Undiscovered Gems in Europe for December 2025

As European markets navigate a complex landscape of mixed economic indicators and potential monetary policy shifts, the pan-European STOXX Europe 600 Index has seen slight declines, reflecting broader market uncertainties. Amid these dynamics, identifying promising small-cap stocks requires a keen understanding of how they can leverage resilience and innovation to thrive in challenging environments.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Embention Sistemas Inteligentes (ENXTPA:MLUAV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Embention Sistemas Inteligentes, S.A. is a drone company specializing in the development, manufacturing, and sale of drone components and autonomous vehicles for both civil and military applications, with a market cap of €263.24 million.

Operations: The company generates revenue through the sale of drone components and autonomous vehicles, catering to both civil and military sectors.

Embention Sistemas Inteligentes, a small player in the aerospace and defense sector, has recently turned profitable, marking a significant milestone. The company's financial health seems robust with more cash than total debt and high-quality earnings. Despite its profitability, the share price has been highly volatile over the past three months. Cash equivalents have fluctuated from €2.26 million in 2020 to €5.28 million in 2022 before stabilizing at €2.21 million by late 2025. This volatility might impact investor sentiment but underscores potential for growth as it navigates its newly profitable status amidst industry challenges.

- Click here to discover the nuances of Embention Sistemas Inteligentes with our detailed analytical health report.

Learn about Embention Sistemas Inteligentes' historical performance.

Cloetta (OM:CLA B)

Simply Wall St Value Rating: ★★★★★★

Overview: Cloetta AB (publ) operates as a confectionery company with a market cap of approximately SEK11.28 billion.

Operations: The company generates revenue primarily from packaged branded goods, contributing SEK6.02 billion, and pick & mix products, adding SEK2.56 billion.

