Is Builders FirstSource Fairly Priced After This Year’s 26.3% Share Price Slide?

- If you are wondering whether Builders FirstSource is a bargain or a value trap at today’s price, you are not alone. That is exactly what we are going to unpack here.

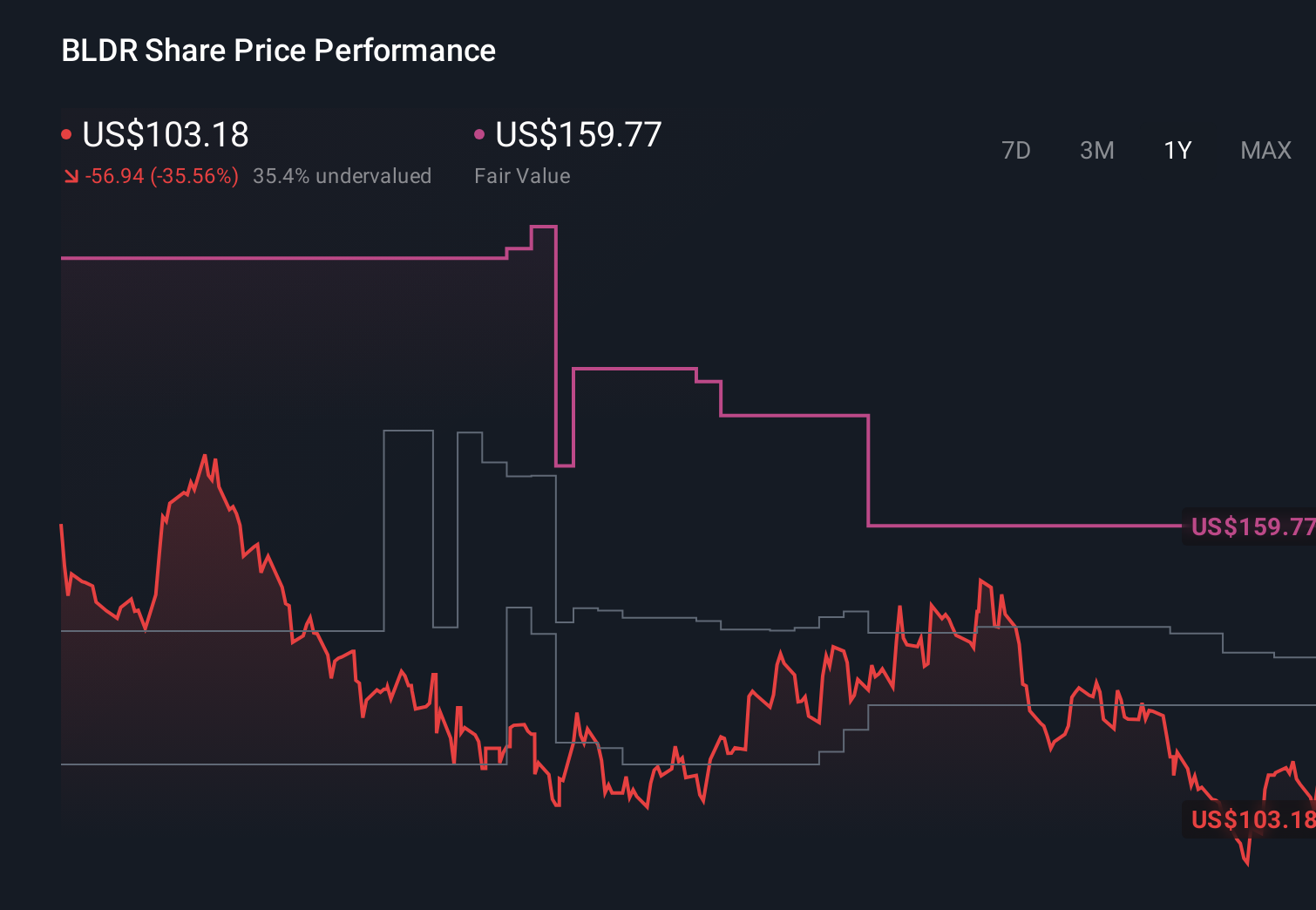

- The stock has been choppy recently, down 2.6% over the last week and 26.3% year to date, even though the 3 year and 5 year returns remain a solid 59.5% and 157.0% respectively.

- Recent headlines have focused on the housing and renovation cycle, tighter financial conditions, and how material and labor dynamics could affect demand for building products. All of these factors feed directly into sentiment around Builders FirstSource. At the same time, analysts and investors are debating whether the market is pricing in too much macro pessimism relative to the company’s long term structural positioning in residential construction.

- In our framework the stock scores a 4/6 valuation check, suggesting it screens as undervalued on most but not all of our metrics. The rest of this article will walk through those methods before finishing with another way to think about Builders FirstSource’s underlying worth.

