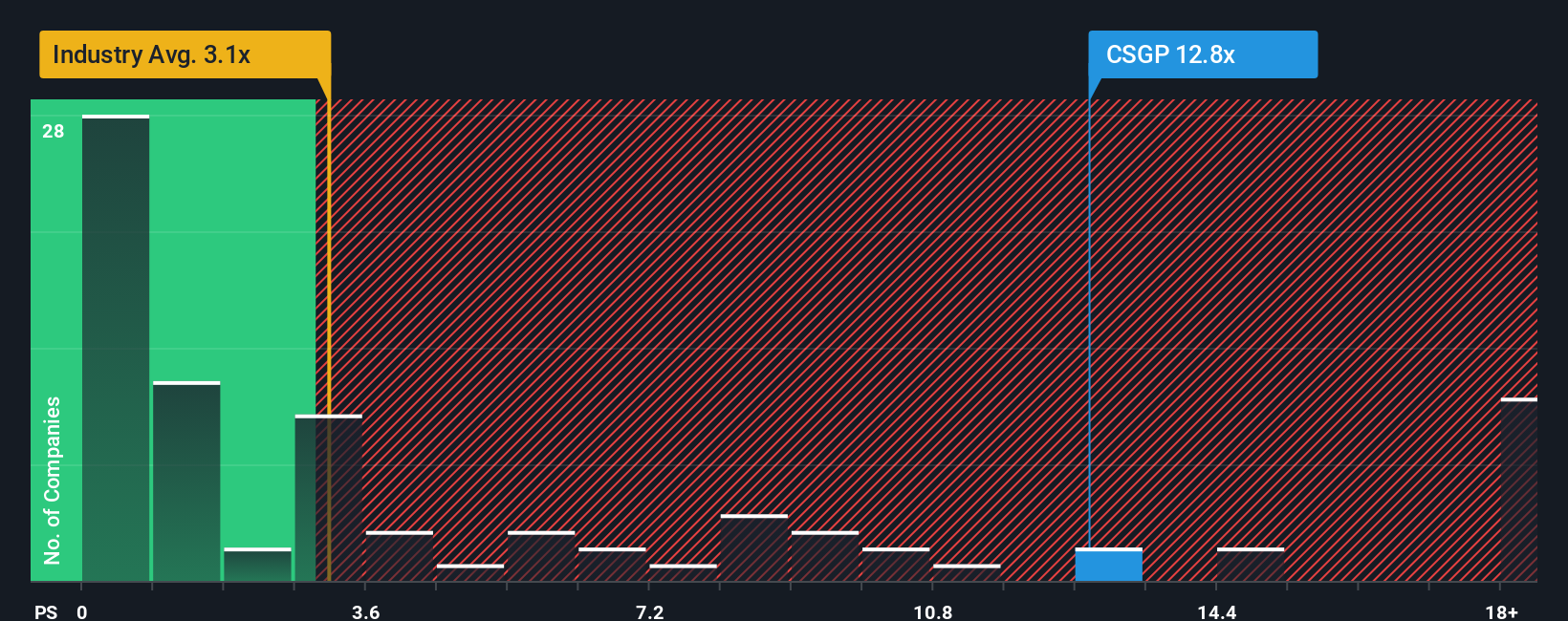

On narrative fair value CoStar looks 30 percent undervalued, but its 8.8 times price to sales is far above both the US real estate industry at 2.2 times and peers at 2.4 times. It even sits above a 6 times fair ratio, which raises the risk that sentiment snaps back before earnings catch up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CoStar Group Narrative

If this perspective does not fully resonate, or you would rather examine the numbers yourself, you can build a custom view in under three minutes: Do it your way.

A great starting point for your CoStar Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity; sharpen your edge by quickly scanning fresh ideas that match your style before the market prices them in.

- Capture potential mispricings early by reviewing these 906 undervalued stocks based on cash flows that strong cash flow analysis flags as trading below their intrinsic worth.

- Explore rapid innovation by checking these 26 AI penny stocks that focus on artificial intelligence and its role in reshaping industries.

- Boost your income strategy by targeting these 13 dividend stocks with yields > 3% that combine attractive yields with the potential for long term capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報