Taking Stock of Atlantic Union Bankshares (AUB) Valuation After Fresh Analyst Upgrades and Strategy Pivot

Atlantic Union Bankshares (AUB) just caught a fresh wave of attention after several Wall Street firms updated their views, zeroing in on the bank’s shift from acquisition driven growth to organic execution and future capital returns.

See our latest analysis for Atlantic Union Bankshares.

That shift in narrative seems to be resonating, with the share price up 7.5 percent over the last week and 13.4 percent over the past month, even though the year to date share price return is still slightly negative and the one year total shareholder return remains in the red. At the same time, longer term total shareholder returns over three and five years point to steadier value creation in the background.

If this kind of transition story has your attention, it could be a good time to look beyond banks and explore fast growing stocks with high insider ownership for other compelling ideas.

With analysts now seeing double digit upside, a cleaner balance sheet and organic growth on the horizon, is Atlantic Union Bankshares still trading below its true value, or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 11.1% Undervalued

The most followed narrative sees Atlantic Union Bankshares worth around $41.44 per share versus the recent $36.85 close, setting up an earnings driven rerating story.

The successful integration of Sandy Spring Bank and the sale of $2 billion in commercial real estate loans have reduced risk concentrations, freed up lending capacity, and expanded the company's customer base in markets with the lowest unemployment nationally, supporting better credit performance, new fee income, and future earnings upside.

Want to see what powers that higher value, beyond one off integrations and loan sales? The narrative leans on aggressive revenue growth, rapidly expanding margins, and a future earnings multiple that looks more ambitious than a typical regional bank. Curious how those moving parts combine into that price tag?

Result: Fair Value of $41.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated Mid Atlantic exposure and heavy investment in new branches and integrations could pressure margins and credit quality if growth or interest rates fall short of expectations.

Find out about the key risks to this Atlantic Union Bankshares narrative.

Another Angle on Valuation

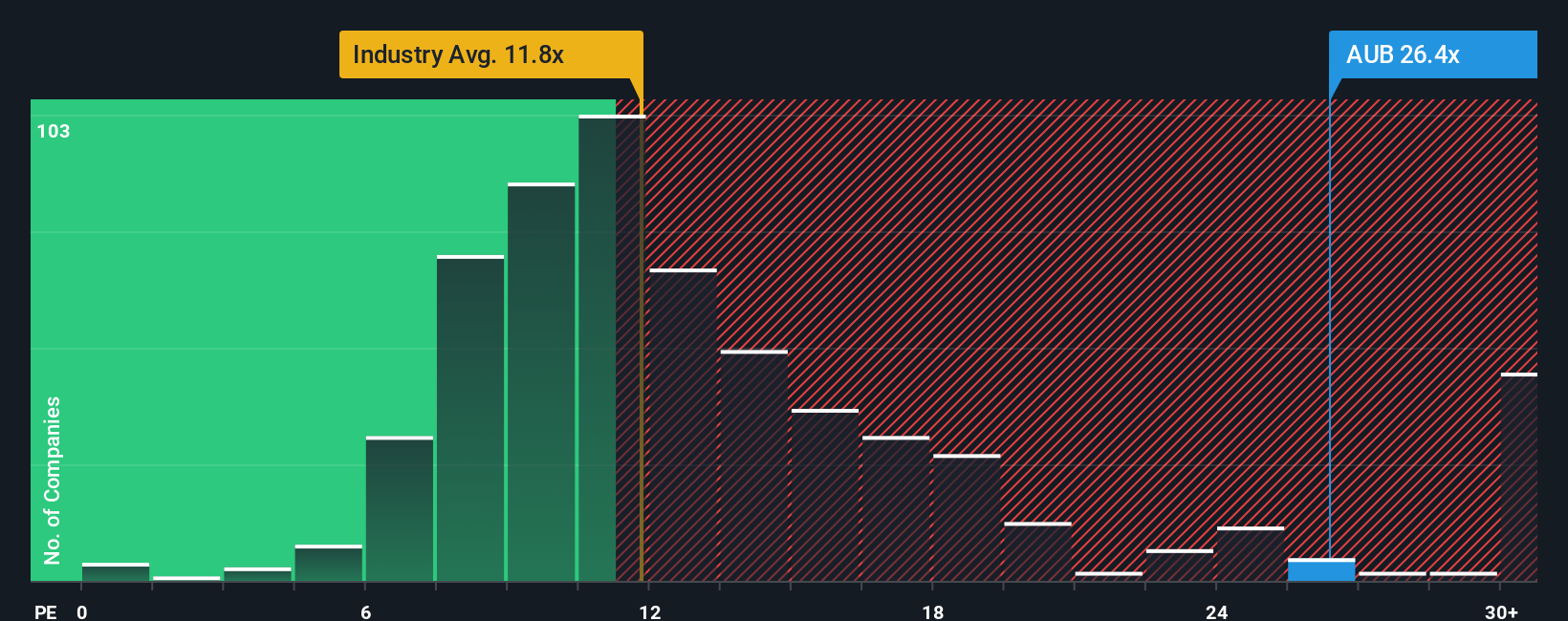

On earnings, Atlantic Union Bankshares looks less forgiving. Its price to earnings ratio sits at 25.3 times, above both its fair ratio of 21.8 times and the US banks average of 11.9 times, suggesting less margin of safety if growth or credit trends disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atlantic Union Bankshares Narrative

If you see the story differently or want to stress test the assumptions yourself, you can quickly craft a personalized view in just minutes: Do it your way.

A great starting point for your Atlantic Union Bankshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an information edge by scanning fresh stock ideas tailored to different strategies so your next move is deliberate, not reactive.

- Target steady income growth by reviewing these 13 dividend stocks with yields > 3% that can help support long term cash flow in your portfolio.

- Catch emerging innovation early by scanning these 26 AI penny stocks positioned at the forefront of artificial intelligence adoption and monetization.

- Strengthen your value playbook with these 906 undervalued stocks based on cash flows that may be trading below their intrinsic worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報