Is Molson Coors A Bargain After Recent Share Price Rebound And DCF Outlook?

- Many investors are asking whether Molson Coors Beverage at around $47.67 is a value opportunity or a value trap, and this breakdown is designed to provide a clearer perspective.

- The stock has bounced 5.4% over the last week and 2.6% over the past month, even though it is still down about 16.7% year to date and 16.6% over the last year. This pattern suggests sentiment may be shifting from overly pessimistic toward more cautious optimism.

- Recently, investors have been reacting to a mix of brand strategy updates, portfolio refreshes, and shifting consumer demand in the beer and beyond-beer categories, which helps explain some of the volatility. At the same time, broader market moves in consumer staples and changing expectations for interest rates have been influencing how investors price steady, cash-generative businesses such as Molson Coors.

- On our framework, Molson Coors scores a 5/6 valuation check, suggesting it screens as undervalued on most metrics. Next, we unpack those methods and then introduce a more holistic way to think about what the stock may be worth.

Find out why Molson Coors Beverage's -16.6% return over the last year is lagging behind its peers.

Approach 1: Molson Coors Beverage Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms.

For Molson Coors Beverage, the latest twelve month Free Cash Flow is about $1.08 billion, and analysts expect it to stay above the $1.2 billion mark in the next few years. Simply Wall St then extrapolates beyond analyst coverage, with projections rising to roughly $1.51 billion of Free Cash Flow by 2035 as growth gradually slows, consistent with a mature beverage company profile.

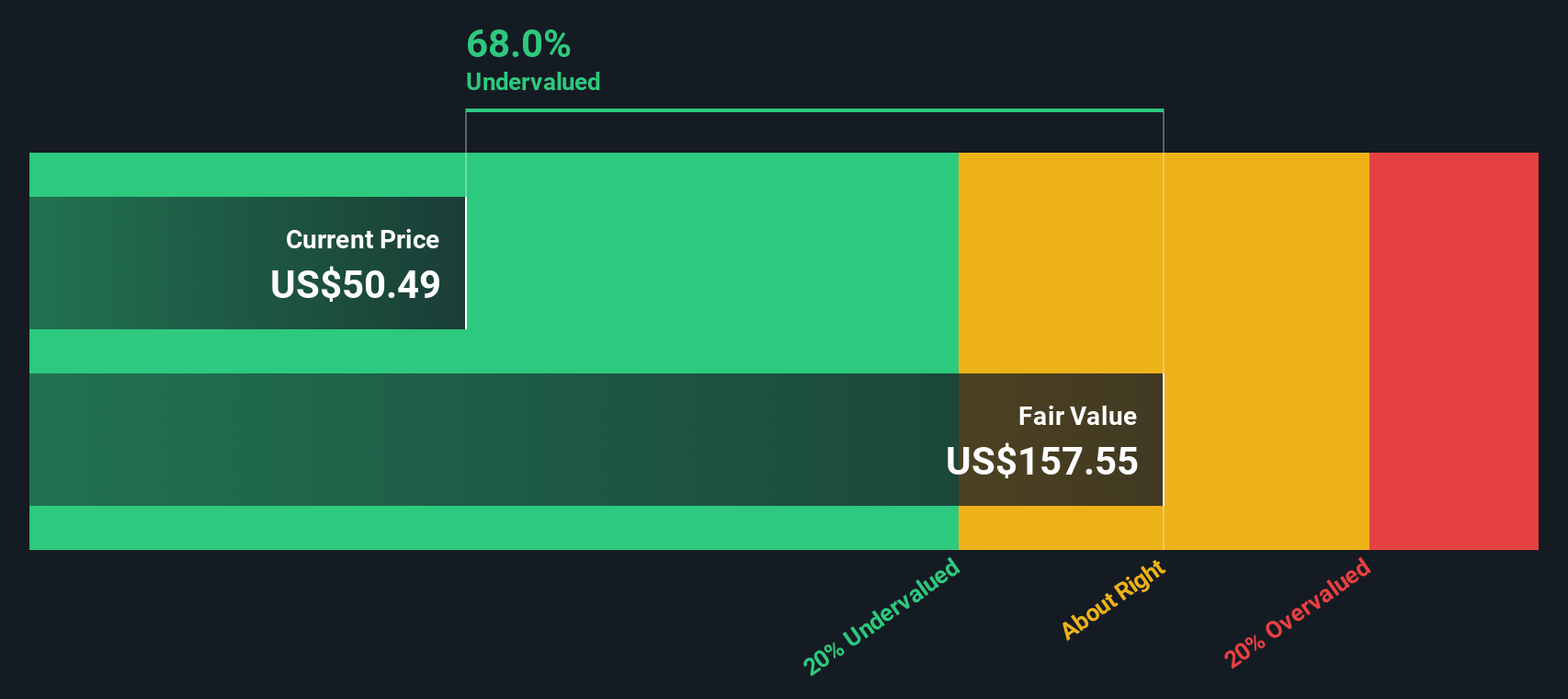

Using a 2 Stage Free Cash Flow to Equity model, these future cash flows are discounted back to arrive at an estimated intrinsic value of about $157.08 per share. Versus the current share price around $47.67, the DCF implies the stock is roughly 69.7% undervalued, indicating that the market is pricing in much weaker prospects than the model assumes.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Molson Coors Beverage is undervalued by 69.7%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Molson Coors Beverage Price vs Sales

