Scotts Miracle-Gro (SMG): Valuation Check After Columbus Crew Stadium Naming Rights Deal and Renewed Investor Optimism

Scotts Miracle-Gro (SMG) just put its name on the Columbus Crew’s stadium, leaning into a bigger partnership to keep its brands front and center with consumers while the core business works through its challenges.

See our latest analysis for Scotts Miracle-Gro.

The naming rights deal lands at a moment when sentiment is trying to turn, with a 7 day share price return of 11.20 percent off a lower base and a 1 year total shareholder return still down 15.50 percent. This suggests early momentum rather than a full comeback.

If this kind of brand led pivot has your attention, it might be worth scanning for other consumer names with resilient balance sheets by exploring stable growth stocks screener (None results).

With shares still well below their five year highs yet trading only a touch under analyst targets, is Scotts Miracle-Gro quietly undervalued after a tough stretch, or is the market already pricing in a greener growth outlook?

Most Popular Narrative Narrative: 20.7% Undervalued

Compared with Scotts Miracle-Gro’s last close at $58.49, the most widely followed narrative points to a meaningfully higher fair value, built on a profitability reset rather than a sales boom.

Significant ongoing investments in supply chain technology, automation, and process efficiencies are unlocking ~$75 million in cost savings for fiscal '25 and another ~$75 million planned for '26/'27, directly driving gross margin recovery (aiming for 35%+), boosting EBITDA, and improving long-term net margins.

Curious how modest top line expectations can still justify a richer future valuation multiple, and what kind of margin upgrade that really implies? Dig into the full narrative to see the numbers behind this upside case.

Result: Fair Value of $73.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting consumer preferences toward organic products and prolonged uncertainty around the Hawthorne divestiture could still derail this margin recovery narrative.

Find out about the key risks to this Scotts Miracle-Gro narrative.

Another Angle on Value

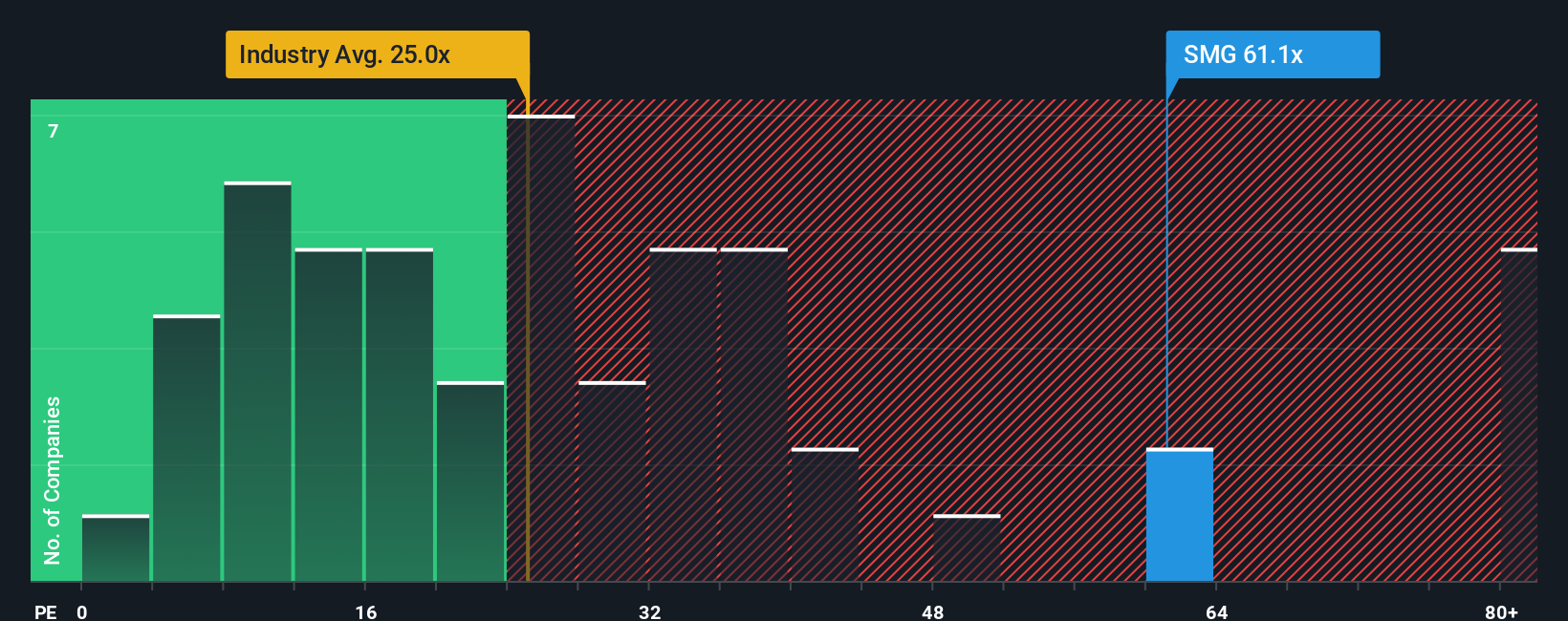

On earnings, Scotts Miracle-Gro looks less forgiving. Its 23.4 times price to earnings ratio sits above a 20.6 times fair ratio and more than double a 10.2 times peer average, which hints that expectations are already rich if this margin recovery stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Scotts Miracle-Gro Narrative

If your view diverges from these takes, or if you simply prefer digging into the numbers yourself, you can build a tailored storyline in minutes using Do it your way.

A great starting point for your Scotts Miracle-Gro research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover fresh ideas that match your strategy before the market catches on.

- Target steady income by reviewing these 13 dividend stocks with yields > 3% that can help anchor your portfolio through different market cycles.

- Ride structural growth by evaluating these 26 AI penny stocks positioned at the forefront of intelligent automation and data driven innovation.

- Capture potential bargains early by scanning these 908 undervalued stocks based on cash flows where market sentiment has not yet caught up with underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報