Is It Too Late to Consider GXO Logistics After Strong 2025 Share Price Gains?

- If you are wondering whether GXO Logistics is actually worth its current share price, or if the recent excitement has left it looking a bit stretched, you are not alone. That is exactly what we are going to unpack here.

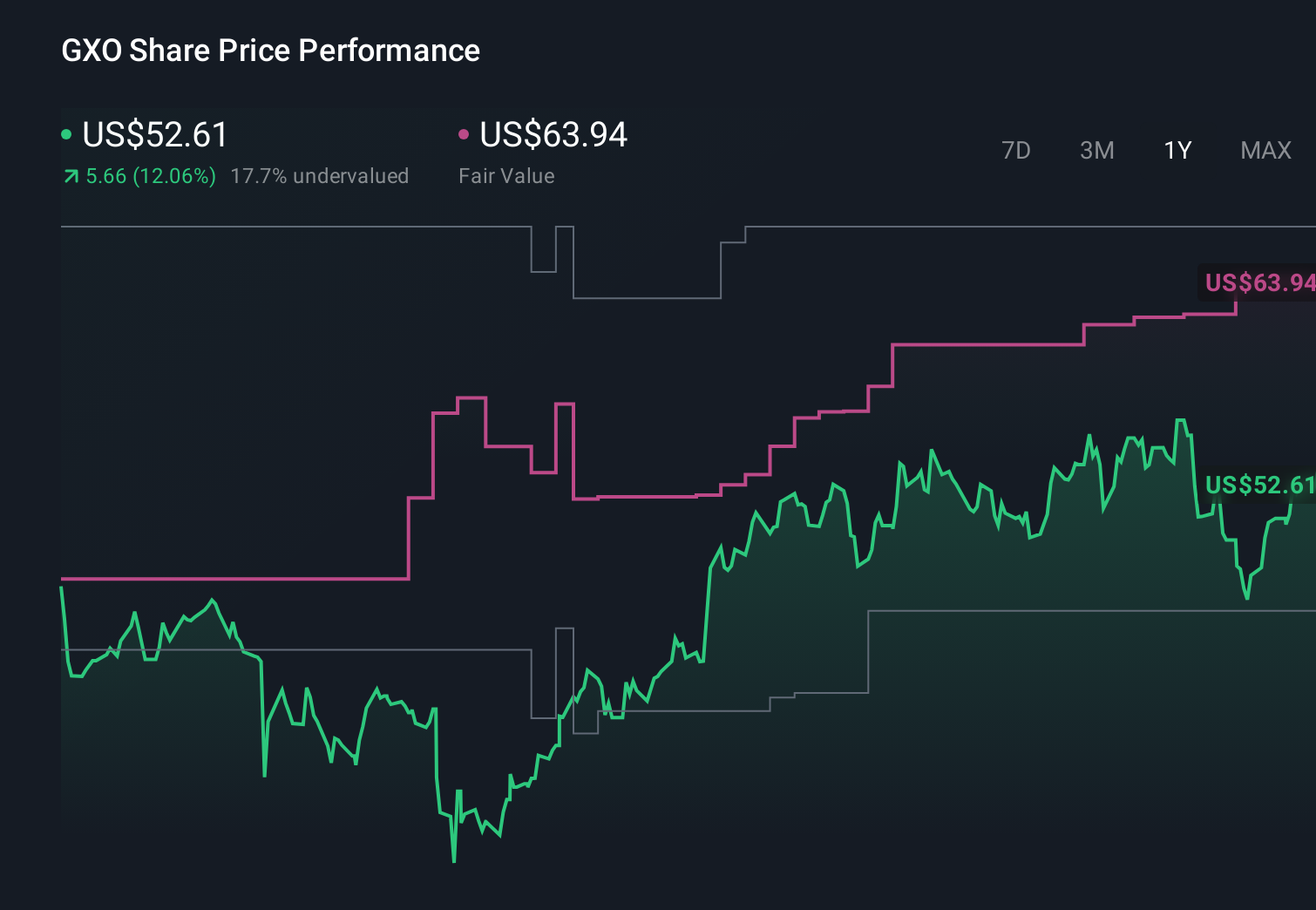

- Despite a small dip of about 1.1% over the last week, the stock is still up roughly 5.7% over the past month and 21.5% year to date, which suggests that investors see something to like in its long term story.

- Some of that optimism has been driven by ongoing enthusiasm around outsourced logistics and warehouse automation, where GXO continues to win new contracts and expand relationships with large global customers. The market has been rewarding companies that can scale efficiently in this space, and GXO has positioned itself as a key player in that trend.

