Madison Square Garden Entertainment (MSGE): Valuation Check After Sphere Immersive Sound Debut at Radio City

Madison Square Garden Entertainment (MSGE) just put a fresh spotlight on its venues by pairing Radio City Music Hall’s new Sphere Immersive Sound system with a one night New York Philharmonic debut.

See our latest analysis for Madison Square Garden Entertainment.

That backdrop of tech driven upgrades arrives as investors have already pushed MSGE’s share price to $52.71, with a strong year to date share price return and double digit 3 month gains suggesting positive momentum that broadly aligns with its solid 1 year total shareholder return.

If this kind of venue innovation has your attention, it may also be worth exploring fast growing stocks with high insider ownership as another way to spot companies where growth and conviction could be lining up.

With shares up more than 50 percent over the past year and now trading slightly above the average analyst target, the question is whether MSGE still offers upside from here or if markets are already pricing in future growth.

Most Popular Narrative Narrative: 2.3% Overvalued

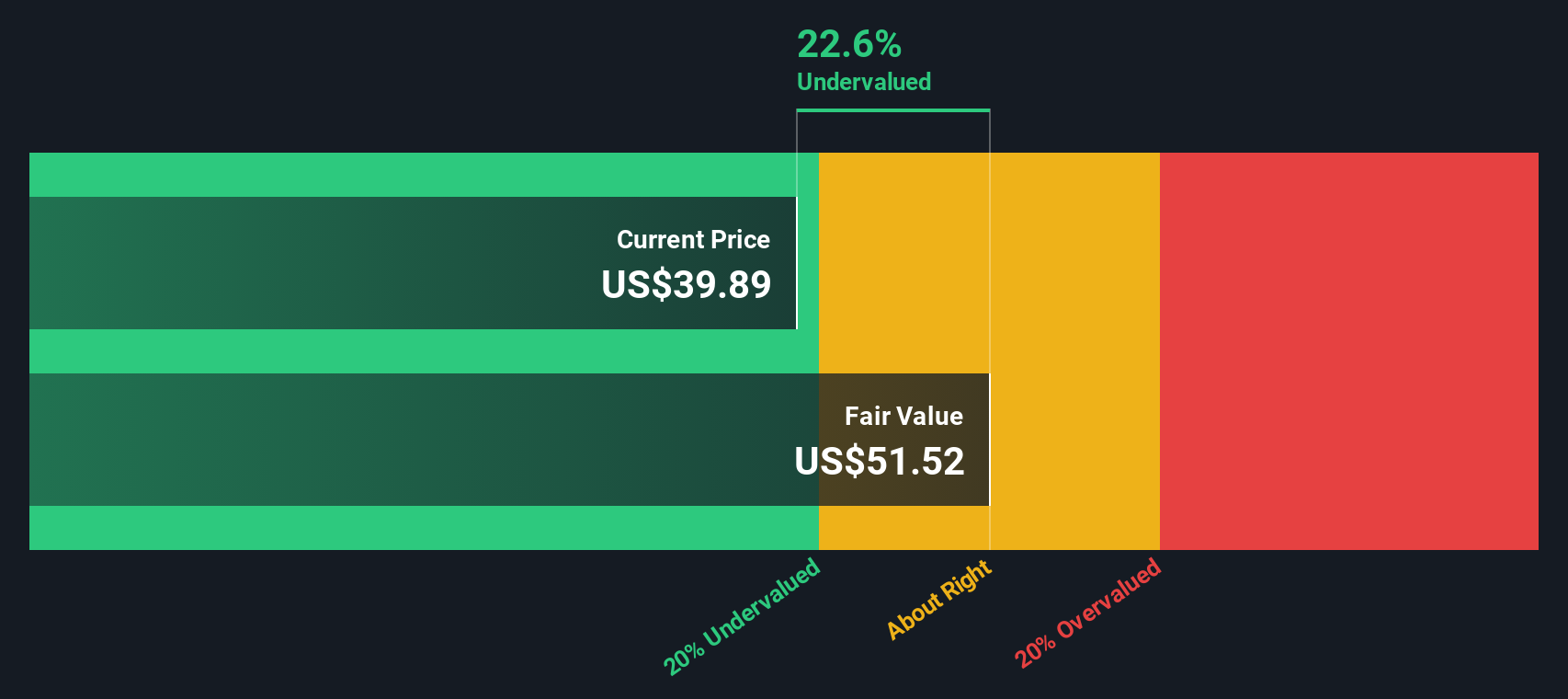

With Madison Square Garden Entertainment closing at $52.71 against a narrative fair value of $51.50, the current setup assumes only modest upside from here and puts the focus squarely on how its future earnings story unfolds.

Analysts expect earnings to reach $131.3 million (and earnings per share of $2.38) by about September 2028, up from $37.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $162 million in earnings, and the most bearish expecting $100.6 million.

Curious how a live entertainment company earns this kind of earnings leap, while assuming a tamer future valuation multiple than many peers? The narrative quietly incorporates steady revenue expansion, sharp margin improvement, and shrinking share count to justify today’s pricing and beyond. Want to see exactly how those moving parts combine into that fair value call?

Result: Fair Value of $51.5 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could unravel if marquee events fail to refill the calendar or if a consumer slowdown undercuts premium hospitality and sponsorship demand.

Find out about the key risks to this Madison Square Garden Entertainment narrative.

Another Angle on Valuation

Our DCF model presents a different perspective, indicating that MSGE may be about 15.7 percent undervalued at $52.71 compared with an estimated fair value of $62.56. If cash flows align with expectations and sentiment adjusts accordingly, the potential upside from here could be greater than the current narrative suggests.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Madison Square Garden Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Madison Square Garden Entertainment Narrative

If you see things differently, or want to dig into the numbers yourself, you can shape a personalized view in minutes: Do it your way.

A great starting point for your Madison Square Garden Entertainment research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener now to hunt fresh ideas before other investors seize the most compelling setups.

- Capture overlooked value by running through these 908 undervalued stocks based on cash flows where discounted cash flow potential could signal tomorrow’s strongest winners.

- Supercharge your growth watchlist by zeroing in on these 26 AI penny stocks positioned at the forefront of intelligent automation.

- Boost your income stream by scanning these 13 dividend stocks with yields > 3% that may offer reliable yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報