Kurashicom (TSE:7110) Q1 EPS Jump Reinforces Bullish Profitability Narratives

Kurashicom (TSE:7110) Q1 2026 Results in Focus

Kurashicom (TSE:7110) has opened fiscal 2026 with Q1 revenue of ¥2.4 billion and EPS of ¥29.7, alongside net income of ¥219 million that anchors the latest set of reported numbers.

Over the past few quarters, the company has seen revenue move from ¥1.9 billion in Q1 2025 to ¥2.0 billion in Q4 2025 and now ¥2.4 billion in Q1 2026. Quarterly EPS has shifted from ¥10.6 in Q1 2025 to ¥19.9 in Q4 2025 and ¥29.7 in the latest quarter, giving investors a clearer view of how the top and bottom lines are tracking into the new fiscal year as they weigh the durability of margins and profit momentum.

See our full analysis for Kurashicom.With the headline figures on the table, the next step is to compare these results with the prevailing market and community narratives to see which stories hold up and which ones the latest margin performance quietly challenges.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM earnings up 28.7% year on year

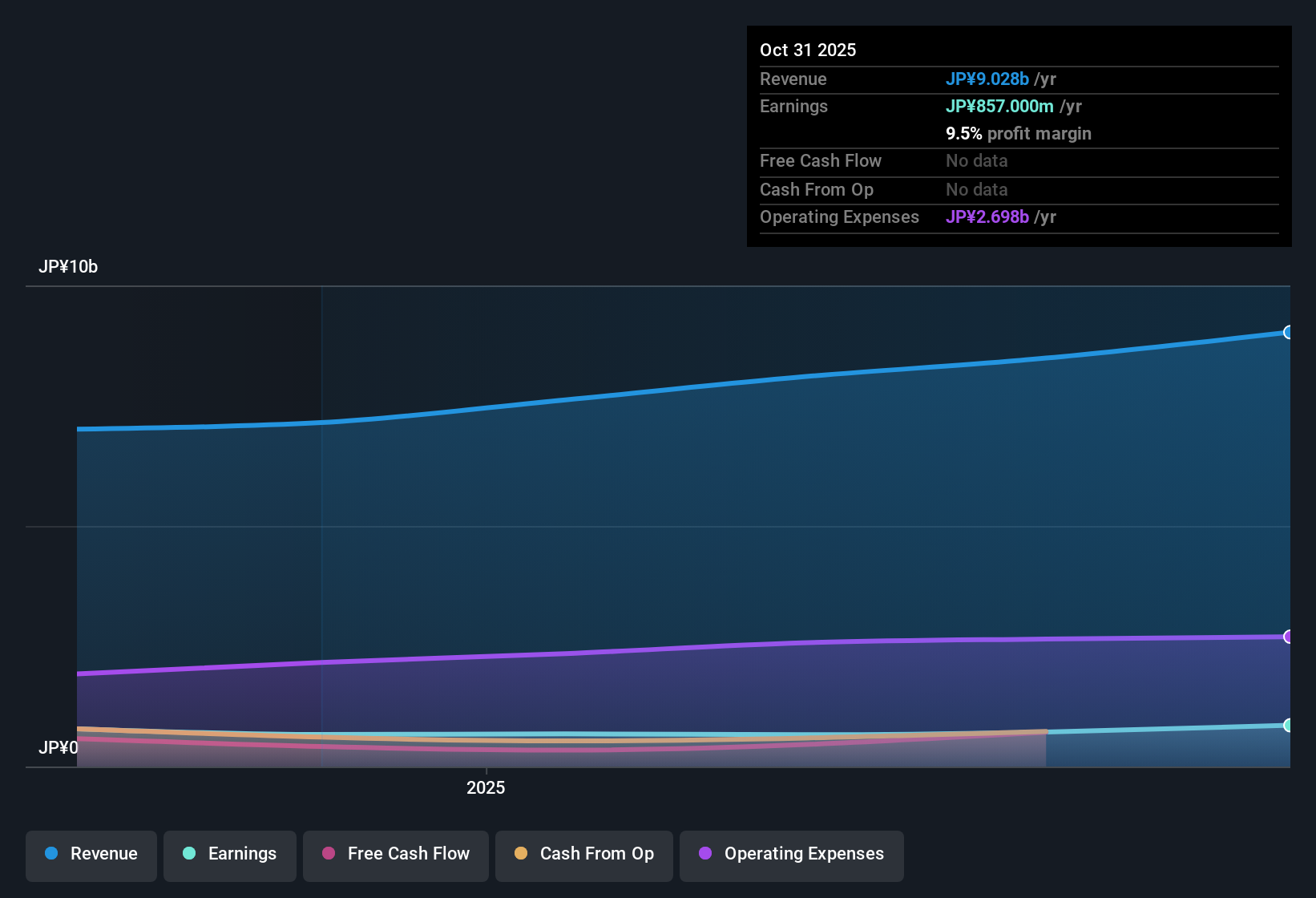

- Over the last twelve months, net income reached ¥857 million and Basic EPS was ¥116.28, compared with ¥785 million and ¥106.51 a year earlier, lining up with the stated 28.7% earnings growth.

- Supporters of a bullish view point to this steady EPS climb, and the data gives them something concrete to work with:

- Trailing revenue moved from ¥7,012 million to ¥9,028 million over the same window, so profits have risen alongside a larger sales base rather than on cost cuts alone.

- Quarter by quarter, net income has stayed positive from Q1 2025 through Q1 2026, ranging between ¥78 million and ¥277 million, which heavily supports the bullish case that the business is not just having a one off spike.

Margins edge up to 9.5%

- Trailing net profit margin stands at 9.5%, a touch higher than the 9.3% level a year ago, while Q1 2026 net income of ¥219 million on ¥2,433 million of revenue shows the company staying solidly profitable.

- Investors taking a cautious, more bearish angle might say a 0.2 percentage point margin lift is modest, and the figures give them details to scrutinize:

- Within the last fiscal year, quarterly net income moved from ¥78 million in Q1 2025 to ¥277 million in Q2 and then ¥219 million in Q1 2026, so profitability has been positive but not on a straight line.

- Because the margin improvement is small and quarterly profit has bounced around within a ¥78 million to ¥277 million band, bears can argue that efficiency gains are still relatively limited even as sales grow.

Valuation sits between peers and sector

- The stock trades on a 19.1x trailing P/E, which is lower than the 24.1x peer average but higher than the 15.9x JP Multiline Retail industry, with a DCF fair value of ¥1,866.69 versus the current ¥2,223 share price.

- What stands out for investors weighing a more cautious interpretation is how the valuation and income profile line up with the cash figures:

- A 4.32% dividend yield looks appealing on the surface, yet it is described as not well covered by free cash flow, which makes that income stream more sensitive if profits or cash generation slip.

- With the share price sitting above the DCF fair value and the company having less than three years of public history, more conservative investors may see fewer hard data points to justify paying above the modelled intrinsic value.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kurashicom's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

While Kurashicom is growing, its modest margin improvement, fluctuating quarterly profits, and share price above DCF fair value raise questions about the balance between risk and reward.

If paying a premium for uneven profitability makes you uneasy, use our these 906 undervalued stocks based on cash flows to quickly focus on companies where price and fundamentals are more convincingly aligned.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報