Westlake (WLK) Is Up 7.6% After US$415 Million Plant Closures Plan - Has The Bull Case Changed?

- Westlake Corporation recently approved a plan to cease operations at several North American chlorovinyl and styrene facilities by December 2025, affecting about 295 employees and leading to an estimated US$415 million in pre-tax closure-related costs.

- The closures will significantly reshape Westlake’s production footprint while still leaving billions of pounds of annual PVC, VCM, chlorine, and caustic soda capacity available to serve customers from its remaining plants.

- We’ll now examine how this planned capacity reduction and associated US$415 million in closure costs may influence Westlake’s existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Westlake Investment Narrative Recap

To own Westlake today, you generally need to believe in a recovery in basic chemicals and management’s ability to improve profitability from a still‑large chlorovinyl platform. The planned 2025 closures and US$415 million in largely non‑cash charges reshape capacity but do not appear to alter the near term catalyst around restoring margins in the Performance & Essential Materials segment, or the key risk from ongoing global oversupply and weak pricing.

The most relevant recent announcement alongside these closures is Westlake’s late 2025 debt tender offer for its 3.600% Senior Notes due 2026, funded by new senior notes. Together with capacity cuts, this highlights how the company is working on its balance sheet while contending with pressures in core chlorovinyl chains and ongoing efforts to lift segment profitability.

Yet beneath the capacity cuts and balance sheet moves, investors should also be aware of the risk that persistent global oversupply in key chemical chains could...

Read the full narrative on Westlake (it's free!)

Westlake's narrative projects $13.0 billion revenue and $893.8 million earnings by 2028.

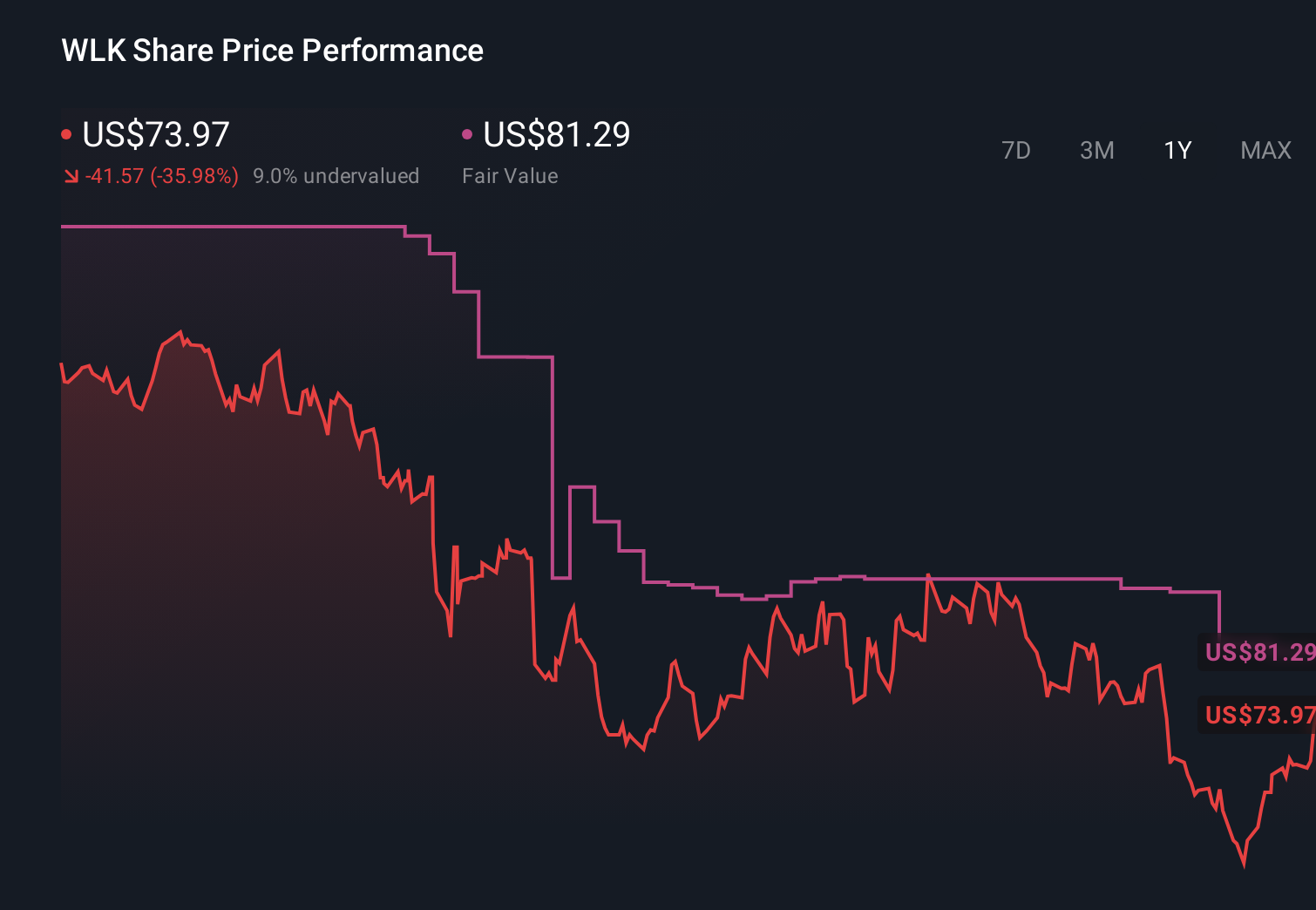

Uncover how Westlake's forecasts yield a $81.29 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community cluster between about US$64.83 and US$81.29 per share, underscoring how differently individual investors view Westlake. Set against that, the risk of prolonged global oversupply and weak pricing in core chlorovinyl products could remain a key swing factor for the company’s ability to improve margins and earnings.

Explore 2 other fair value estimates on Westlake - why the stock might be worth 12% less than the current price!

Build Your Own Westlake Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westlake research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Westlake research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westlake's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報