WisdomTree (WT) Launches Tokenized Income Fund: What the New Digital Push Means for Its Valuation

WisdomTree (WT) just rolled out its Equity Premium Income Digital Fund, a tokenized strategy that uses put writing to target equity income with potentially smoother returns, delivered through its Prime and Connect platforms.

See our latest analysis for WisdomTree.

This launch lands while WisdomTree’s share price, now at $11.67, shows solid underlying momentum, with a double digit year to date share price return and a standout three year total shareholder return well into triple digits. This suggests investors are rewarding its digital asset push.

If this kind of innovation has your attention, it could be a good time to explore fast growing stocks with high insider ownership for more potential standouts with strong alignment between management and shareholders.

With shares still trading at a hefty discount to analyst targets despite strong multi year returns and accelerating earnings, is WisdomTree an underappreciated digital asset winner in the making, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 21.1% Undervalued

With WisdomTree closing at $11.67 against a narrative fair value near $14.79, the story frames today’s price as lagging improving fundamentals and digital momentum.

The continued global shift from active to passive investing remains a powerful driver for WisdomTree's core ETF business, as evidenced by broad-based net inflows, growing international scale, and record AUM, which should translate to higher revenue and improved operating leverage.

Curious what kind of revenue runway, earnings surge, and future valuation multiple are needed to back this price gap, and how ambitious those targets really are.

Result: Fair Value of $14.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy digital asset and stablecoin investments that face regulatory setbacks or weak adoption could stall margin expansion and challenge the current undervaluation thesis.

Find out about the key risks to this WisdomTree narrative.

Another Take On Value

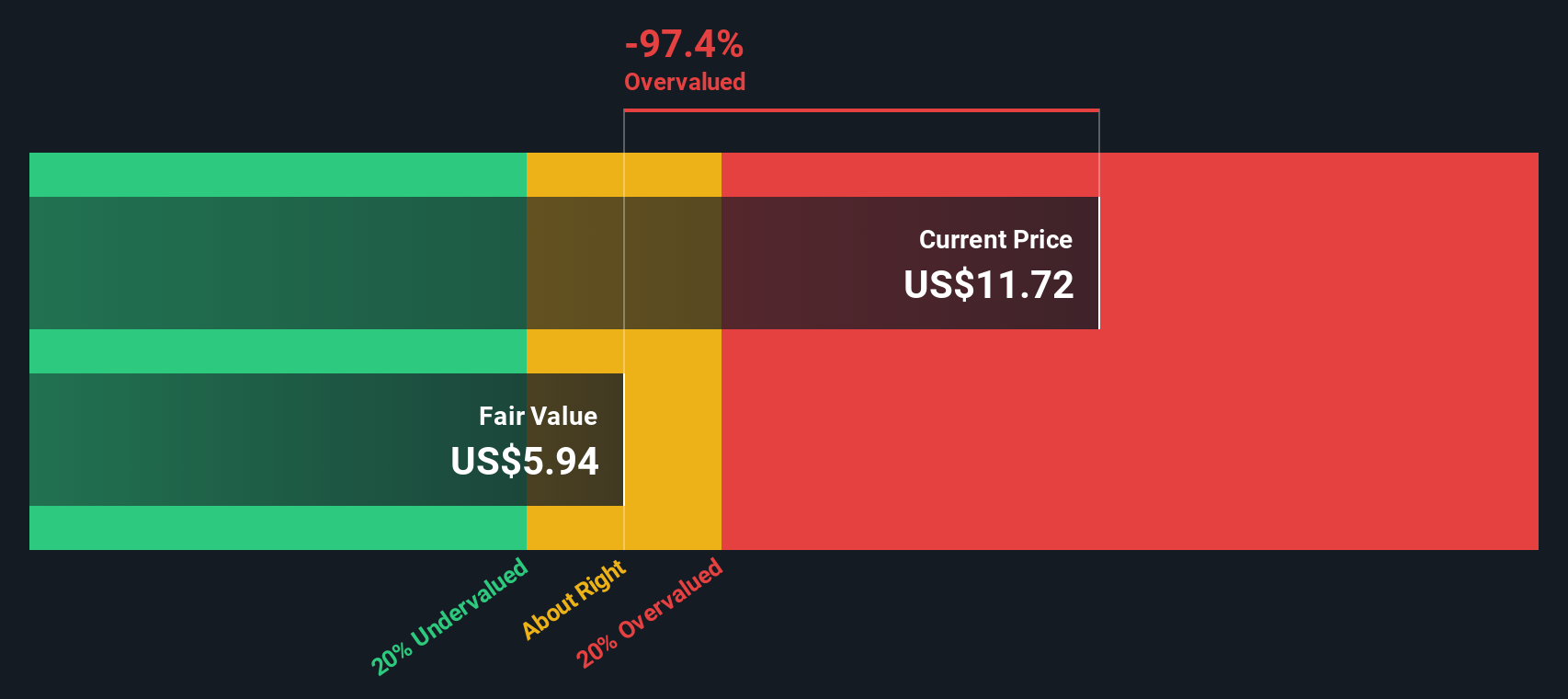

While the narrative fair value points to a 21.1% upside, our DCF model paints a tougher picture. It puts fair value near $6.04, well below the current $11.67 share price. If cash flows matter more than sentiment, is WisdomTree actually priced for perfection rather than upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out WisdomTree for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own WisdomTree Narrative

If you see the story differently or want to stress test your own assumptions, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your WisdomTree research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one opportunity. Use the Simply Wall Street Screener to uncover fresh, data driven ideas that other investors may still be overlooking.

- Capture potential mispricing early by scanning these 908 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Tap into powerful secular trends by focusing on these 26 AI penny stocks positioned to benefit from rapid advances in artificial intelligence.

- Secure more reliable portfolio income by targeting these 13 dividend stocks with yields > 3% that pay attractive, sustainable yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報