Thomson Reuters (TSX:TRI) Valuation Check After New Crunchafi Lease Accounting Partnership

Crunchafi’s new strategic partnership with Thomson Reuters (TSX:TRI) plugs automated lease accounting directly into the company’s Cloud Audit Suite, giving audit teams cleaner workflows, fewer manual steps, and a stickier reason to stay in the ecosystem.

See our latest analysis for Thomson Reuters.

The Crunchafi tie up lands at an interesting moment for Thomson Reuters, with a recent 30 day share price return of negative 8.29 percent and a year to date share price return of negative 21.81 percent. At the same time, its five year total shareholder return of 90.78 percent shows the longer term wealth creation story is still intact.

If this deal has you thinking about which information and workflow platforms could see similar tailwinds, it might be worth exploring fast growing stocks with high insider ownership as a hunting ground for the next wave of compounders.

Yet despite recent share price weakness, Thomson Reuters is still growing earnings and trades at a sizable discount to analyst targets. This raises the question: is this a mispriced compounder, or is the market already baking in future gains?

Most Popular Narrative: 32.2% Undervalued

Compared with the last close at CA$181.64, the most followed narrative pegs Thomson Reuters’ fair value much higher, framing recent weakness as a potential opportunity.

The analysts have a consensus price target of CA$274.103 for Thomson Reuters based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$308.28, and the most bearish reporting a price target of just CA$232.96.

Want to see what justifies paying a rich earnings multiple for a mid single digit grower? The narrative leans on compounding margins, disciplined buybacks, and surprisingly robust long term cash flow math.

Result: Fair Value of $267.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying AI competition and slower than expected client adoption could blunt pricing power, delay margin expansion, and challenge the long term earnings narrative.

Find out about the key risks to this Thomson Reuters narrative.

Another Lens on Value

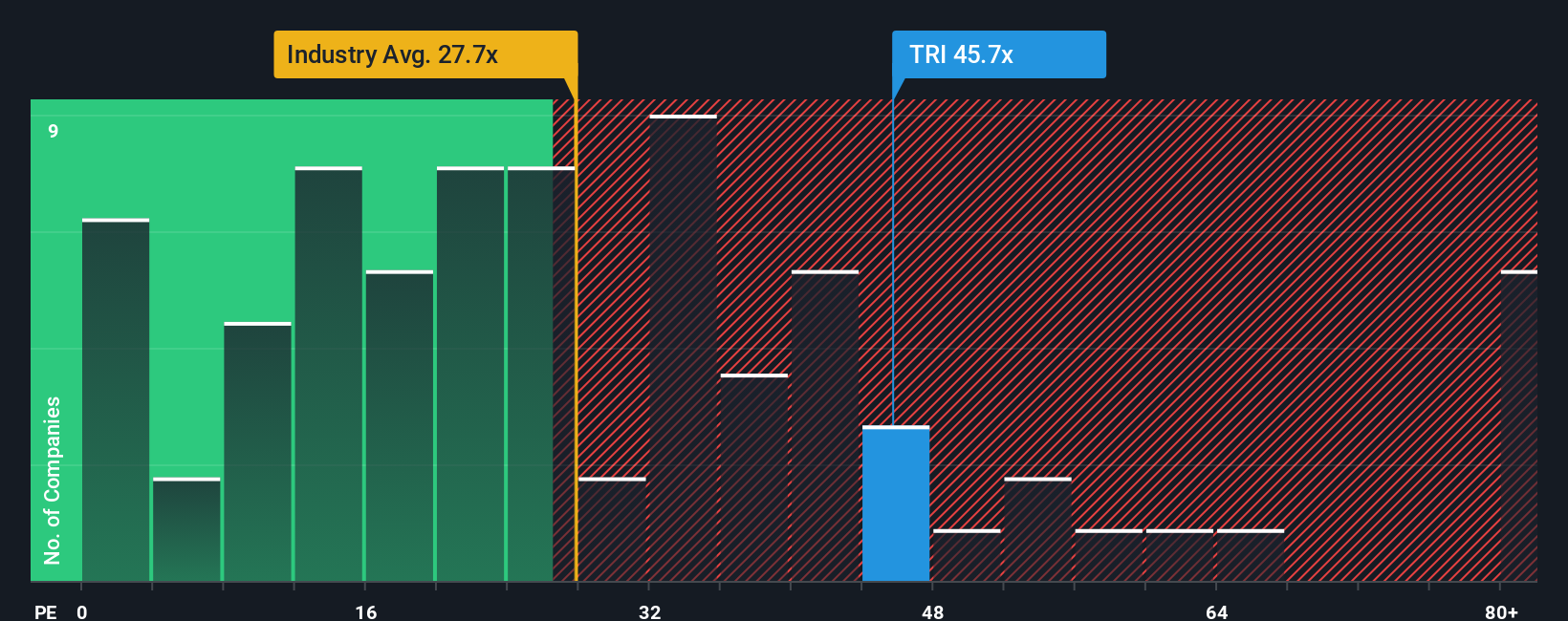

On earnings, Thomson Reuters looks punchy, trading at about 33.6 times profits versus 24.8 times for the North American professional services group and a 29.1 times peer average. Our fair ratio sits nearer 31.9 times, which hints the market may be paying a premium that leaves less room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Thomson Reuters Narrative

If you see the story differently, or want to stress test the numbers yourself, you can build a fresh take in minutes: Do it your way.

A great starting point for your Thomson Reuters research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before markets move on without you, put Simply Wall Street’s Screener to work and spot fresh opportunities that match your strategy in minutes.

- Capture early stage potential by reviewing these 3613 penny stocks with strong financials that already show financial strength and momentum, before broader market attention changes valuations.

- Ride the shift toward intelligent automation by focusing on these 26 AI penny stocks that blend scalable software models with growing real world adoption and recurring revenue.

- Lock in income focused opportunities by targeting these 13 dividend stocks with yields > 3% that balance attractive yields with payout sustainability and long term cash flow support.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報