PARK24 (TSE:4666) Margin Compression Tests Bullish Growth Narrative After FY 2025 Results

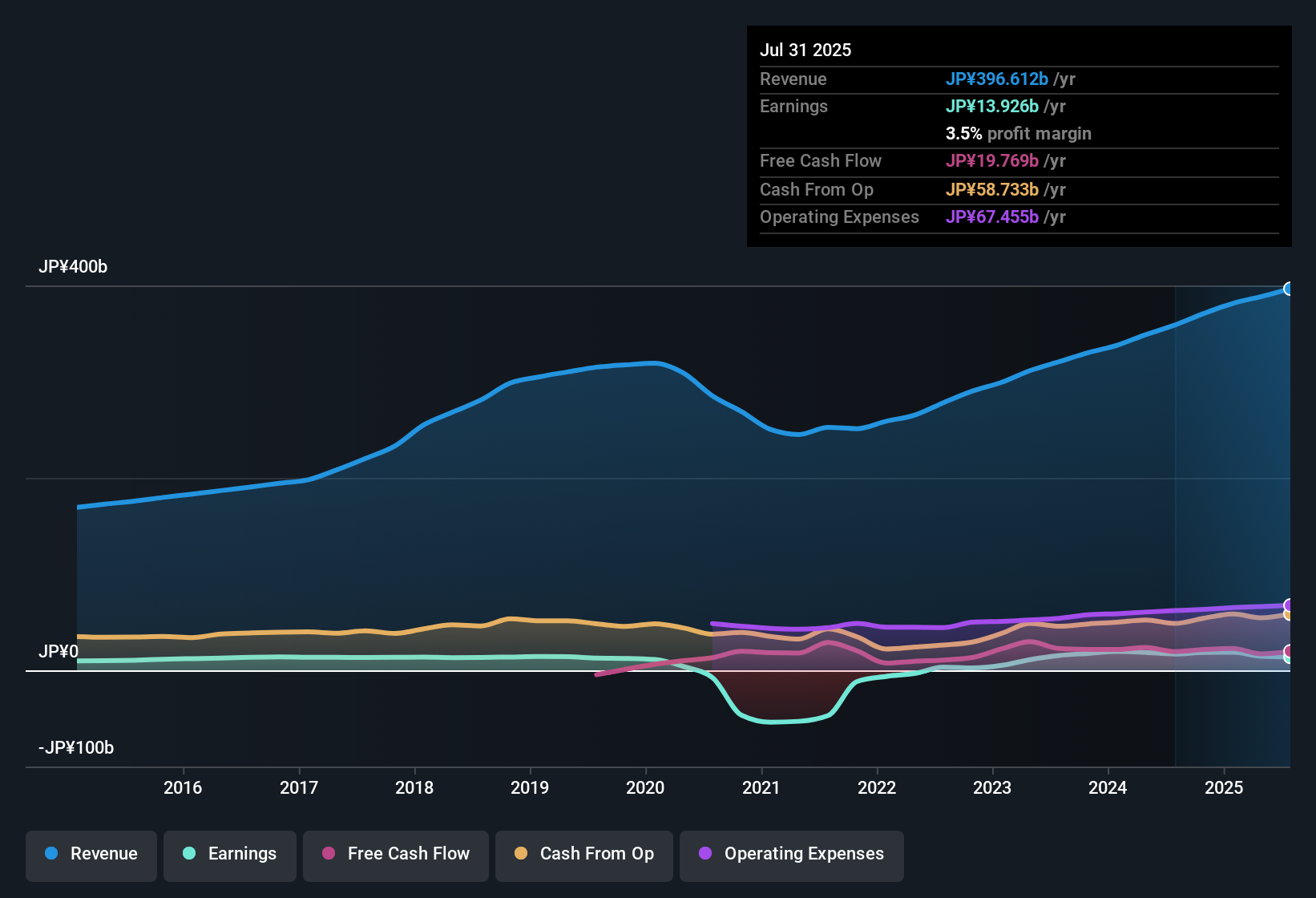

PARK24 (TSE:4666) has wrapped up FY 2025 with fourth quarter revenue of ¥110.3 billion and net income of ¥6.0 billion, translating to EPS of ¥34.93, while trailing twelve month revenue and net income came in at ¥406.2 billion and ¥15.9 billion respectively. The company has seen quarterly revenue move from ¥100.7 billion in FY 2024 Q4 to ¥110.3 billion in FY 2025 Q4, with EPS shifting from ¥23.27 to ¥34.93 over the same period, as margins softened from a 5% net profit level a year ago to 3.9% on a trailing basis. For investors, that mix of higher revenue, solid EPS and thinner margins sets up a nuanced read on the latest results and what they imply for the sustainability of profitability.

See our full analysis for PARK24.With the headline numbers on the table, the next step is to see how this earnings profile lines up with the dominant narratives around PARK24, and where the latest margin picture might start to challenge them.

See what the community is saying about PARK24

5 year earnings growth meets a soft most recent year

- PARK24 grew earnings about 71.5% per year over the last five years, but trailing twelve month net income is ¥15.9 billion, below the prior year level of ¥18.6 billion.

- Consensus narrative highlights restructuring and expansion as long term profit drivers, yet the latest year on year drop in trailing profit

- contrasts with the idea that profitability is already improving abroad, given ongoing losses and impairments in the U.K. and Australia cited in the narrative

- suggests that while usage fees and new technology are pushing revenue higher, the short term hit from overseas restructuring is still visible in the consolidated numbers

Margins dip to 3.9 percent despite revenue growth

- Net profit margin on a trailing twelve month basis is 3.9 percent, down from 5.0 percent a year earlier, even as trailing revenue rose from ¥370.9 billion to ¥406.2 billion.

- Analysts optimistic view that margins can rise to 6.1 percent over several years is being tested by this compression

- because current margins are not only below that 6.1 percent goal but also below last year’s 5.0 percent, showing cost pressure while the business scales

- and because impairment losses of ¥1.9 billion and tax expenses of ¥1.5 billion overseas are still weighing on profitability, despite planned cancellation of unprofitable sites

Premium valuation leans on 16 point 5 percent earnings growth forecasts

- The stock trades on a P E of 22.7 times versus 14.2 times for the JP Commercial Services industry and 17.7 times for peers, while earnings are forecast to grow about 16.5 percent annually and revenue about 6.4 percent.

- Bullish expectations that the current share price of ¥2,121.50 can move toward an analyst target of ¥2,652.00 rely heavily on those growth forecasts

- even though a DCF fair value of ¥737.70 is far below the market price, indicating a wide gap between growth based optimism and cash flow based valuation

- and while revenue and EPS have been trending up in recent quarters, the lower 3.9 percent trailing margin and high debt level make it more important that the forecast acceleration in profits actually materializes

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PARK24 on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See these figures from a different angle and think the story should read differently? Take a few minutes to shape your own view with Do it your way.

A great starting point for your PARK24 research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

PARK24’s reliance on optimistic growth assumptions, compressed margins, and a premium valuation suggests that execution and downside protection may be less robust than investors would like.

If you want ideas where pricing already reflects more caution and potential upside, use our these 905 undervalued stocks based on cash flows today to focus on companies trading below their estimated intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報