First Juken (TSE:8917) Margin Compression Reinforces Bearish Narrative Despite DCF Valuation Upside

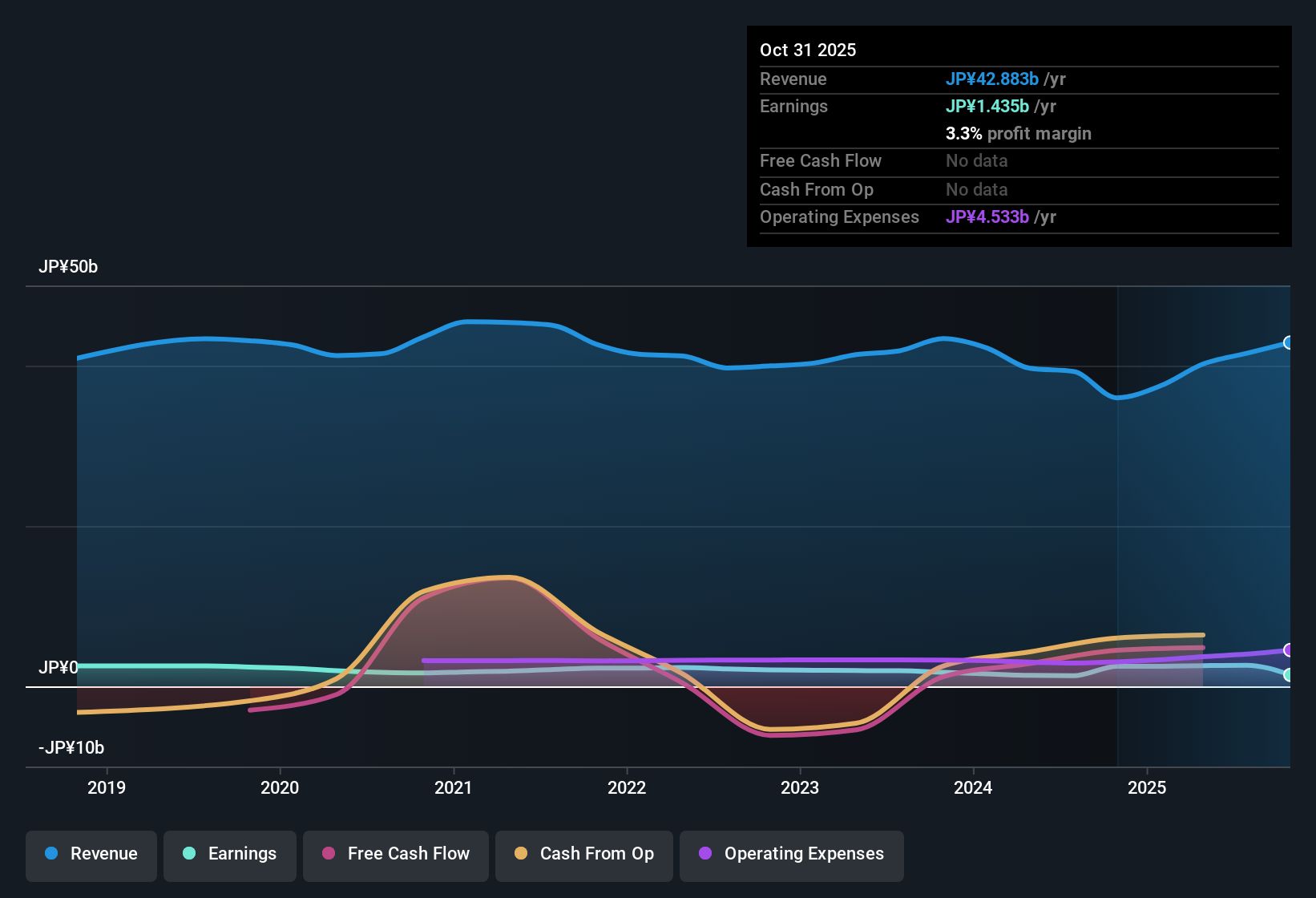

First Juken (TSE:8917) has just closed out FY 2025 with fourth quarter revenue of ¥11.7 billion and basic EPS of ¥32.3, capping a year in which trailing 12 month revenue reached ¥42.9 billion and EPS came in at ¥103.2. Over the last few quarters the company has seen revenue move from ¥10.3 billion and EPS of ¥118.6 in Q4 FY 2024 to a range of roughly ¥9.0 billion to ¥12.3 billion per quarter in FY 2025, with EPS fluctuating between ¥13.6 and ¥32.4, leaving investors focused on how consistently management can convert that top line into sustainable margins.

See our full analysis for First Juken.With the headline numbers on the table, the next step is to compare this earnings print with the most widely shared market narratives and see which stories hold up and which ones the latest margin trends start to challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Halve to 3.3 percent on TTM Basis

- Over the last 12 months, net profit margin was 3.3 percent compared with 6.9 percent a year earlier, alongside trailing 12 month net income of ¥1.4 billion on ¥42.9 billion of revenue.

- Bears focus on this squeeze in profitability, and the data backs that concern in several ways:

- Trailing 12 month earnings are described as having negative growth over the past year even though the five year pace was about 0.9 percent per year, which points to recent pressure rather than a long run collapse.

- Within FY 2025 itself, quarterly net income ranged from ¥189 million to about ¥451 million, well below the ¥1.6 billion booked in Q4 FY 2024, so recent margin compression is not limited to a single weak quarter.

EPS Trend Softens After Strong FY 2024 Peak

- Q4 FY 2025 basic EPS of ¥32.3 compares to ¥118.6 in Q4 FY 2024, and trailing 12 month EPS has slipped from ¥179.6 a year ago to ¥103.2 now even though it stayed above ¥180 through FY 2025 Q1 to Q3.

- What is striking for a bearish narrative is how the earnings path has shifted within a short span:

- Across FY 2025, quarterly EPS moved between about ¥13.6 and ¥32.4, much tighter and lower than the prior year Q4 spike to ¥118.6, which gives skeptics concrete evidence that recent profitability is running below that earlier high watermark.

- Yet trailing 12 month EPS still sits above the FY 2025 quarterly run rate, which suggests the latest year long view is being held up by stronger earlier periods rather than current momentum.

DCF Fair Value Far Above 11x P E Price

- The current share price of ¥1,132 sits about 75.8 percent below a DCF fair value of ¥4,677.06, while the trailing P E of 11 times is slightly under the JP Consumer Durables industry average of 11.6 times but above the peer average of 8 times.

- Bullish investors point to that valuation gap as their main argument, and the figures give them a specific framework to work with:

- The model based upside from ¥1,132 to a DCF fair value of ¥4,677.06 is large even after acknowledging that net profit margin has fallen from 6.9 percent to 3.3 percent over the last year.

- At the same time, the 11 times P E suggests the market is neither paying a clear premium to the wider industry nor washing its hands of the stock, leaving room for upside if earnings and margins move back toward the five year growth trend.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First Juken's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

First Juken's halved margins and sharply lower EPS versus last year's peak underline how fragile its recent profitability has become.

If those swings leave you uneasy, focus on steadier names by using our stable growth stocks screener (2102 results) to quickly find businesses with more predictable revenue and earnings trends across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報