Qualys (QLYS): Has the Recent Pullback Created a Quiet Valuation Opportunity?

Qualys (QLYS) has drifted slightly lower over the past week, even though the stock is still up over the past 3 months and year to date. That mix makes the current setup interesting.

See our latest analysis for Qualys.

That recent dip comes after a solid run, with a 90 day share price return of 9.6 percent and a three year total shareholder return of 27.4 percent, suggesting that momentum is still broadly positive despite short term volatility.

If Qualys has you rethinking your exposure to cybersecurity and cloud, this could be a good moment to explore other high growth tech and AI names via high growth tech and AI stocks.

With shares hovering near analyst targets but still trading at a modest intrinsic discount, investors face a key question: is Qualys quietly undervalued here, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 1.6% Overvalued

With the narrative fair value sitting just below Qualys' last close of $144.90, the story hinges on steady growth and premium profitability assumptions.

Adoption of Qualys' new cloud-native risk operations center (ROC) and Agentic AI platform positions the company as a leading pre-breach risk management provider, offering unified orchestration, automation, and remediation across both Qualys and non-Qualys data; this opens incremental greenfield opportunities and should support higher ARPU and expanded TAM, leading to durable revenue and earnings growth.

Curious how moderate growth expectations, rich margins, and a higher future earnings multiple still add up to only a slight upside gap? Unpack the full narrative math.

Result: Fair Value of $142.56 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Qualys keeping pace in fast moving AI security and proving that its new Flex pricing model boosts revenue, rather than blunts it.

Find out about the key risks to this Qualys narrative.

Another View: Earnings Multiple Signals Caution

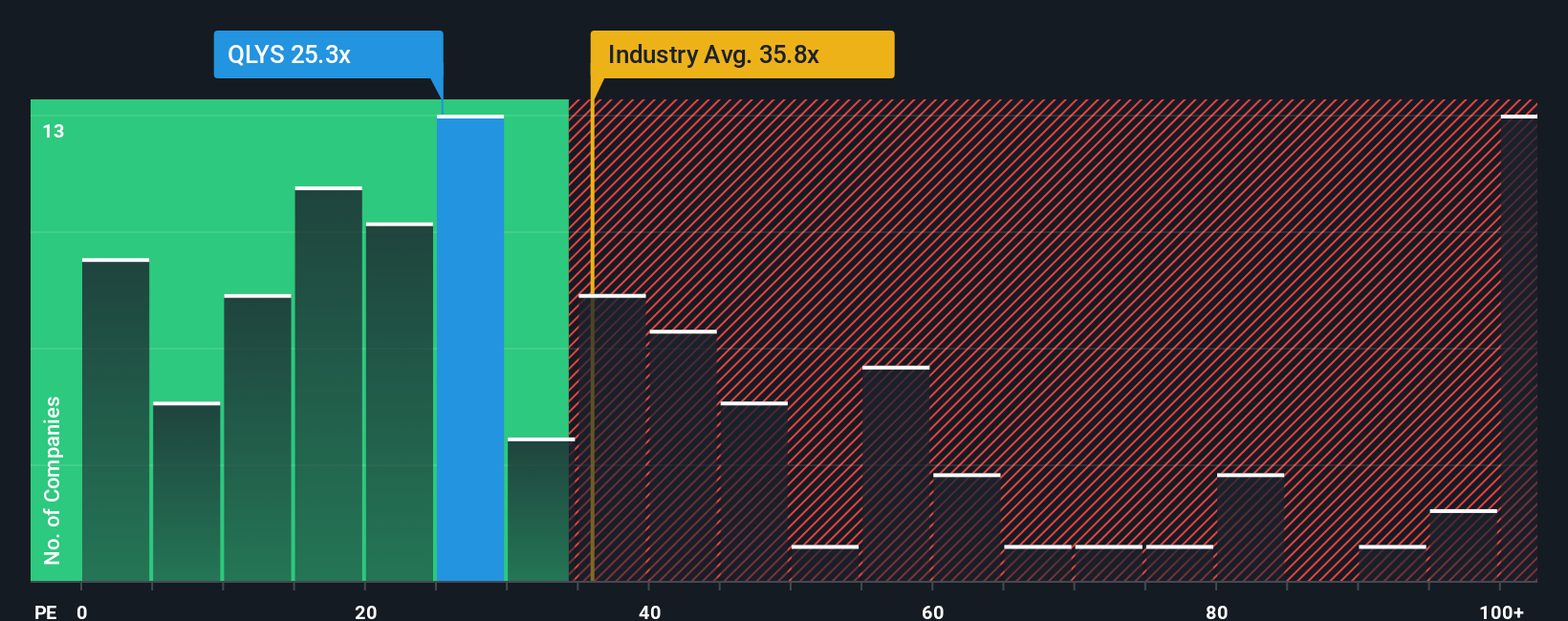

Analysts see Qualys as 1.6 percent overvalued on narrative fair value, yet our valuation using a single earnings multiple paints a mixed picture. The current P/E of 27.5x sits below the US software average of 32.4x but above our 25x fair ratio, hinting at some valuation risk if growth cools. Is the market paying a quiet quality premium, or front loading too much optimism into a slower growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Qualys for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Qualys Narrative

If you see the setup differently or want to dig into the numbers yourself, you can build a custom Qualys story in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Qualys.

Ready for more high conviction ideas?

Do not stop at one opportunity; use the Simply Wall St Screener to line up a watchlist of high potential stocks that match your strategy.

- Capture early stage potential with these 3617 penny stocks with strong financials that already show solid balance sheets and improving fundamentals before the crowd notices.

- Capitalize on the AI transformation by targeting these 26 AI penny stocks poised to benefit from surging demand for automation, data analytics, and intelligent infrastructure.

- Lock in value focused opportunities through these 906 undervalued stocks based on cash flows where market pessimism may be overstated compared to long term cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報