Gift Holdings (TSE:9279) EPS Beat Strengthens Growth Narrative Despite Softer Margins

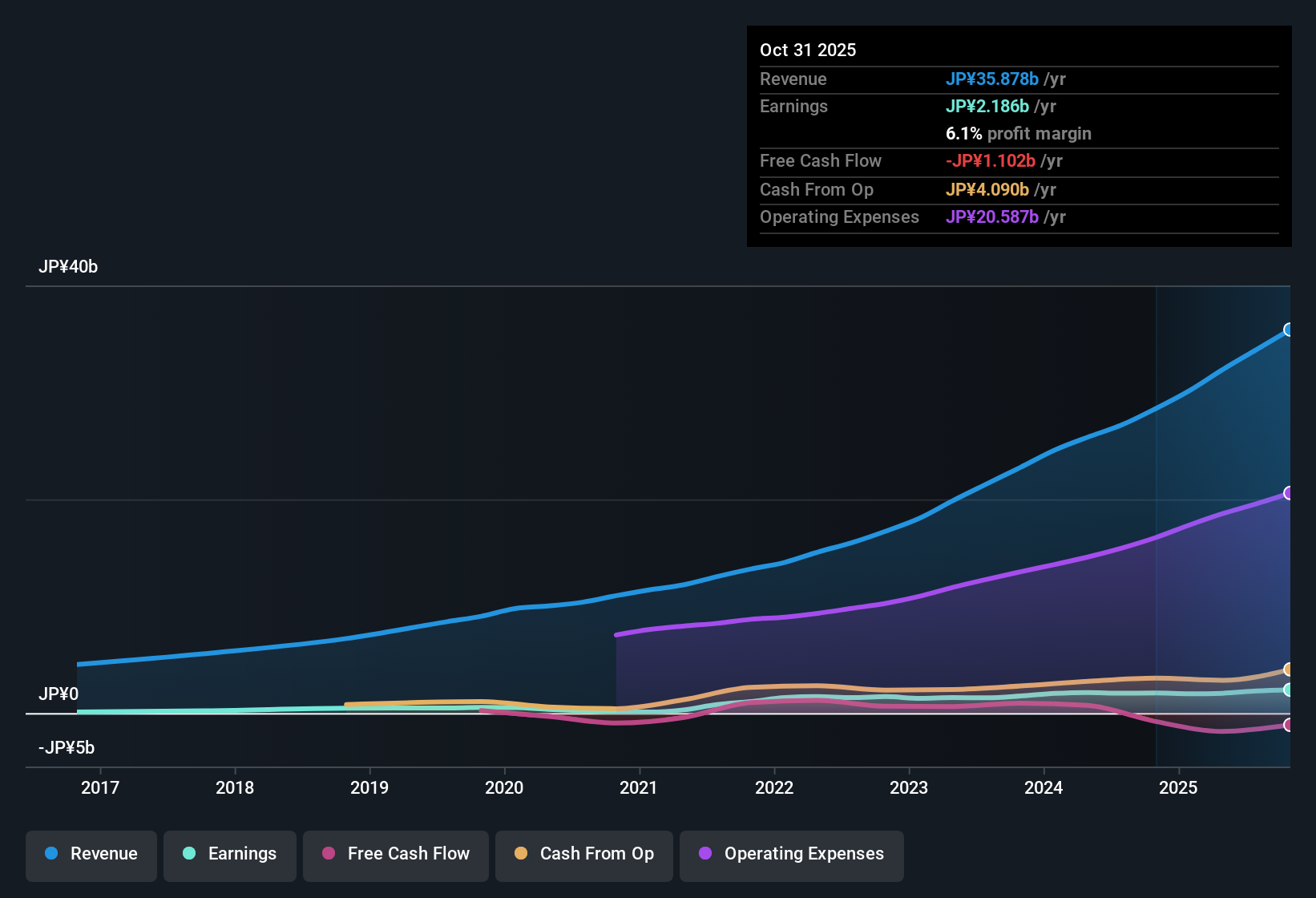

Gift Holdings (TSE:9279) just wrapped up FY 2025 with fourth quarter revenue of ¥9.8 billion and EPS of ¥30.45, capping off a year in which trailing 12 month revenue reached ¥35.9 billion and EPS came in at ¥109.30. The company has seen revenue climb from ¥28.5 billion in the trailing 12 months to Q4 FY 2024 to ¥35.9 billion by Q4 FY 2025, while EPS over the same span moved from ¥93.95 to ¥109.30. This sets the stage for investors to focus closely on how those headline gains translate into the underlying margin story.

See our full analysis for Gift Holdings.With the latest results on the table, the next step is to see how these hard numbers line up with the dominant narratives around Gift Holdings, and where the data might start to shift investor expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM profit up 16.5% despite softer 6.1% margin

- Over the last 12 months, net income rose to ¥2,185 million on ¥35,878 million revenue, with net margin at 6.1% compared to 6.6% the prior year.

- What stands out for a bullish view is that double digit profit growth is happening even as margins eased. This suggests the business is currently leaning more on scale than on margin expansion:

- Trailing 12 month earnings grew 16.5% year over year, while five year earnings growth averaged 24.9% per year, pointing to a track record of compounding.

- At the same time, the move from a 6.6% to 6.1% net margin shows why bulls need that growth to continue rather than expecting profitability alone to carry the story.

25.5% earnings growth forecast versus 29.5x P/E

- Earnings are forecast to grow 25.5% per year, with revenue expected to rise 19.6% annually, while the stock trades on a 29.5 times trailing P/E.

- This setup heavily supports a bullish narrative that is comfortable paying a premium multiple as long as the company delivers on growth:

- Forecast earnings growth at 25.5% per year sits well above the broader Japanese market expectation of 8.5%, which helps justify a richer P/E than many domestic names.

- Revenue is also projected to grow 19.6% per year versus 4.5% for the market, so both top and bottom line forecasts back the idea that Gift is being valued more like a growth stock than a typical hospitality chain.

DCF fair value ¥3,011.38 vs ¥3,225 price

- The shares trade at ¥3,225 compared with a DCF fair value estimate of ¥3,011.38 and an analyst price target of ¥3,975.00.

- Analysts with a more cautious, effectively bearish tilt on valuation can point to a tension between growth hopes and downside if expectations slip:

- On one side, the stock changes hands above the stated DCF fair value and at a 29.5 times P/E, which is higher than the 23.6 times average for the JP Hospitality industry.

- On the other side, that P/E is still below the 32.5 times peer average and the ¥3,975.00 price target implies about 23% upside from ¥3,225, so valuation is not stretched in the same way across every metric.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Gift Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Gift Holdings impressive growth is bumping up against a rich valuation, with margins softening and the share price already sitting above DCF fair value.

If you do not want to pay up for softening profitability and stretched pricing, use our these 906 undervalued stocks based on cash flows to quickly zero in on cheaper companies with stronger value support.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報