Assessing Kennametal’s Valuation as It Expands Digital Tooling Through New Hexagon CAM Integration

Kennametal (KMT) is turning heads after announcing a new integration with Hexagon's cloud based Tool Library, linking its digital tooling data directly into Hexagon's WORKNC CAM platform to streamline setup and improve machining accuracy.

See our latest analysis for Kennametal.

The integration news comes amid strong momentum, with Kennametal’s share price returning about 40 percent over the last 90 days and roughly 23 percent year to date, while the one year total shareholder return sits near 14 percent. This suggests that investors may be responding positively to its digital push.

If this kind of tooling and manufacturing upgrade has your attention, it might also be worth exploring other industrial names and discovering fast growing stocks with high insider ownership.

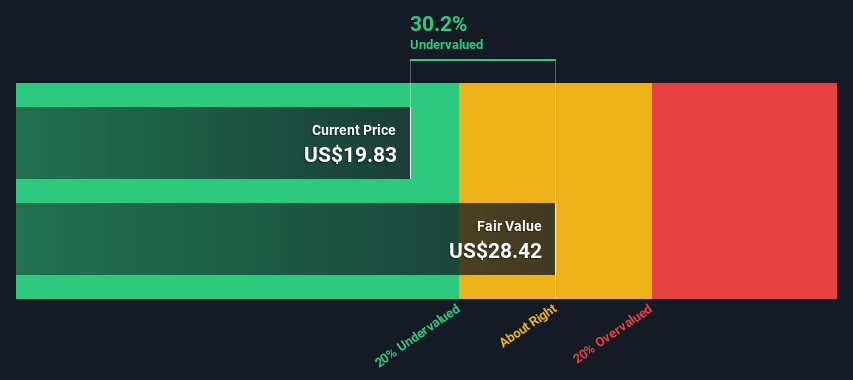

Yet with the stock trading above consensus analyst targets but still appearing heavily discounted on some intrinsic measures, investors now face a key question: Is Kennametal a genuine value opportunity, or is future growth already priced in?

Most Popular Narrative Narrative: 15.4% Overvalued

With Kennametal’s fair value estimate sitting below the last close, the most followed narrative frames today’s rally as running ahead of fundamentals.

The analysts have a consensus price target of $21.062 for Kennametal based on their expectations of its future earnings growth, profit margins and other risk factors. In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $120.7 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 8.9%.

Curious what kind of slow but steady revenue climb, margin rebuild, and lower future earnings multiple still produce that valuation call? The full narrative spells it out.

Result: Fair Value of $25.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in core end markets and unproven cost savings from ongoing restructuring could quickly undermine the optimistic fair value narrative that investors are leaning on.

Find out about the key risks to this Kennametal narrative.

Another Angle on Value

While the most popular narrative says Kennametal is around 15 percent overvalued versus a 25.25 dollar fair value, our DCF model points the other way and implies the shares are trading at a steep discount instead. Which set of assumptions feels more believable to you?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kennametal for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kennametal Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can build a tailored view in minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kennametal.

Ready for more smart investment ideas?

Before you move on, take a moment to scan fresh stock ideas powered by data driven screeners that can sharpen your next move and uncover under the radar opportunities.

- Capture income potential by reviewing these 13 dividend stocks with yields > 3% that may strengthen your portfolio’s cash flow and reduce reliance on short term market swings.

- Target future growth by using these 26 AI penny stocks to zero in on companies harnessing artificial intelligence to reshape industries and earnings power.

- Strengthen your core holdings with these 908 undervalued stocks based on cash flows that appear attractively priced relative to their cash flows and long term prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報