Johnson & Johnson (JNJ): Evaluating Valuation After FDA Approval of Akeega Prostate Cancer Therapy

Johnson & Johnson (JNJ) just secured FDA approval for Akeega, a targeted combo therapy for BRCA2-mutated metastatic castration-sensitive prostate cancer, a niche where treatment options have been thin yet clinically important.

See our latest analysis for Johnson & Johnson.

The FDA greenlight for Akeega lands while Johnson & Johnson’s share price has climbed strongly, with a roughly 48.7% year to date share price return and a robust 1 year total shareholder return of about 53.4%. This signals building momentum despite ongoing legal noise and mixed views on future pipeline catalysts.

If this kind of late stage oncology win has your attention, it is a good moment to explore other established and emerging names across healthcare stocks and compare their growth, income, and risk profiles.

With the stock near record highs, trading slightly above consensus price targets but still at a hefty intrinsic discount, is Johnson & Johnson a rare quality compounder still mispriced by the market, or is future growth already fully baked in?

Most Popular Narrative: 5.7% Overvalued

With Johnson & Johnson last closing at $214.17 against a narrative fair value of about $202.54, the current price reflects a modest valuation premium that rests heavily on specific long term growth and margin assumptions.

Recent research updates reflect a broadly constructive stance on Johnson & Johnson, with a growing number of firms highlighting improving fundamentals, a stronger growth profile, and a more compelling risk reward setup following the latest results and guidance.

Want to see what justifies paying above fair value for a mature pharma giant? The narrative leans on steady top line growth, resilient margins, and a richer future earnings multiple than the broader sector. Curious how those moving parts combine to support that premium pricing story?

Result: Fair Value of $202.54 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, litigation overhangs and pressure from key drug patent expiries could quickly challenge the premium valuation if outcomes or biosimilar competition disappoint.

Find out about the key risks to this Johnson & Johnson narrative.

Another View: Big Undervaluation Signal

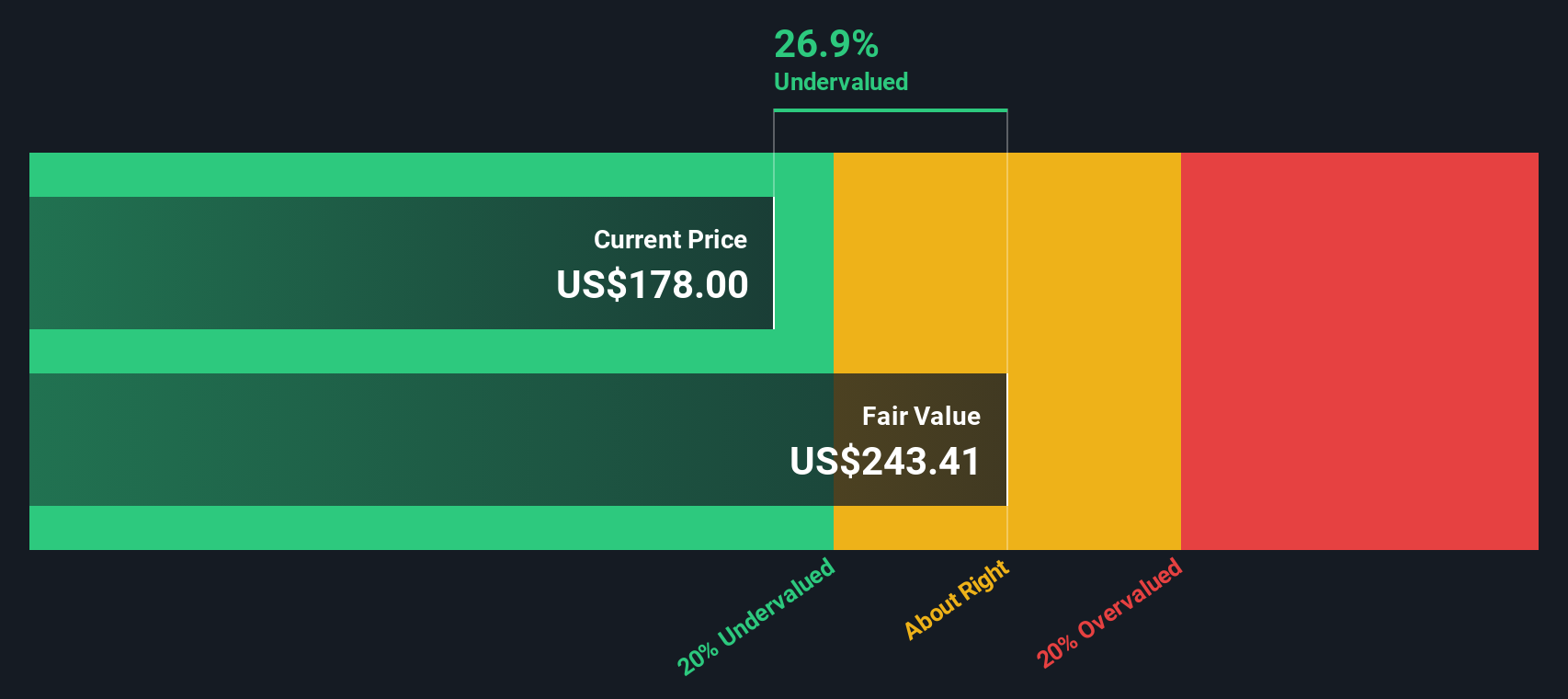

While the narrative fair value suggests Johnson & Johnson is modestly overvalued, our DCF model paints the opposite picture, implying shares are trading at a steep discount to intrinsic value. When one framework sees caution and another sees opportunity, which set of assumptions do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Johnson & Johnson for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Johnson & Johnson Narrative

If you are not fully aligned with this view or would rather interrogate the numbers yourself, you can quickly build a custom take in under three minutes: Do it your way.

A great starting point for your Johnson & Johnson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider adding a few fresh angles to your watchlist using our powerful stock screener tools, so you are not leaving potential upside on the table.

- Look for potential multi-baggers early by targeting these 3613 penny stocks with strong financials that already back their small size with real financial strength.

- Explore opportunities at the forefront of automation and data intelligence by reviewing these 26 AI penny stocks reshaping entire industries.

- Reinforce your income stream with these 13 dividend stocks with yields > 3% that can help support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報