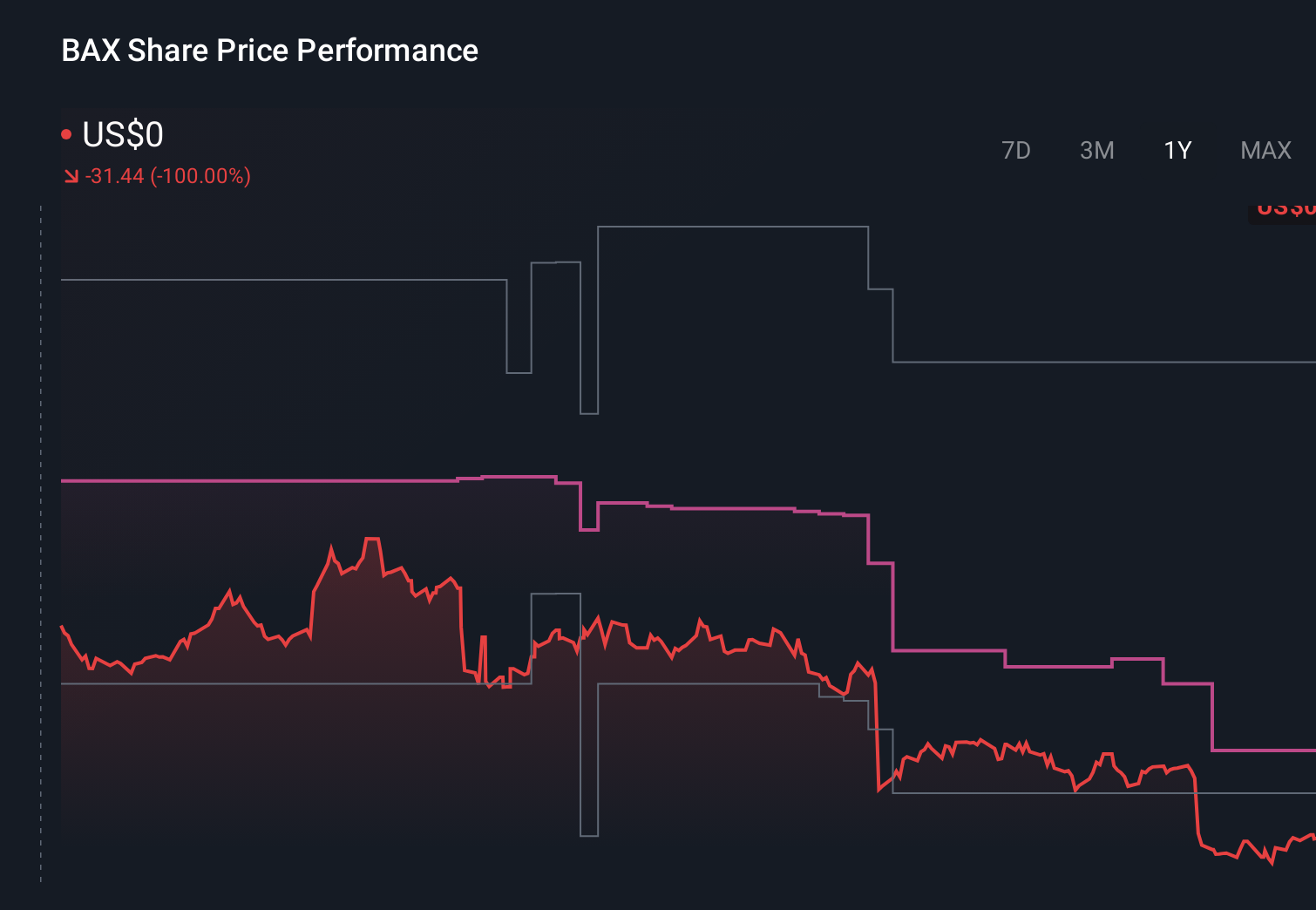

Baxter International (BAX) Is Up 7.5% After Class Action Over Infusion Pump Defects Filed

- Levi & Korsinsky, LLP has filed a class action securities lawsuit against Baxter International, alleging that the company concealed serious safety defects in its Novum LVP infusion pumps and misled investors about product performance between February 23, 2022 and October 29, 2025.

- The complaint’s focus on reported malfunctions, injuries, and deaths linked to Novum LVP, alongside claims of inadequate remediation, raises material questions about Baxter’s product oversight, regulatory risk, and the reliability of its earlier disclosures to the market.

- We’ll now examine how allegations of systemic Novum LVP defects and related legal risk could reshape Baxter International’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Baxter International Investment Narrative Recap

To own Baxter today, you need to believe it can turn around an unprofitable but essential hospital products business while managing execution and balance sheet constraints. The new securities class action around alleged Novum LVP defects directly heightens Baxter’s most immediate risk in infusion pumps, potentially affecting regulatory scrutiny, customer confidence, and how investors assess the credibility of past disclosures.

Against this backdrop, Baxter’s ongoing tender offers for its 2026 and 2027 notes matter because they interact with the company’s already stretched leverage and cash flow profile. Any additional legal or remediation costs tied to Novum LVP could limit financial flexibility at a time when Baxter is trying to reshape its portfolio, invest in innovation, and work toward profitability targets set out in recent guidance.

Yet investors should recognize that allegations of systemic Novum LVP defects could also magnify Baxter’s existing risk around...

Read the full narrative on Baxter International (it's free!)

Baxter International's narrative projects $12.1 billion revenue and $913.6 million earnings by 2028. This requires 3.7% yearly revenue growth and an earnings increase of about $1.16 billion from -$247.0 million today.

Uncover how Baxter International's forecasts yield a $23.80 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span an extremely wide range from about US$14.80 to over US$20,500.83, showing just how far apart individual views can be. Against that backdrop, the fresh legal scrutiny of Novum LVP infusion pump quality and disclosure practices gives you a concrete risk to weigh carefully when judging Baxter’s future performance and deciding which of these perspectives feels more realistic.

Explore 7 other fair value estimates on Baxter International - why the stock might be a potential multi-bagger!

Build Your Own Baxter International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baxter International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Baxter International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baxter International's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報