US non-farm payrolls confirmed the cooling of the labor market in November and strengthened the logic of the Federal Reserve's interest rate cut

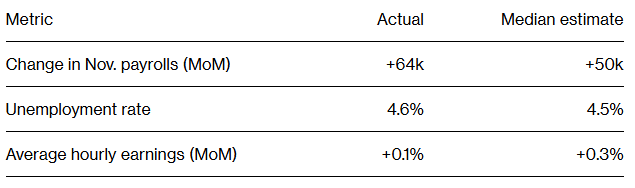

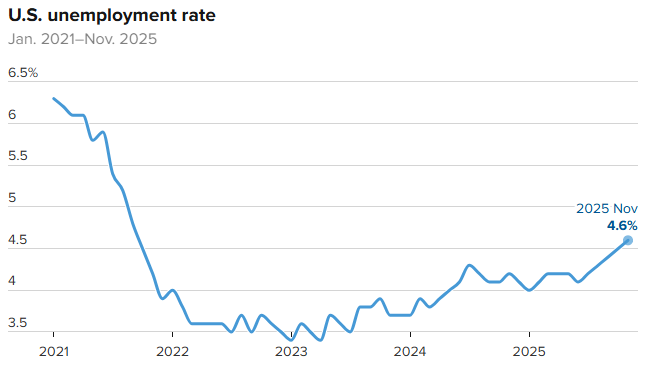

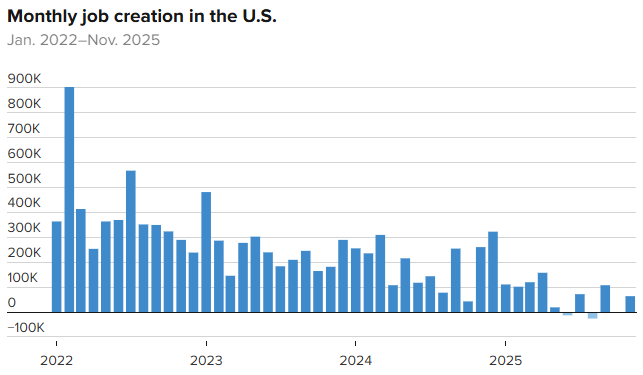

The Zhitong Finance App learned that according to data released by the US Bureau of Labor Statistics, the number of non-farm payrolls increased by 64,000 in November, and the market expects an increase of 50,000. In October, the number of non-farm payrolls fell by 105,000, and the market expected a decrease of 25,000. The unemployment rate in November was 4.6%, higher than market expectations and the highest level since 2021. Due to the shutdown of the US government, the Bureau of Labor Statistics was unable to collect relevant data retroactively, so it was unable to announce the unemployment rate for October.

The number of new non-farm payrolls was revised from -40,000 to -26,000 in August; the number of new non-farm payrolls was revised from 119,000 to 108,000 in September. After the revision, the total number of new jobs added in August and September was 33,000 lower than before the revision.

The increase in employment in November was supported by health care, social assistance, and a decline in employment in the construction, transportation and storage industries, and leisure and hospitality industries. The analysis indicates that the number of people employed in the US manufacturing industry has fallen to its lowest level since March 2022 — this is clearly not the situation the Trump administration wants to see. There are currently no signs that policies promoting the return of manufacturing will effectively drive employment growth. Moreover, the year-on-year increase in average hourly wages has slowed to the most moderate level since May 2021. Although the 3.5% increase is still higher than the inflation rate, it is lower than the 3.6% forecast, which also indicates that actual wage growth is slowing down, down from 3.8% in September. This does not help ease the pressure on people's living costs.

The analysis points out that this has intensified the development of the K-type economy in the US. Consumer demand in the US has remained stable, but it has become increasingly polarized. This is because consumer confidence is weakening, and labor-market fragility is increasing, and the gap between wage growth for low-income households and wage growth for high-income households continues to widen.

