Reassessing Hillman Solutions (HLMN) Valuation After Fitch’s Credit Rating Upgrade to ‘BB’

Fitch’s decision to lift Hillman Solutions (HLMN) to a BB credit rating puts a fresh spotlight on the stock, as lower perceived credit risk can subtly shift how investors think about its long term upside.

See our latest analysis for Hillman Solutions.

Even with a softer 1 day share price return of around negative 1 percent and a year to date share price return in the low single digit negatives, the 3 year total shareholder return near 30 percent suggests underlying momentum is still intact as the market reassesses Hillman’s risk profile after the upgrade.

If this shift in sentiment has you rethinking your watchlist, it could be a smart moment to explore auto manufacturers as another way to uncover cyclical names reshaping their balance sheets and growth stories.

With earnings growing much faster than the share price and analysts still seeing over 30 percent upside to their targets, is Hillman quietly undervalued here, or are markets already baking in the next leg of growth?

Most Popular Narrative: 25.8% Undervalued

With Hillman Solutions last closing at $9.13 against a narrative fair value of about $12.31, the spread points to meaningful upside if the projections land.

Continued growth in residential repair and remodeling spend, driven by the aging US housing stock, is expected to provide Hillman with a stable and recurring revenue base, supporting steady top line growth regardless of fluctuations in new home sales or broader economic cycles.

Want to see what is powering that revenue engine and earnings ramp? The narrative leans on aggressive margin gains and a bold future profit multiple. Curious how those moving parts combine to support that higher fair value? Unlock the full playbook behind these forecasts.

Result: Fair Value of $12.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could unravel if volume softness persists or key big box retailers exert more pricing pressure than Hillman can offset with efficiencies.

Find out about the key risks to this Hillman Solutions narrative.

Another View: Earnings Multiple Flashes a Warning

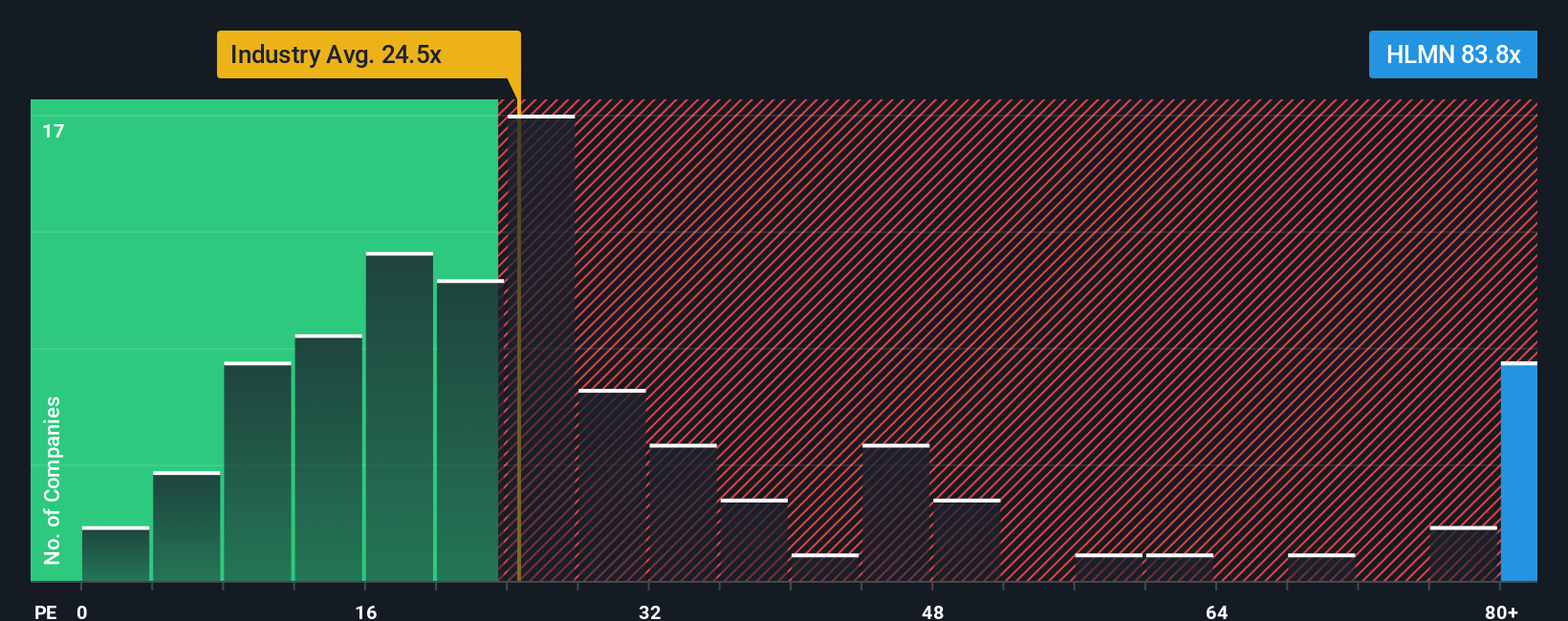

While the narrative and SWS fair value work suggest Hillman is undervalued, the earnings multiple tells a tougher story. At about 48.1 times earnings versus a fair ratio of 30.5 times, and above both peers at 38.8 times and the industry at 26.2 times, investors are paying up for this growth path.

That kind of premium can amplify downside if margins or demand disappoint. The key question becomes whether Hillman can grow into this price before sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hillman Solutions Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fully custom view in just minutes. Do it your way.

A great starting point for your Hillman Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas that could change your portfolio?

Before you move on, put Simply Wall Street’s Screener to work and look for fresh opportunities that other investors may overlook while they stay focused on today’s headlines.

- Target steady income by using these 13 dividend stocks with yields > 3% to seek companies that pay you consistently while you wait for growth to compound.

- Look for early growth stories through these 3625 penny stocks with strong financials, where smaller businesses with improving fundamentals may offer additional upside.

- Position yourself for the next wave of innovation with these 26 AI penny stocks, filtering for companies involved in the development of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報