JGC Holdings (TSE:1963) Valuation Check After LNG Canada Train 2 Milestone with Fluor

JGC Holdings (TSE:1963) just cleared a major milestone with partner Fluor, finishing Train 2 of the LNG Canada Project and effectively wrapping up phase one of Canada’s first LNG mega development.

See our latest analysis for JGC Holdings.

The milestone in Canada comes as momentum in JGC Holdings’ shares has been building, with a 90 day share price return of 26.19 percent and a year to date share price return of 42.05 percent, alongside a robust 1 year total shareholder return of 51.75 percent. This points to growing confidence in its long term project pipeline.

If this LNG milestone has you thinking about where large scale engineering and energy demand might head next, it could be a good moment to explore aerospace and defense stocks for more ideas beyond JGC.

But with JGC’s share price already surging and analysts now seeing limited upside, is the market underestimating its long term LNG and energy pipeline, or has it already priced in the next leg of growth?

Most Popular Narrative: 8.5% Overvalued

With JGC Holdings last closing at ¥1,888.5 versus a narrative fair value of ¥1,740, the story leans toward optimism about future profitability and multiples.

Analysts expect earnings to reach ¥35.9 billion (and earnings per share of ¥146.59) by about September 2028, up from ¥-7.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ¥31.0 billion.

Want to see how a shrinking top line can still support sharply higher profits and a richer earnings multiple? Usually, that playbook is reserved for much flashier sectors. Curious which margin upgrades and return assumptions are doing the heavy lifting here? Dive deeper to unpack the full valuation blueprint behind this call.

Result: Fair Value of ¥1,740 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, repeated project execution missteps and reliance on volatile, large scale LNG EPC work could quickly erode confidence in those upgraded margin assumptions.

Find out about the key risks to this JGC Holdings narrative.

Another View: Cash Flows Tell a Different Story

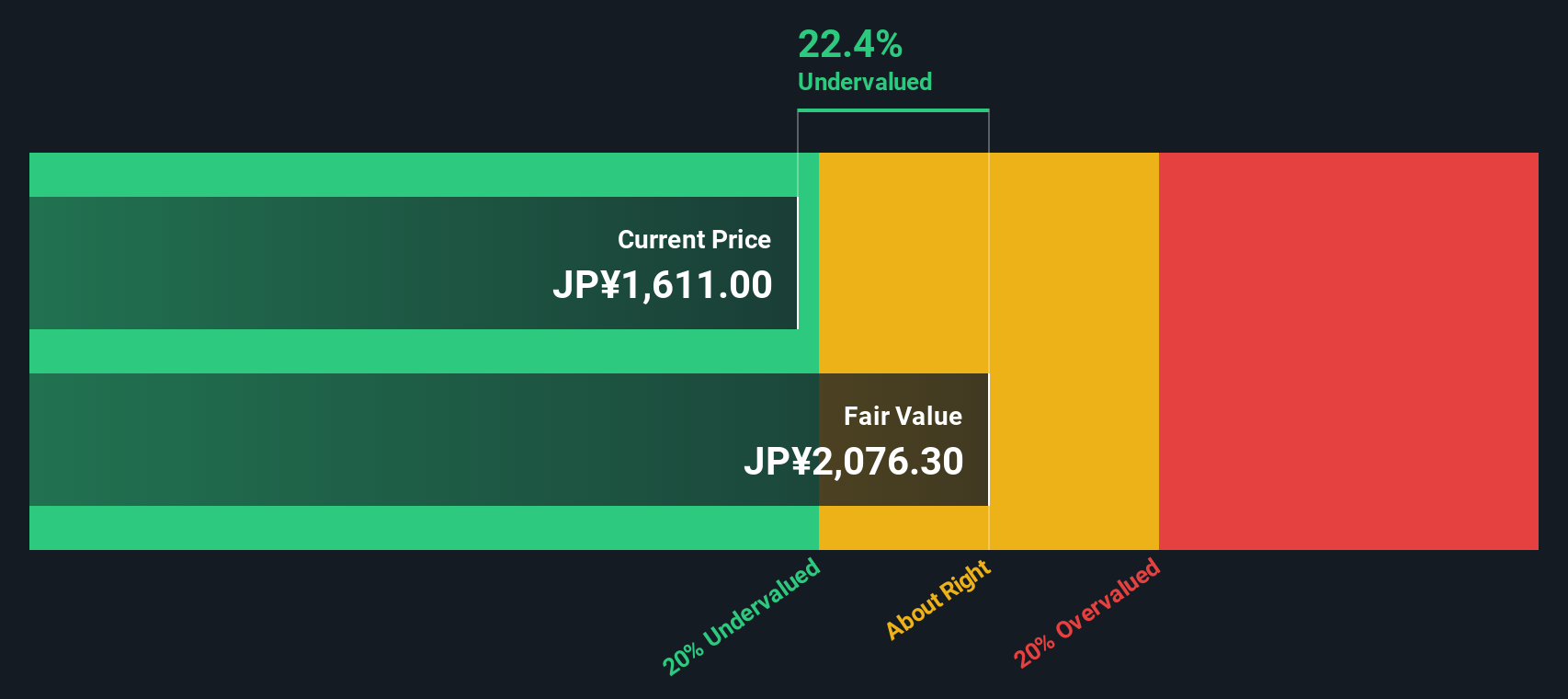

While the narrative fair value points to modest overvaluation, our DCF model suggests something else entirely and indicates JGC Holdings could be undervalued relative to its long term cash flow potential. If future projects land closer to plan than in the past, is the market still underpaying for that optionality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JGC Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JGC Holdings Narrative

If you would rather examine the numbers yourself and develop a different storyline, you can build a fresh narrative in just a few minutes, Do it your way.

A great starting point for your JGC Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before markets move on without you, put Simply Wall Street’s Screener to work and line up your next opportunities with data driven, long term potential.

- Capture early stage momentum by scanning these 3613 penny stocks with strong financials that already pair tiny market caps with surprisingly solid balance sheets and improving fundamentals.

- Position your portfolio for the digital infrastructure race by targeting these 80 cryptocurrency and blockchain stocks shaping payments, tokenization, and blockchain rails behind the scenes.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that combine attractive yields with business models built to handle volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報