Is Kuehne and Nagel Fairly Priced After Recent 13.4% Share Price Rebound?

- Wondering if Kuehne + Nagel International is quietly turning into a value opportunity, or if the recent interest is just noise? Let us unpack what the current share price is really telling you.

- After a rough stretch that still leaves the stock down 15.3% year to date and 10.5% over the last year, the shares have bounced with gains of 6.5% in the last week and 13.4% over the past month.

- Those moves come as investors refocus on global trade normalising, ongoing supply chain recalibration after recent disruptions, and the company’s efforts to streamline operations and expand higher margin logistics services. Together, these themes are nudging the market to reassess both the risks and the long term earnings power embedded in the current price.

- On our framework, Kuehne + Nagel International currently scores 1/6 on valuation checks, suggesting that while parts of the market may still see it as fully priced, there could be pockets of mispricing worth exploring. We will walk through different valuation approaches next, before finishing with a more intuitive way to judge whether the stock really offers value.

Kuehne + Nagel International scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Kuehne + Nagel International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a business is worth by projecting future cash flows and discounting them back to today, reflecting the time value of money and risk. For Kuehne + Nagel International, the model uses a 2 stage Free Cash Flow to Equity approach in CHF.

The company generated trailing twelve month free cash flow of about CHF 1.39 billion. Analyst forecasts and extrapolations suggest free cash flow moderates over time, with projected cash flow in 2035 of roughly CHF 0.78 billion, based on a gradual decline from the initial forecast peak in 2027. Simply Wall St extends analyst estimates beyond year five using its own extrapolation assumptions.

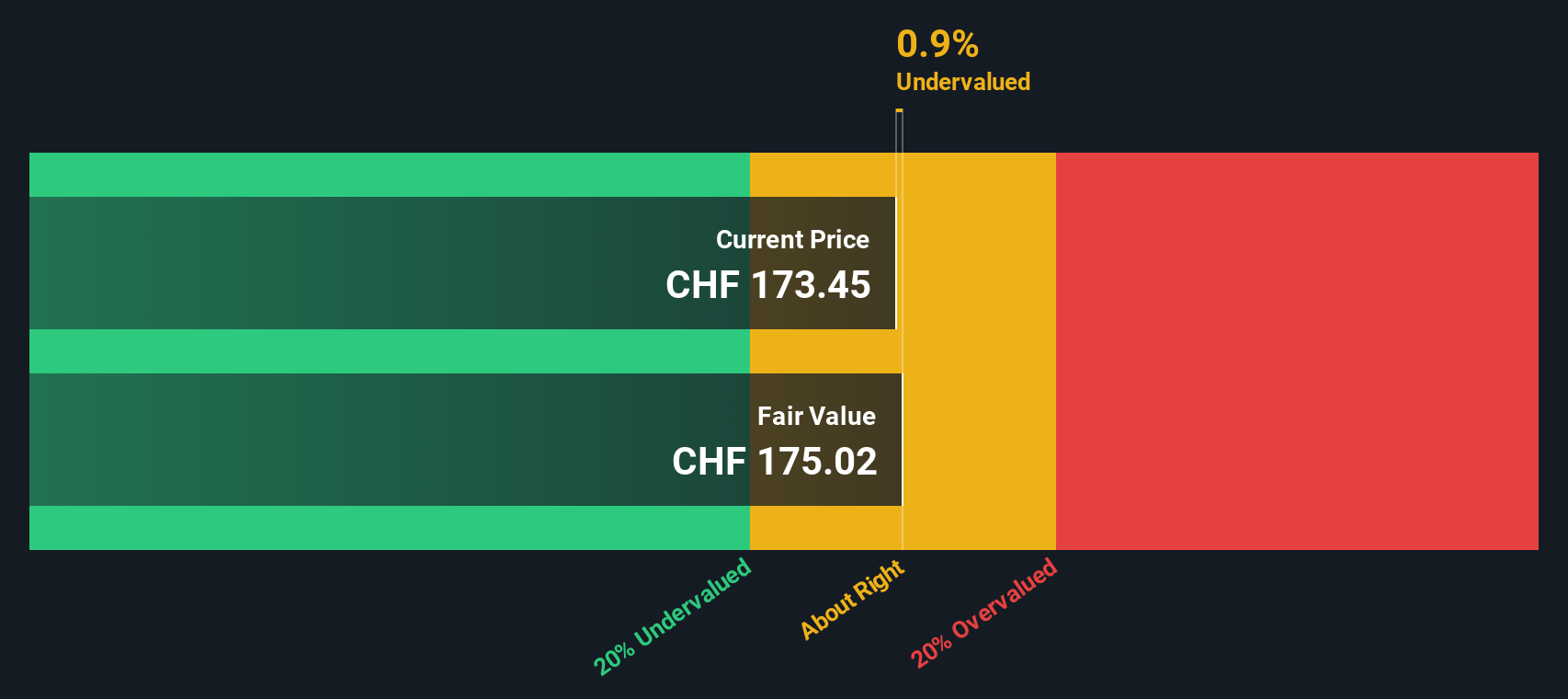

Discounting these cash flows back to today yields an estimated intrinsic value of around CHF 175.60 per share. With the DCF implying the stock is about 0.3% overvalued relative to its current price, the model is effectively saying the market is very close to fair value on these assumptions.

