Allegion Stock: Is ALLE Outperforming the Industrial Sector?

Dublin, Ireland-based Allegion plc (ALLE) is a global security products and solutions company specializing in mechanical and electronic access control systems. The company commands a market cap of $13.8 billion, and its portfolio includes door hardware, locks, exit devices, and smart access solutions sold under well-known brands such as Schlage, Von Duprin, and LCN.

Companies worth $10 billion or more are generally described as "large-cap stocks." Allegion fits right into that category, reflecting its significant presence and influence in the security and safety industry, providing cutting-edge products to enhance security worldwide. Allegion primarily serves the commercial, institutional, and residential markets, with a strong presence in North America and expanding international operations, with a focus on safety, security, and seamless access management.

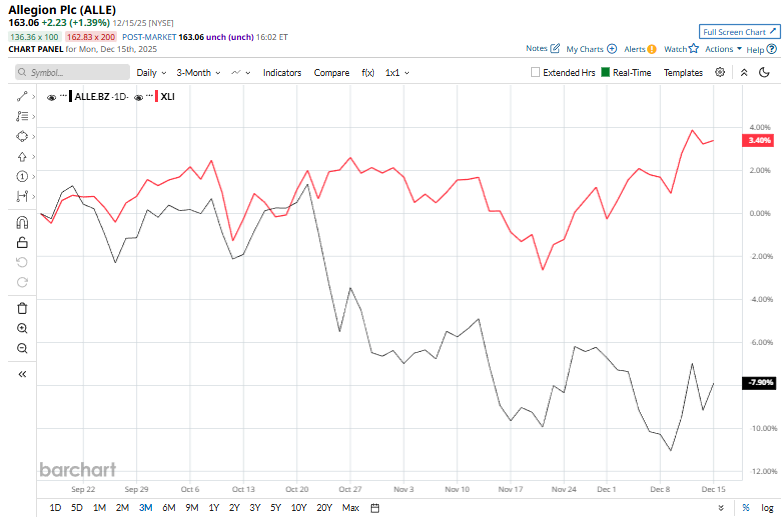

Allegion touched its 52-week high of $180.68 on Oct. 21, but the rally has since cooled, with the stock now trading about 9.8% below that peak. Recent performance has softened as well, with the stock down 7.5% over the past three months, underperforming the Industrial Select Sector SPDR Fund's (XLI) 3.1% gainduring the same time frame.

Stepping back, however, the broader trend remains constructive. Allegion has delivered strong gains of 24.8% year to date and 17.5% over the past 52 weeks, comfortably outperforming XLI’s 19.2% rise in 2025 and 14.2% return over the past year.

From a technical perspective, the stock continues to trade above its 200-day moving average, a sign of longer-term strength. Although the recent dip below the 50-day moving average since mid-October suggests some near-term consolidation.

Allegion reported a solid third-quarter performance on Oct. 23, exceeding earnings expectations, yet the stock declined 2.4% as investors focused on mixed underlying trends. Revenue reached $1.07 billion, up 10.7% year over year, including 5.9% organic growth, while adjusted EPS increased 6.5% to $2.30, reflecting healthy profitability. Strength in the Americas drove regional results, and recent acquisitions contributed to international growth.

However, margins, though still strong, were modestly lower than a year ago, which appeared to temper market sentiment. Even so, management raised its full-year revenue and EPS guidance, signaling continued confidence in the company’s operating trajectory despite the short-term pullback in the shares.

When compared to its peer, Allegion has notably outperformed ADT Inc.’s (ADT) 18.5% surge in 2025 and 13.8% gains over the past 52 weeks.

Among the 12 analysts covering the ALLE stock, the consensus rating is a “Moderate Buy.” Its mean price target of $184.40 implies an upswing potential of 13.1% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Nasdaq

Nasdaq 華爾街日報

華爾街日報