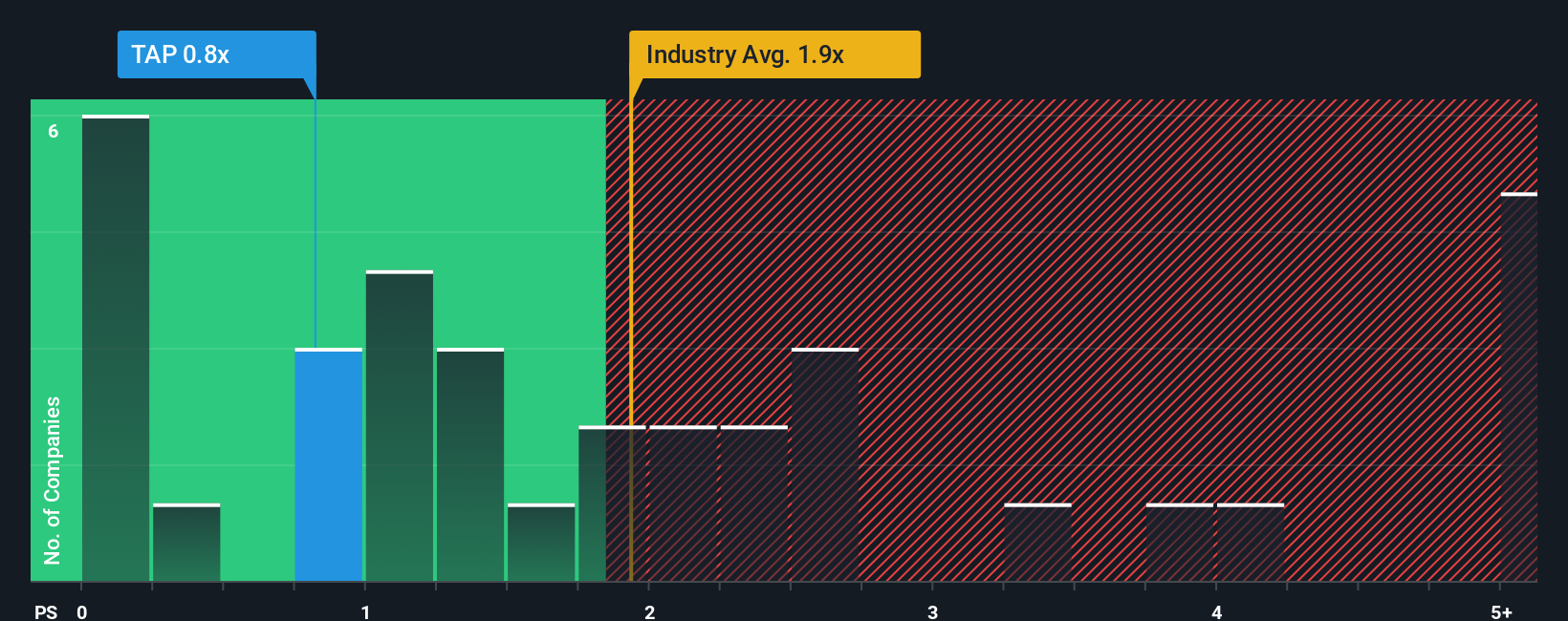

For consumer staples like Molson Coors, the Price to Sales ratio is a useful yardstick because revenue is relatively stable and less affected by accounting choices than earnings. This makes it a cleaner way to compare valuation across companies with solid, recurring demand.

In general, investors are willing to pay a higher multiple of sales when they expect faster growth and perceive lower risk. Slower growth or higher uncertainty usually justifies a lower, or discounted, sales multiple. The key is judging what counts as a normal range for a given business profile.

Molson Coors currently trades at about 0.84x sales, below the Beverage industry average of roughly 2.46x and a peer average of around 1.90x. Simply Wall St’s Fair Ratio for the stock, however, is 1.29x, which estimates what investors might reasonably pay for each dollar of sales after considering growth prospects, margins, risk profile, market cap and its specific industry position.

This Fair Ratio can be more informative than a simple comparison with peers or the sector average because it adjusts for Molson Coors unique fundamentals rather than assuming all beverage companies warrant the same multiple. With the shares at 0.84x compared with a 1.29x Fair Ratio, the stock appears attractively priced on a sales basis according to this framework.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Molson Coors Beverage Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Molson Coors Beverage’s future with a clear financial forecast and Fair Value estimate that you can track on Simply Wall St’s Community page, used by millions of investors. You can decide when to buy or sell by comparing that Fair Value to today’s price, see it automatically update as new news or earnings arrive, and understand how two reasonable investors can disagree. For example, one bullish Narrative might assume the business stabilizes and premium offerings drive enough growth and margins to justify a Fair Value closer to the most optimistic analyst target of about $72. A more cautious Narrative, focusing on persistent category weakness and limited growth, might instead point to a Fair Value nearer the most pessimistic target around $42. Both are grounded in different assumptions about future revenue, earnings and margins but expressed in the same, easy to use framework.

Do you think there's more to the story for Molson Coors Beverage? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報