Result: ABOUT RIGHT

Kuehne + Nagel International is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Kuehne + Nagel International Price vs Earnings

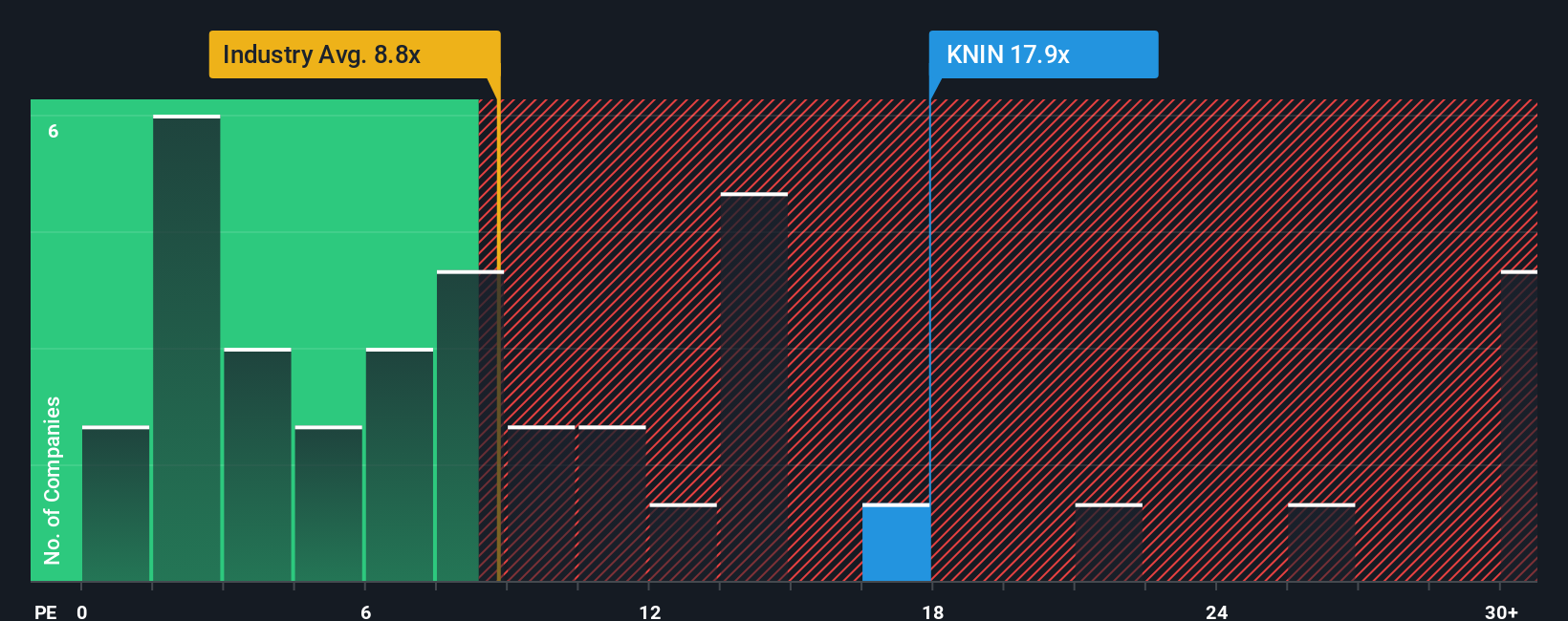

For a consistently profitable company like Kuehne + Nagel International, the price to earnings (PE) ratio is a useful way to judge whether investors are paying a reasonable price for each unit of current earnings. In broad terms, higher expected growth and lower perceived risk tend to justify a higher PE, while slower or more volatile businesses usually trade on lower multiples.

Kuehne + Nagel International currently trades on a PE of about 20.5x. That is well above the broader Shipping industry average of roughly 9.9x and also higher than the peer group average of about 12.1x. At first glance this can make the stock look expensive. However, Simply Wall St’s Fair Ratio framework estimates that, after accounting for the company’s earnings growth outlook, margins, risk profile, industry and market cap, a PE of around 24.2x would be reasonable.

Because this Fair Ratio is meaningfully higher than the current 20.5x multiple, the PE based view suggests the market is still applying a discount to what might be a justified valuation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kuehne + Nagel International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story to your numbers by spelling out what you believe about a company’s future revenue, earnings and margins, and then turning that story into a financial forecast and an explicit fair value.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy, accessible tool to define their view of a business, link it to a forecast, and then compare their fair value directly with the current share price to decide whether it is time to buy, hold or sell.

Because Narratives update dynamically as new information like earnings, guidance changes or major news comes in, they help you keep your thesis current without rebuilding your entire model from scratch.

For Kuehne + Nagel International, for example, one investor might build a more optimistic Narrative that leans toward the higher CHF 225 price target, assuming stronger volume growth and margin recovery, while another might anchor closer to the bearish CHF 127 view, focusing on freight volatility and margin pressure, and Narratives make those differing assumptions, and their impact on fair value, completely transparent.

Do you think there's more to the story for Kuehne + Nagel International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報