The average number of job growth over the past three months is currently 22,000. Even without taking Powell's adjustment factors into account, this figure is lower than what most economists expected the so-called “equilibrium ratio.” The so-called “balance ratio” refers to the amount of additional labor required each month to meet the new demand in the labor market. Due to the reduction in the number of immigrants, this “equilibrium rate” has declined drastically. Some economists estimate this ratio to be around 50,000 people, and maybe even lower. But the current number of people is far below that level, and most economists believe this is not enough to prevent the unemployment rate from rising.

Brian Bethune, a professor of economics at Boston College, said, “The current situation is that companies don't want to increase the number of employees, but they won't have large-scale layoffs like during the recession. When large companies are hit by an unexpected shock, the easiest response is to stop hiring. ”

The number of employed people increased in November, ending the decline in October, which made the fluctuating trend in the labor market in recent months even more obvious. However, the unemployment rate continues to rise, as layoffs increase, making it difficult for many unemployed Americans to find new jobs. Despite some limitations in these data, the report will help provide a reference basis for investors' expectations for next year's interest rate trends.

The Federal Reserve cut interest rates for the third time in a row last week to support what Powell called a “gradually cooling down” labor market, which has “significant” downside risks. However, the bitmap shows that officials had major differences not only in decisions made at last week's meeting, but also in future policy formulation. Officials' median predictions show that interest rates will be cut once by 2026, while traders still expect to cut interest rates twice. Expectations of market interest rate cuts heated up slightly after the data was released.

Yesterday, New York Federal Reserve Chairman Williams — the policymaker who accurately predicted that the Federal Reserve would cut interest rates in December — said he expected the employment data to show that the labor market was “gradually cooling down,” which appears to be what we are currently seeing. There is no large-scale recession, but the employment situation is definitely weakening: this can be seen in rising unemployment, falling employment, and slowing wage growth.

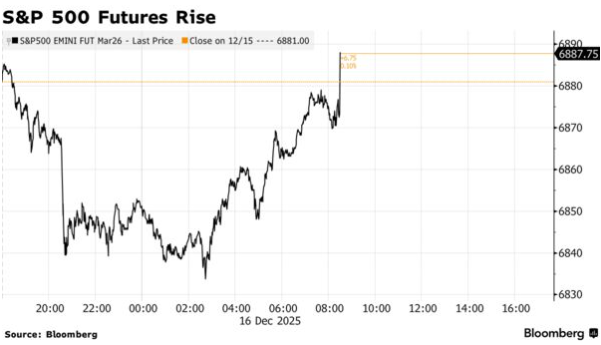

Meanwhile, Morgan Stanley strategist Michael Wilson previously said that the weakness of non-farmers will boost US stocks. Wilson said in a report, “We are now clearly back to the 'good news is bad news/bad news is good news' situation.”

After the US non-agricultural data was released, US stock futures also rose in the short term as scheduled. Nasdaq futures rose 0.13% during the day, S&P 500 futures rose 0.13%, and Dow futures rose 0.12%; the US dollar index declined in the short term and fell below the 98 mark. Currently, it is 97.92, down 0.35% during the day. Spot gold rose slightly, rising 0.14% during the day to 4311 US dollars/ounce.

The latest forecast from Citigroup strategists also shows that by the end of 2026, the S&P 500 index will rise 12% to 7,700 points. The core support for this forecast is steady corporate profit growth and expectations of monetary policy easing. The bank's strategist Scott Cronart said bluntly: “A Federal Reserve that generally supports interest rate cuts is a key assumption in our predictions.”

However, the market still believes that it is unlikely that interest rates will be cut again in January. According to the Chicago Mercantile Exchange's “Federal Reserve Watch” data, after the release of the employment report, this possibility was about 24.4%, the same as Monday's data.

Kay Haigh, global head of fixed income and liquidity solutions at Goldman Sachs Asset Management, said: “Given the data disruptions, it is unlikely that the Federal Reserve will give too much weight to today's report. And the report on December employment data (which will be released in early January, before the next meeting) will be a more meaningful indicator for the Federal Reserve to decide on recent policy trends.”

Nasdaq

Nasdaq 華爾街日報

華爾街日報