Find out why Builders FirstSource's -34.8% return over the last year is lagging behind its peers.

Approach 1: Builders FirstSource Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today’s value. For Builders FirstSource, this approach focuses on the cash the company can return to shareholders over time rather than just today’s earnings.

The company generated about $996 million in Free Cash Flow over the last twelve months, in $. Analysts provide detailed forecasts for the next few years. Beyond that period, Simply Wall St extrapolates trends to build out a 10-year view. By 2035, those projections imply annual Free Cash Flow of just over $1.0 billion, still in $, reflecting moderate, steady growth rather than an aggressive expansion story.

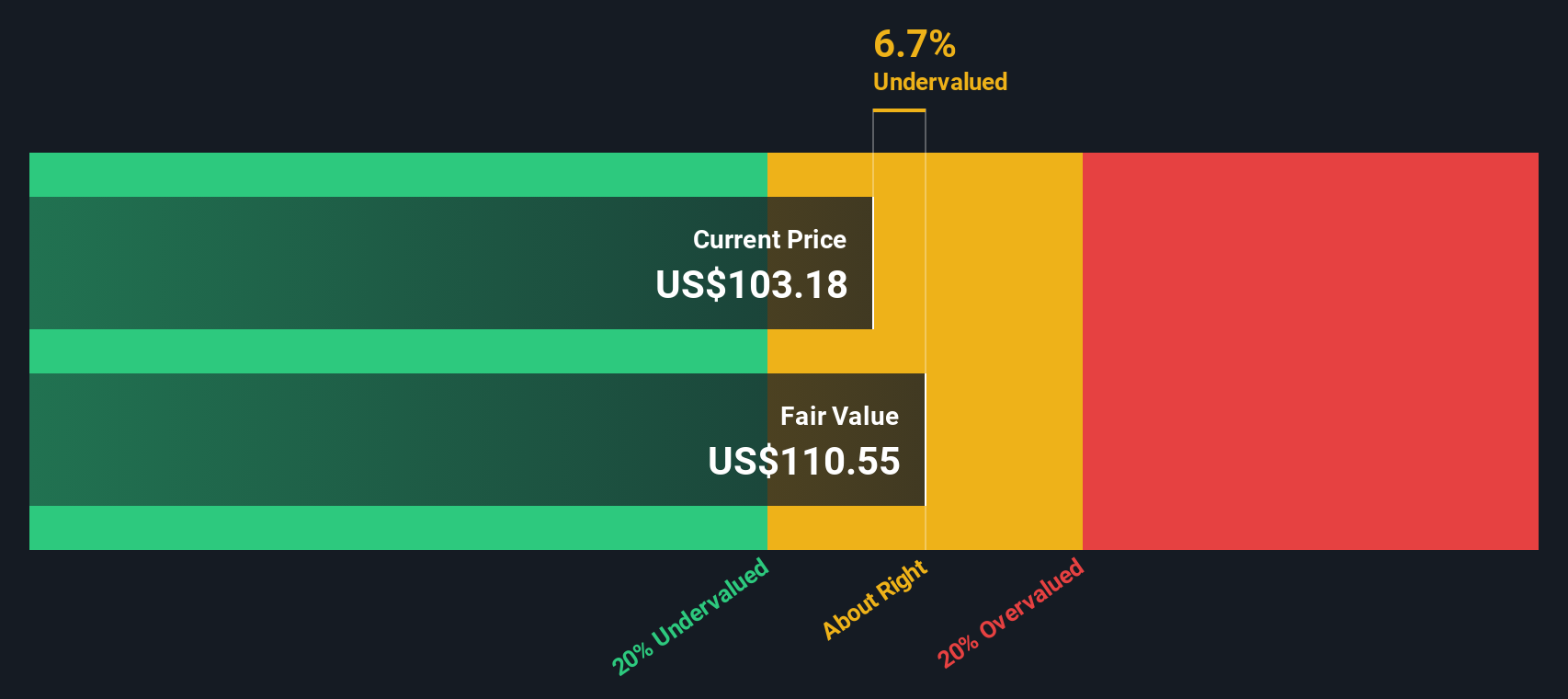

Using a 2 Stage Free Cash Flow to Equity model, these projected cash flows translate to an estimated intrinsic value of about $114.02 per share. Compared to the current share price, this implies the stock is roughly 8.2% undervalued, which is close enough that it falls within a reasonable margin of error rather than a clear mispricing.