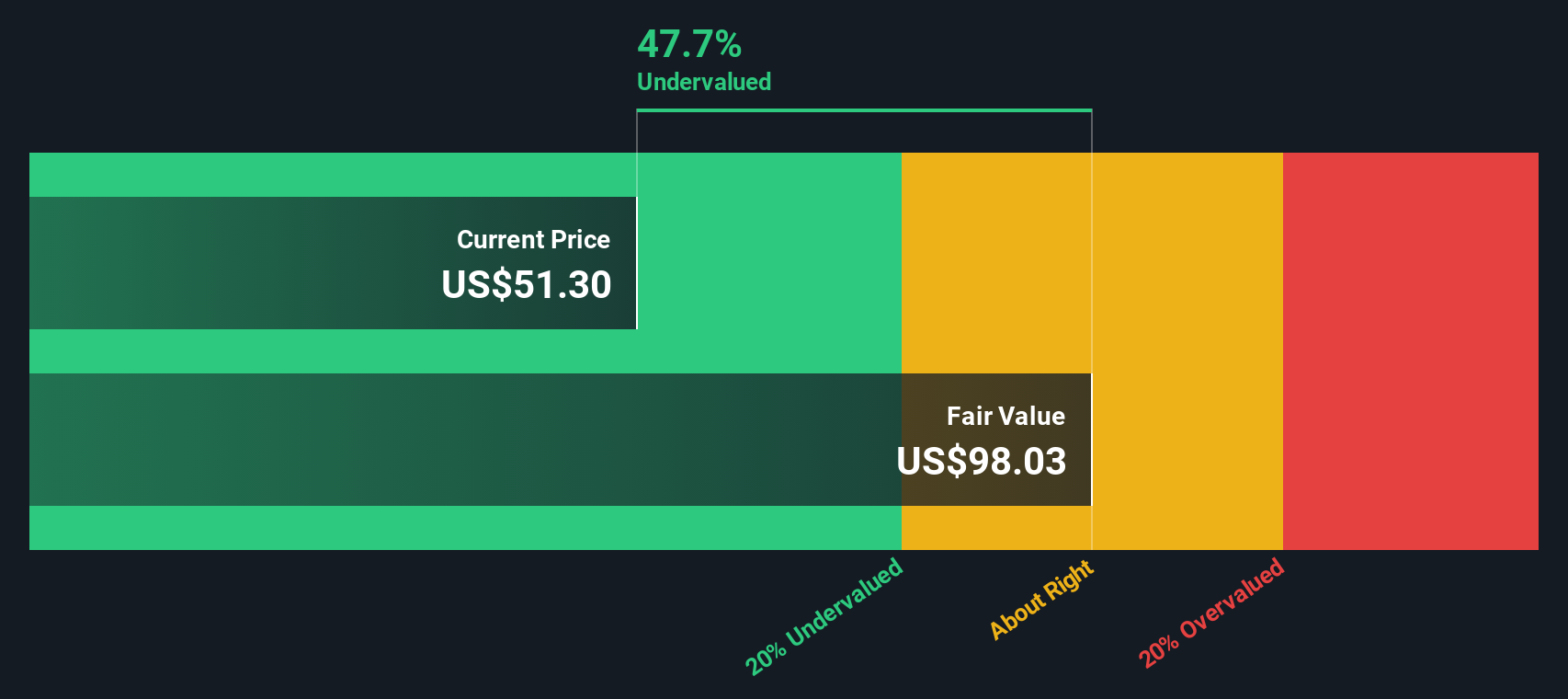

- Even so, GXO only scores 1 out of 6 on our undervaluation checks right now. We will walk through different valuation methods to see what the numbers indicate and finish with a more holistic way to think about its value that often gets missed.

GXO Logistics scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: GXO Logistics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today, using a required rate of return to reflect risk and the time value of money.

For GXO Logistics, the model uses a 2 Stage Free Cash Flow to Equity approach, starting from last twelve months free cash flow of about $63.8 Million and building up to analyst and extrapolated forecasts. By 2027, free cash flow is projected to reach roughly $350 Million, and the 10 year outlook continues to climb from around $340.7 Million in 2026 to about $444.9 Million in 2035, based on modest low single digit annual growth estimates.

