Cava (CAVA): Valuation Check After Fresh Buy Ratings and Ongoing Expansion Challenges

CAVA Group (CAVA) is back in focus after several Wall Street firms reiterated Buy ratings, even as the chain works through softer same store sales and squeezed margins tied to rapid expansion.

See our latest analysis for CAVA Group.

All of this comes against a backdrop where CAVA’s share price has slid sharply year to date, with a steep negative total shareholder return over the last year, even as recent 1 month share price gains hint that sentiment may be stabilizing rather than breaking down further.

If CAVA’s story has you watching the broader restaurant and consumer space, it could be a good moment to widen the lens and explore fast growing stocks with high insider ownership.

With the stock down sharply this year but still trading at a hefty implied growth premium, the key question now is simple: are investors staring at a mispriced Mediterranean growth story, or is the market already baking in tomorrow’s expansion?

Most Popular Narrative Narrative: 24% Undervalued

With the narrative fair value of $67.89 sitting above CAVA Group’s last close at $51.92, the story hinges on whether its growth runway truly merits a premium.

The analysts have a consensus price target of $92.214 for CAVA Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $125.0, and the most bearish reporting a price target of just $72.0.

Want to see why a maturing profit profile still commands a sky high earnings multiple, even as margins compress and growth expectations cool? The full narrative breaks down the bold revenue ramp, shrinking profitability, and surprisingly rich future earnings multiple that together underpin this fair value call.

Result: Fair Value of $67.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing same restaurant sales and the risk of over expansion into saturated markets could quickly undermine the bullish long term growth narrative.

Find out about the key risks to this CAVA Group narrative.

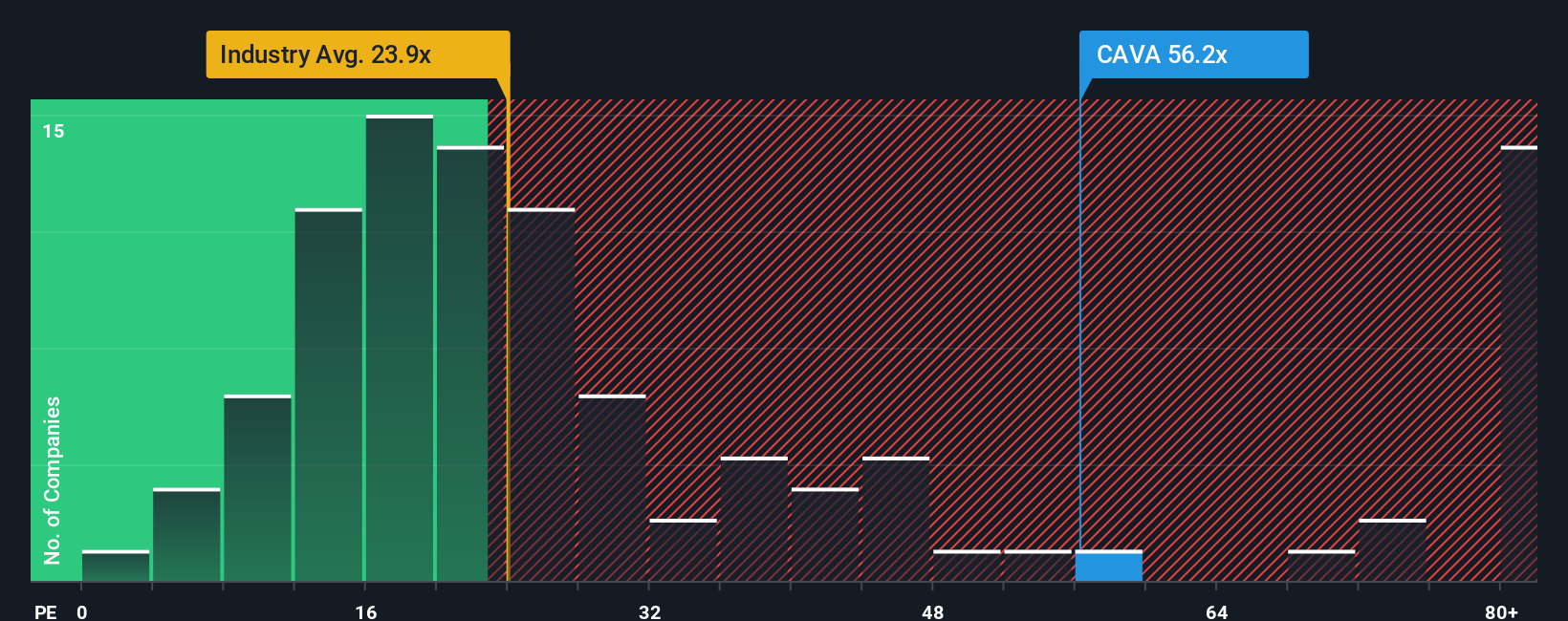

Another View, Market Multiple Sends a Harsher Message

While the narrative fair value suggests upside, CAVA’s current price to earnings of 43.8 times stands far above both the US Hospitality average of 23.1 times and its own fair ratio of 15.9 times. This spread implies investors could face real downside if sentiment normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CAVA Group Narrative

If you see the story differently or want to test your own assumptions against the numbers, build a personalized view in just minutes: Do it your way.

A great starting point for your CAVA Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to surface focused, data driven ideas that match your strategy.

- Capture potentially mispriced opportunities early by running through these 903 undervalued stocks based on cash flows that may offer strong upside based on their cash flow prospects.

- Ride powerful innovation trends by scanning these 26 AI penny stocks positioned at the forefront of artificial intelligence breakthroughs and adoption.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that balance yield with sustainable business foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報