Result: ABOUT RIGHT

Builders FirstSource is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Builders FirstSource Price vs Earnings

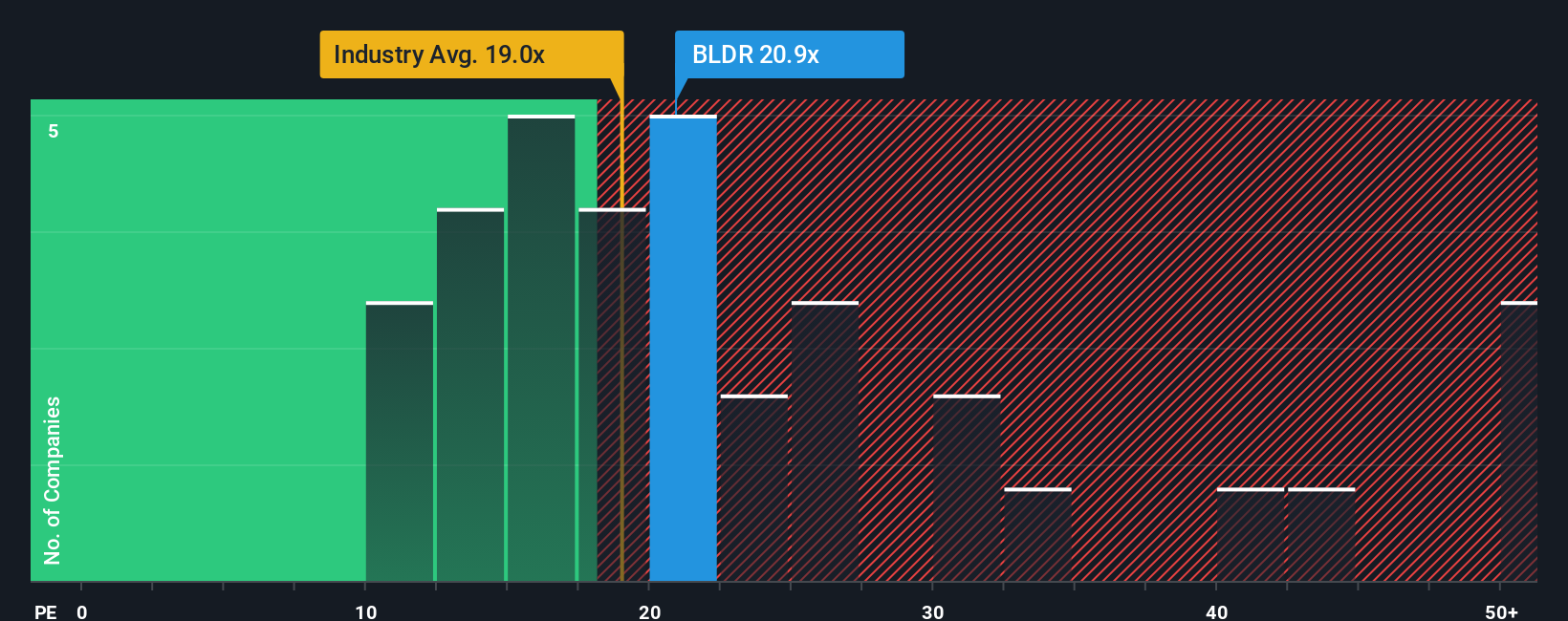

For a profitable business like Builders FirstSource, the Price to Earnings, or PE, ratio is a straightforward way to gauge how much investors are willing to pay today for each dollar of current earnings. What counts as a reasonable PE depends on how quickly earnings are expected to grow and how risky those earnings are, with faster growth and lower risk usually justifying a higher multiple.

Builders FirstSource currently trades on a PE of about 19.5x, broadly in line with both the Building industry average of around 19.8x and the peer group average near 19.4x. At first glance, this suggests the market is valuing the company similarly to its closest comparables.

Simply Wall St’s Fair Ratio framework goes a step further. It estimates what PE multiple would be appropriate for Builders FirstSource given its specific growth outlook, profitability, industry, size and risk profile. On this basis, the stock’s Fair PE Ratio is 26.7x. The current 19.5x multiple therefore sits noticeably below what this model would expect for a business with these characteristics, which indicates potential upside if the company’s fundamentals evolve in line with those assumptions.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Builders FirstSource Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Builders FirstSource’s story to a concrete financial forecast and a clear fair value estimate.

A Narrative on Simply Wall St is your story behind the numbers, where you spell out how you think revenue, earnings and margins will evolve, and the platform automatically links that story to a forecast and a calculated fair value that you can compare with today’s share price to inform your decision.

These Narratives live on the Community page used by millions of investors, are easy to set up, and update dynamically as new information such as earnings releases, guidance changes or major news flows through the platform, so your fair value stays aligned with the latest data rather than a static spreadsheet.

For Builders FirstSource, one investor might build a bullish Narrative that leans on digital transformation, consolidation and operating leverage to justify a fair value near the higher end of recent targets, while another could construct a cautious Narrative that emphasizes housing cyclicality, margin pressure and competitive risks to arrive at a fair value closer to the low end.

Do you think there's more to the story for Builders FirstSource? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報