3 Global Dividend Stocks Yielding Over 3.4%

As global markets navigate a complex landscape marked by interest rate adjustments and economic uncertainties, investors are increasingly seeking stability through dividend stocks. In this environment, selecting stocks that offer consistent income potential while yielding over 3.4% can provide a buffer against market volatility and support long-term financial goals.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.82% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.09% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.95% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.56% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.29% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.38% | ★★★★★★ |

Click here to see the full list of 1322 stocks from our Top Global Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Namuga (KOSDAQ:A190510)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Namuga Co., Ltd. designs, produces, and sells cameras and 3D sensing modules in Korea and internationally, with a market cap of approximately ₩241.55 billion.

Operations: Namuga Co., Ltd. generates revenue through its design, production, and sale of cameras and 3D sensing modules both domestically and internationally.

Dividend Yield: 3.7%

Namuga's dividend prospects are promising, with a low payout ratio of 31.9% ensuring dividends are well covered by earnings and cash flows. Although it's too early to assess stability or growth due to recent initiation, its 3.68% yield ranks in the top 25% of Korea's market. Recent buybacks totaling KRW 996.6 million and strong earnings growth—net income rose significantly year-over-year—underscore financial health, supporting sustainable dividend payments moving forward.

- Click to explore a detailed breakdown of our findings in Namuga's dividend report.

- According our valuation report, there's an indication that Namuga's share price might be on the cheaper side.

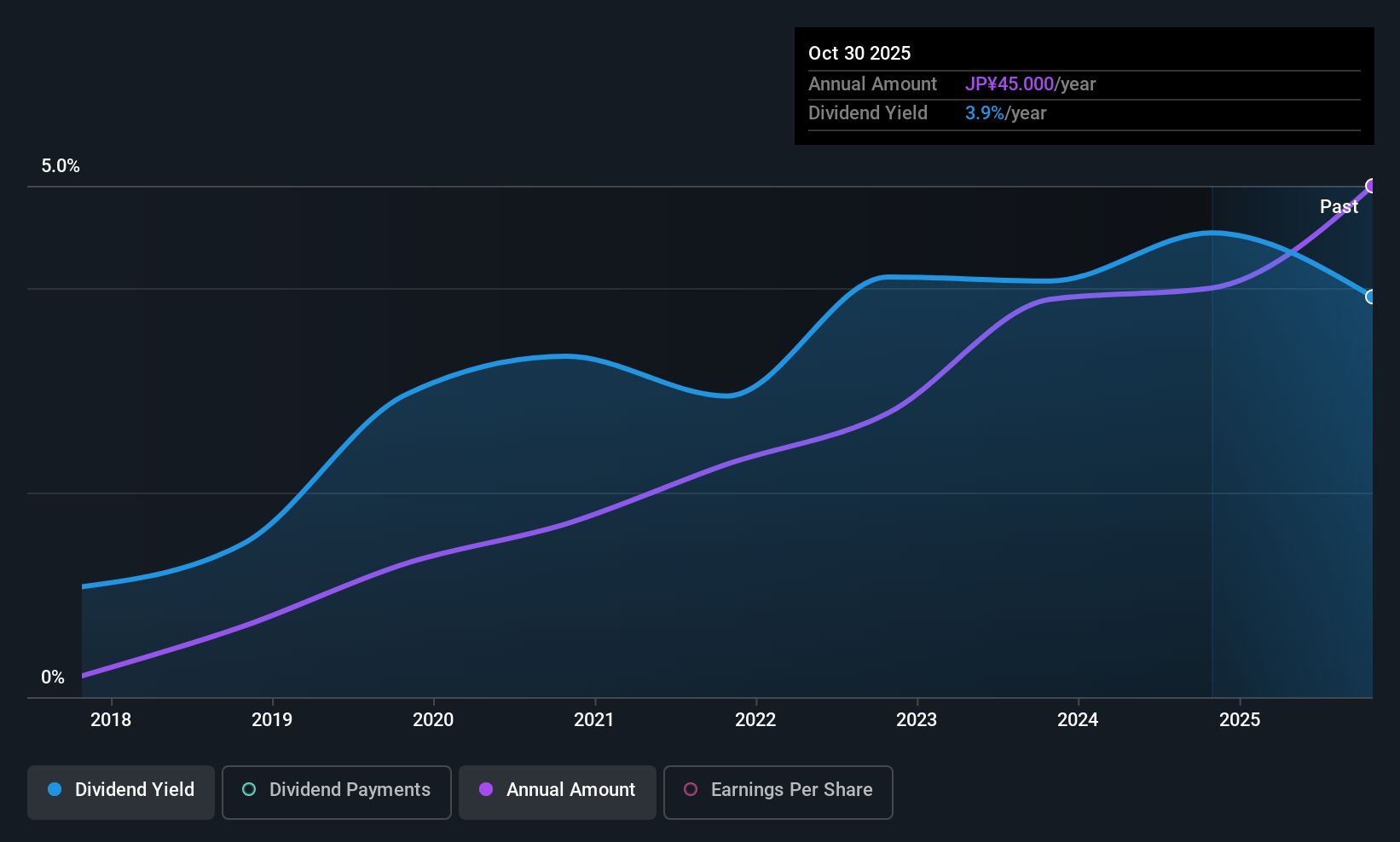

Good Com Asset (TSE:3475)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Good Com Asset Co., Ltd. and its subsidiaries plan, develop, and sell condominiums under the GENOVIA brand name in Japan and internationally, with a market cap of ¥32.02 billion.