When these projected cash flows are discounted back, the model arrives at an intrinsic value of about $46.01 per share. Compared with the current share price, this implies GXO is roughly 13.8% overvalued on a DCF basis, suggesting expectations in the market are already quite optimistic.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GXO Logistics may be overvalued by 13.8%. Discover 908 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: GXO Logistics Price vs Earnings

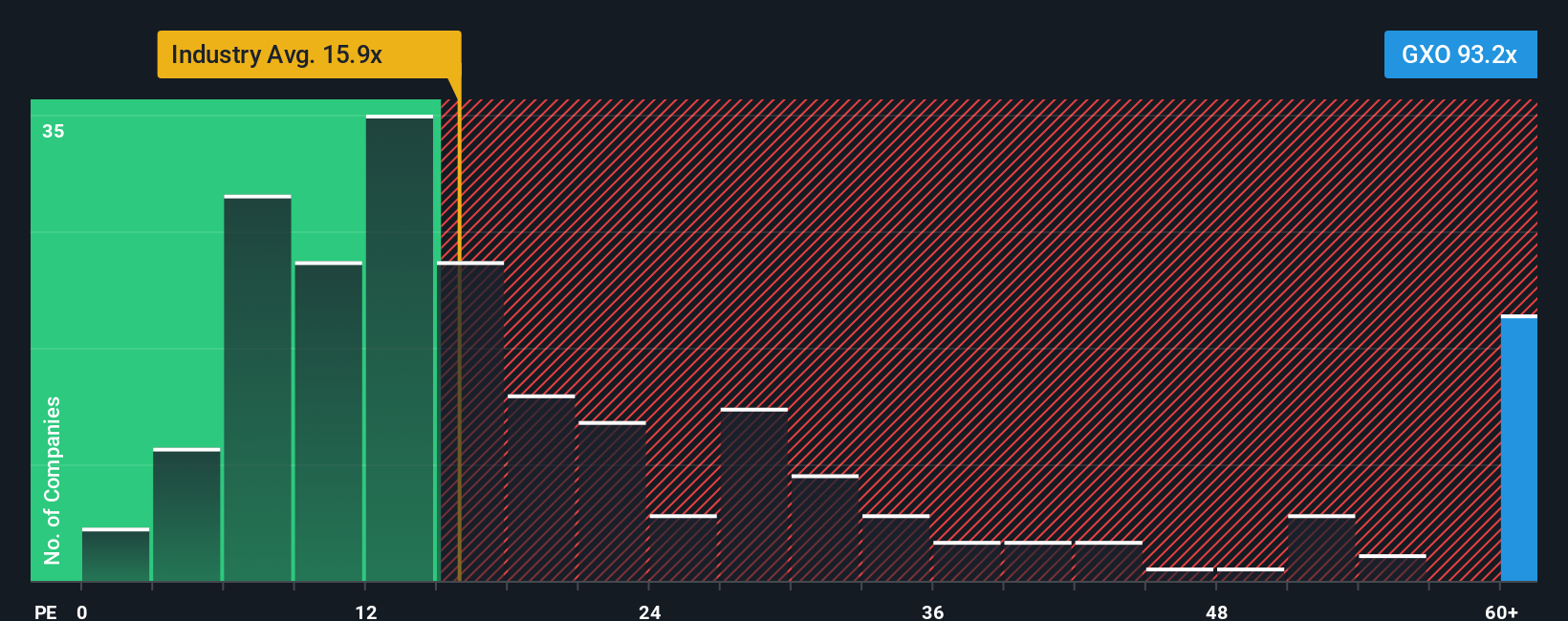

For profitable businesses like GXO Logistics, the price to earnings ratio is a helpful way to gauge whether investors are paying a sensible price for each dollar of current earnings. In general, faster growth and lower risk justify a higher PE, while slower growth or higher uncertainty should translate into a lower, more conservative multiple.

GXO currently trades on a PE of about 67.33x, which is well above both the Logistics industry average of roughly 15.94x and the broader peer group average of around 23.37x. To refine this comparison, Simply Wall St uses a proprietary Fair Ratio, which estimates what a reasonable PE should be for GXO, given its earnings growth outlook, profitability, industry, size and risk profile. For GXO, that Fair Ratio is calculated at about 41.79x, meaning the stock is trading significantly above what its fundamentals would typically justify.

Because the actual PE sits materially higher than the Fair Ratio, the multiple based view supports the idea that GXO is currently priced for very strong execution and leaves less margin for error.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GXO Logistics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your own story about a company that ties what you believe about its future revenue, earnings and margins to a concrete forecast and a fair value, all within an easy to use tool on Simply Wall St’s Community page that millions of investors already rely on.

Instead of only looking at static multiples like PE, a Narrative lets you set assumptions and see how they flow through to future financials and a fair value estimate. You can then compare that fair value with today’s share price to decide whether GXO looks like a buy, a hold or a sell. That view updates dynamically as new news, earnings or guidance changes come in.

For example, one GXO Narrative might assume strong contract wins, successful automation and upside toward the higher analyst target near $67. A more cautious Narrative could lean on slower freight recovery and integration risks, anchoring closer to the lower target around $52. This gives you a clear, numbers backed way to choose which story you believe and act on it.

Do you think there's more to the story for GXO Logistics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報