Will Expanding ECOCycle® Recycling Capacity Across Europe Change Holcim's (SWX:HOLN) Narrative?

- Holcim recently completed two acquisitions and agreed a third in demolition materials recycling across the UK, Germany and France, adding around 1.3 million tons of annual permitted processing capacity to accelerate its ECOCycle® circular construction platform in Europe.

- By linking these recycling businesses into its existing network, including prior UK and continental European deals, Holcim is deepening local access to circular construction services in major urban and infrastructure markets.

- We’ll now examine how this expansion of ECOCycle® recycling capacity across key European hubs could influence Holcim’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Holcim Investment Narrative Recap

To own Holcim, you need to believe it can compound earnings and cash flows by shifting its portfolio toward higher value, lower carbon building solutions while managing cyclical demand and regulatory pressure. The latest ECOCycle recycling acquisitions modestly reinforce the near term catalyst around sustainable products and capital deployment, but do not materially change the central risk that expectations for long term volume and margin growth may prove too optimistic.

Among recent announcements, the planned North American spin off stands out in this context, because it could reshape how investors think about Holcim’s core European and global circular construction platforms. The new recycling capacity in the UK, Germany and France will likely sit inside the remaining group, which keeps execution risk on M&A integration and circular growth firmly in focus as a key part of the story.

Yet while ECOCycle capacity is growing, investors still need to consider how tightening decarbonization rules in Europe could...

Read the full narrative on Holcim (it's free!)

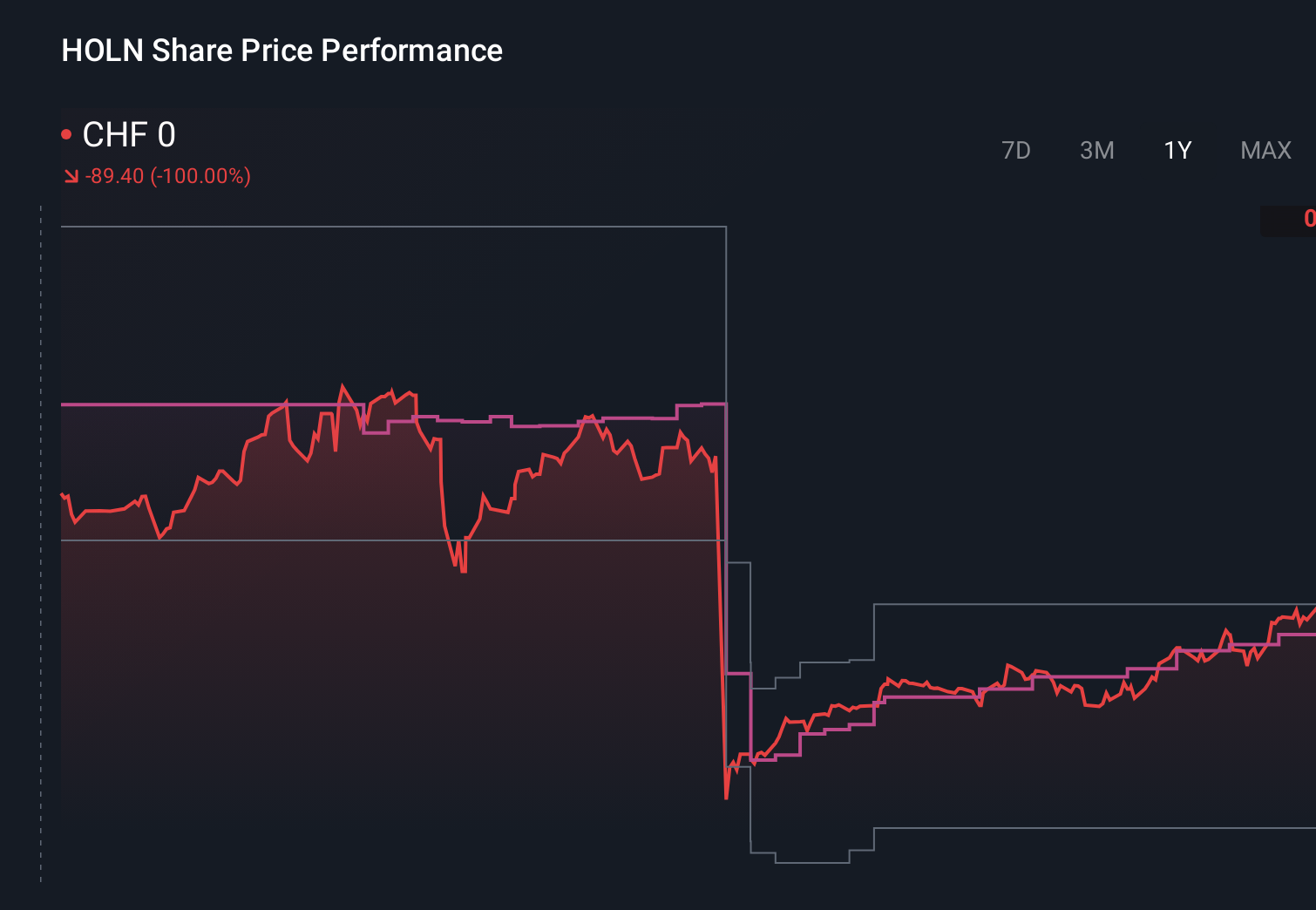

Holcim's narrative projects CHF17.9 billion revenue and CHF2.4 billion earnings by 2028.

Uncover how Holcim's forecasts yield a CHF74.92 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members see Holcim’s fair value anywhere between CHF38.97 and CHF77.72 across 11 separate views, underscoring how far opinions can diverge. Against that backdrop, the assumption that circular and low carbon products will support resilient margins and growth deserves closer scrutiny given Holcim’s expanding ECOCycle footprint in Europe.

Explore 11 other fair value estimates on Holcim - why the stock might be worth 49% less than the current price!

Build Your Own Holcim Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Holcim research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Holcim research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Holcim's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報