Operations: Good Com Asset Co., Ltd.'s revenue primarily stems from its activities in planning, developing, and selling GENOVIA brand condominiums both domestically and internationally.

Dividend Yield: 3.7%

Good Com Asset's dividend payments, though reliable and growing over its nine-year history, face challenges due to recent profit declines. Revised earnings guidance for 2025 indicates decreased profitability, with net sales projected at ¥54.58 billion and operating profit reduced to ¥2.94 billion. Despite a high debt level, dividends remain sustainable with a payout ratio of 52.7% and cash payout at 7.8%. The dividend yield of 4.03% is competitive within Japan's market top quartile.

- Navigate through the intricacies of Good Com Asset with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Good Com Asset is trading beyond its estimated value.

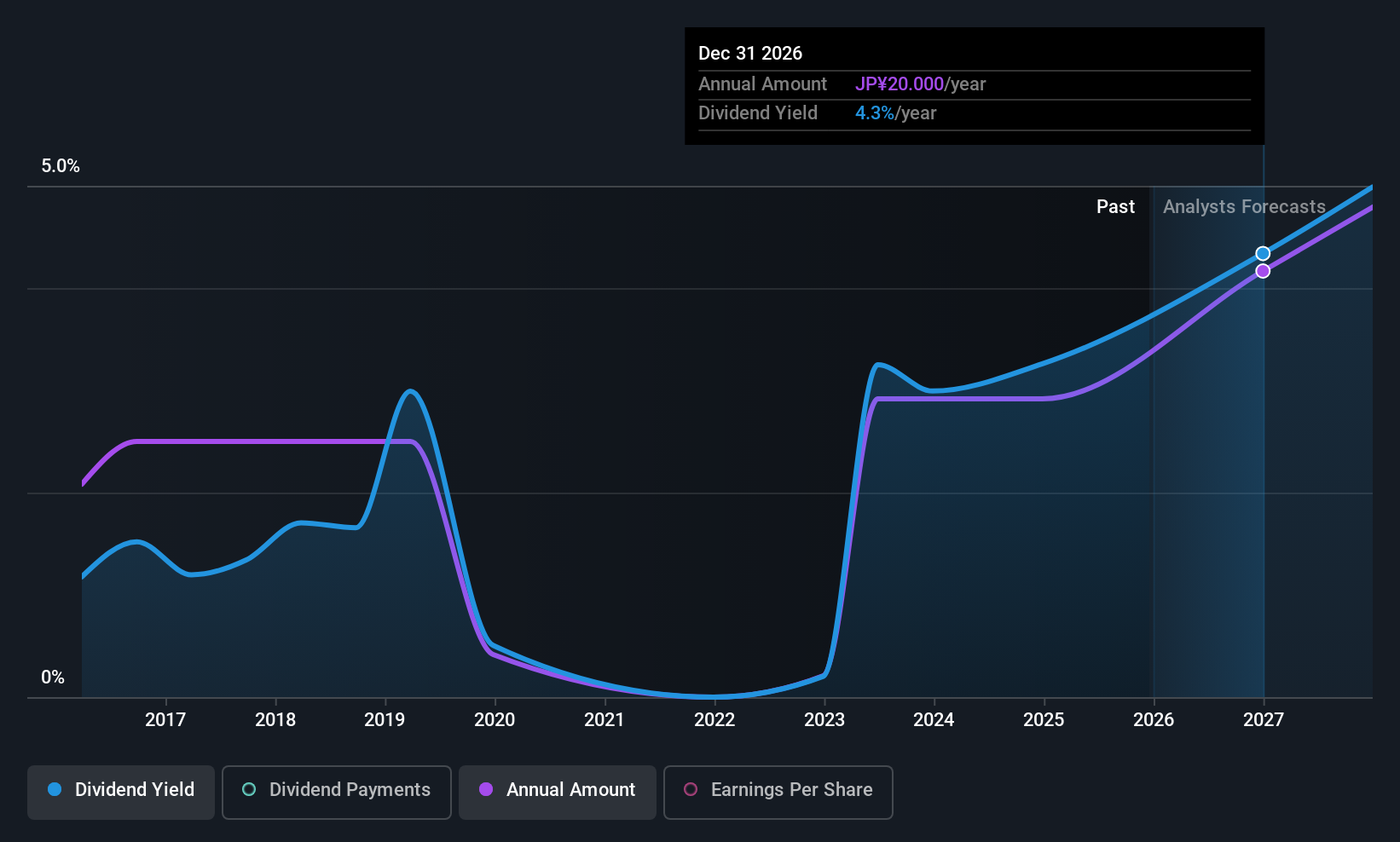

J Trust (TSE:8508)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: J Trust Co., Ltd. provides a range of financial services in Japan and has a market capitalization of ¥59.52 billion.

Operations: J Trust Co., Ltd. generates revenue through its diverse financial services offered in Japan.

Dividend Yield: 3.5%

J Trust's dividend payments are well-covered, with a payout ratio of 36.3% and cash payout at 5.5%, ensuring sustainability despite its volatile dividend history over the past decade. Recent earnings growth of 121.3% and trading at an estimated 36% below fair value suggest potential for future stability, though the current yield of 3.58% is slightly below Japan's top quartile payers. The company recently extended its buyback plan to March 31, 2026, indicating strategic financial management focus.

- Unlock comprehensive insights into our analysis of J Trust stock in this dividend report.

- The analysis detailed in our J Trust valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 1322 Top Global Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報