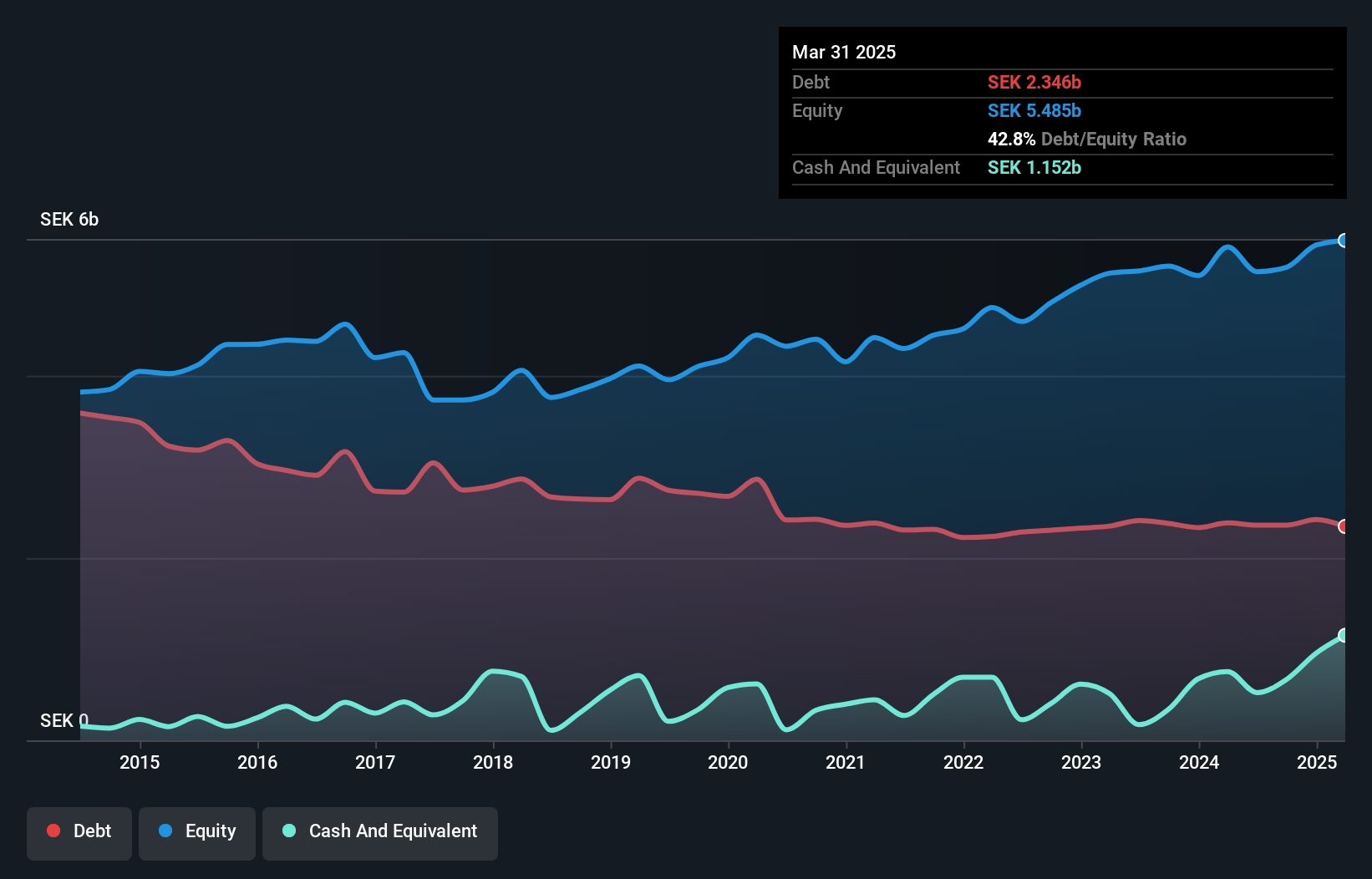

Cloetta, a notable player in the confectionery sector, is making strides with significant financial and strategic developments. Over the past year, earnings surged by 56.7%, outpacing the food industry average of 30%. The company trades at a substantial discount of 32.9% below its estimated fair value, suggesting potential upside. Cloetta's net debt to equity ratio has impressively decreased from 55.1% to 28.1% over five years, indicating prudent financial management. Recent expansions include opening a CandyKing store in New York and relocating Scandinavian operations to Malmö's innovative Werket area in September 2026, enhancing brand presence and operational efficiency.

- Navigate through the intricacies of Cloetta with our comprehensive health report here.

Understand Cloetta's track record by examining our Past report.

RVRC Holding (OM:RVRC)

Simply Wall St Value Rating: ★★★★★★

Overview: RVRC Holding AB (publ) operates in the e-commerce outdoor clothing sector across Germany, Sweden, and internationally, with a market capitalization of approximately SEK6.83 billion.

Operations: RVRC Holding generates revenue primarily from its retail apparel segment, amounting to SEK1.97 billion. The company has a market capitalization of approximately SEK6.83 billion.

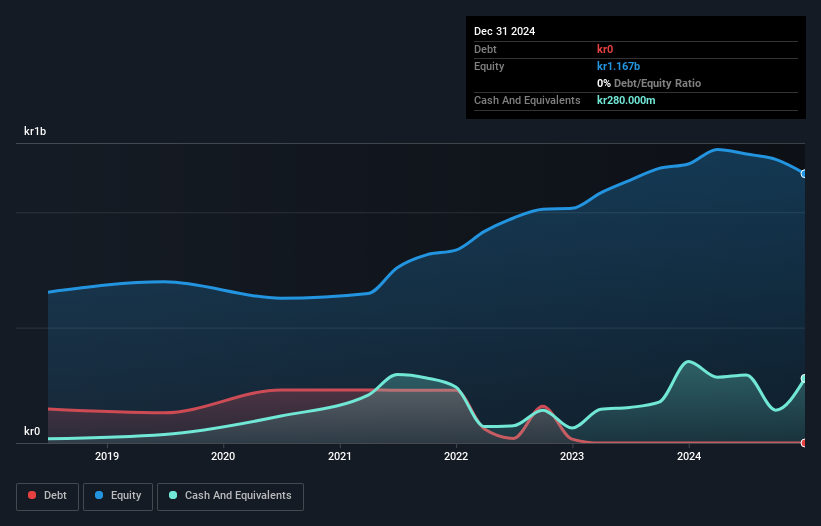

RVRC Holding, a nimble player in the European outdoor apparel market, is making waves with its innovative RVRC Ultra Series. Despite facing a 2% earnings dip last year, it shines with no debt and high-quality earnings. Recent board changes and share repurchases of 2.22% for SEK 110 million indicate strategic adjustments. The company reported Q1 sales of SEK 392 million and net income of SEK 58 million, reflecting solid growth from previous periods. Analysts predict revenue growth at an annual rate of 5.7%, although challenges like digital marketing costs and currency volatility remain hurdles to watch out for.

Turning Ideas Into Actions

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 309 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報