Does Dolby Present a Long Term Opportunity After Its Recent Share Price Decline?

- Wondering if Dolby Laboratories at around $66.62 is quietly turning into a value opportunity, or just a classic value trap in the making?

- The stock is down 14.4% year to date and 12.9% over the last year, even though it has inched up about 1.6% over the past month. This combination often signals shifting market expectations rather than a simple growth story.

- Recently, investors have been refocusing on Dolby's role as the audio and imaging standard across cinemas, streaming platforms, and consumer devices, as tech ecosystems double down on premium content experiences. At the same time, commentary around licensing strength, partnership momentum with major device makers, and the durability of its royalty model has stirred debate about whether the market is underestimating its long term cash generation.

- On our framework, Dolby scores a 5/6 valuation check for being undervalued. We will unpack this using multiple approaches, and we will wrap up by looking at an even more powerful way to interpret those valuation signals in the context of the broader investment narrative.

Find out why Dolby Laboratories's -12.9% return over the last year is lagging behind its peers.

Approach 1: Dolby Laboratories Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth today by projecting its future cash flows and discounting them back to a present value. For Dolby Laboratories, the model uses a 2 stage Free Cash Flow to Equity approach, starting from last twelve months free cash flow of about $435.7 Million.

Analysts project Dolby's free cash flow to grow to around $541.4 Million by 2028, with further increases extrapolated by Simply Wall St out to 2035, where free cash flow is estimated at roughly $731.1 Million. These figures reflect moderate but steady growth in cash generation, which is then discounted back using a required return to account for risk and the time value of money.

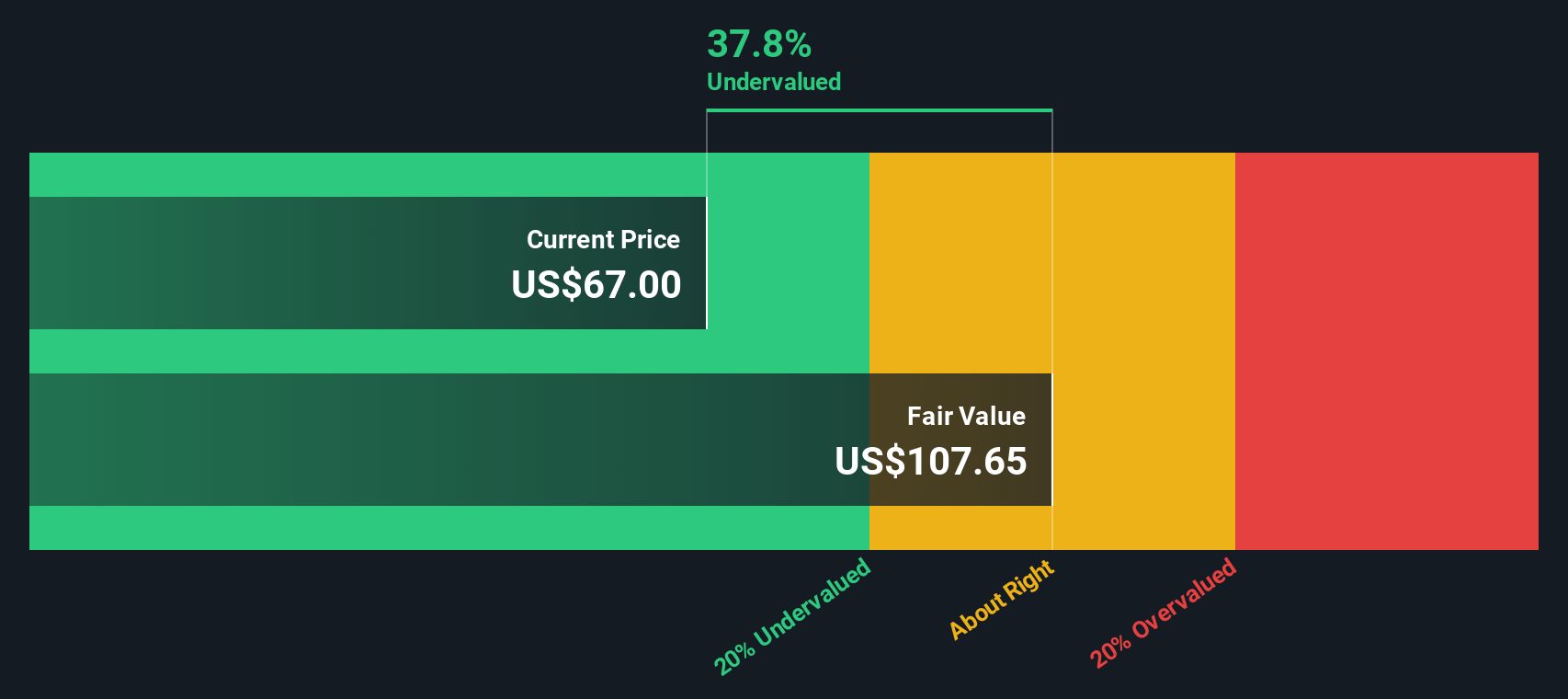

On this basis, the DCF model arrives at an intrinsic value of approximately $108.16 per share. Compared with the current share price near $66.62, the stock appears about 38.4% below this estimate of intrinsic value, based on the cash flow assumptions used in the model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dolby Laboratories is undervalued by 38.4%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

Approach 2: Dolby Laboratories Price vs Earnings

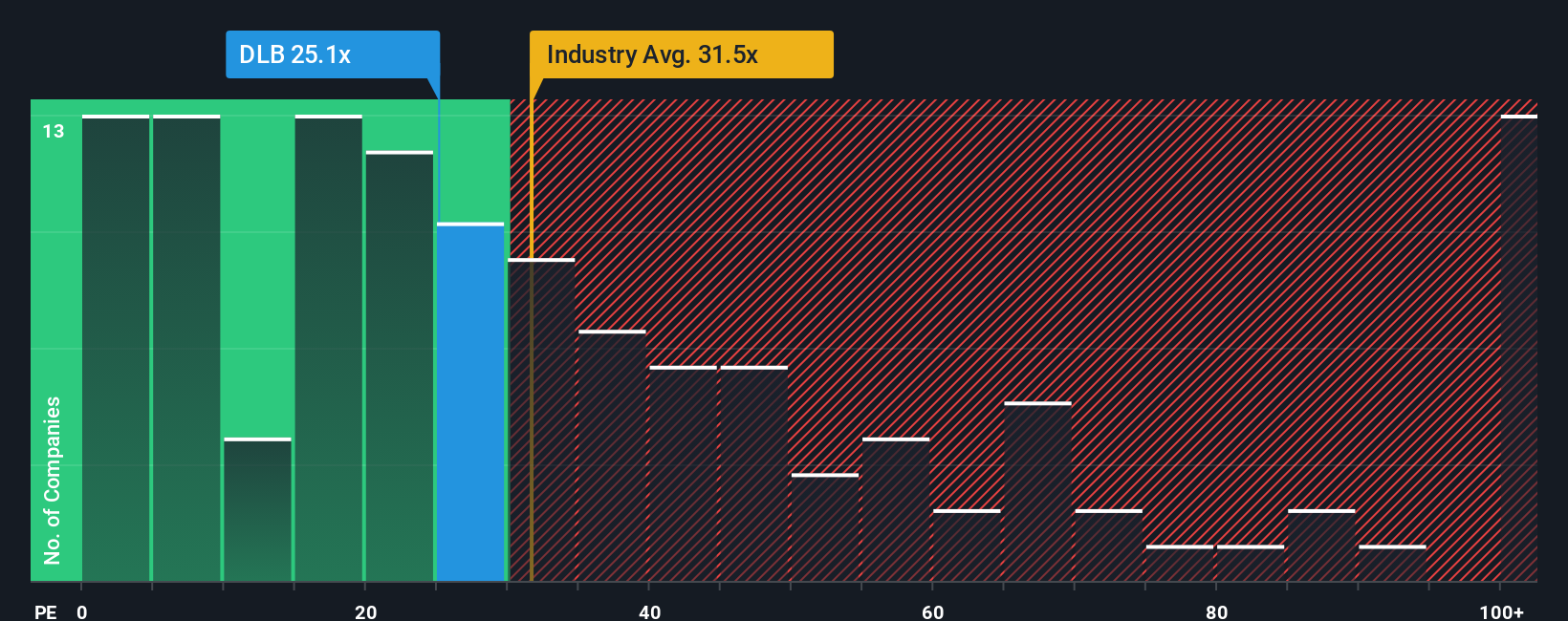

For profitable and relatively mature businesses like Dolby, the price to earnings (PE) ratio is a useful way to gauge how much investors are willing to pay for each dollar of current profits. In general, companies with stronger growth prospects and lower perceived risk are often valued at a higher PE, while slower growth or higher uncertainty can pull that multiple down.

Dolby currently trades on a PE of about 24.9x, which is below both the broader Software industry average of roughly 32.4x and the peer group average near 38.7x. At first glance, that discount might suggest the market is more cautious about Dolby's growth or competitive position than it is about other software names.

Simply Wall St's Fair Ratio framework goes a step further by estimating what PE Dolby might trade on, given its earnings growth outlook, margins, industry, market cap and risk profile. This produces a Fair Ratio of around 27.9x, which is more tailored than a simple comparison with peers or sector averages that may have very different business models or risk levels. Since Dolby's actual PE of 24.9x sits below this Fair Ratio, the shares appear modestly undervalued on a multiples basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dolby Laboratories Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives let you turn your view of Dolby into a simple story that links what you believe about its products, competition, and industry trends to a concrete financial forecast, then to a Fair Value you can compare with the current price to decide whether to buy, hold, or sell. Narratives on Simply Wall St, available on the Community page used by millions of investors, make this easy by letting you plug in assumptions for future revenue, earnings, and margins, then automatically translating them into an updated Fair Value that refreshes as new information like earnings or news arrives. For Dolby, for example, a bullish investor might build a narrative around premium audio and video becoming standard in cars and devices and land near the high end of current analyst targets around 114 dollars. In contrast, a more cautious investor focused on commoditization and macro risks might converge closer to the low end near 74 dollars, with both perspectives kept up to date as conditions change.

Do you think there's more to the story for Dolby Laboratories? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報