Is Tenable (TENB) Quietly Redefining Its Government Cloud Edge With New FedRAMP Access And CTO?

- Tenable Holdings recently appointed former Microsoft security executive Vlad Korsunsky as Chief Technology Officer and Managing Director of Tenable Israel, and earlier this month the U.S. General Services Administration announced a OneGov agreement enabling federal agencies, including the Department of Defense, to access Tenable’s FedRAMP-authorized Cloud Security solution at a discount through March 2027.

- These moves highlight Tenable’s push to scale its Tenable One platform, deepen AI-focused innovation, and broaden its role in securing complex U.S. government multi-cloud and AI environments.

- We’ll now examine how the expanded FedRAMP cloud security access for U.S. agencies could reshape Tenable’s investment narrative and growth profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Tenable Holdings Investment Narrative Recap

To own Tenable, you need to believe its exposure management platform can keep gaining relevance as enterprises and governments grapple with expanding cloud and AI-driven attack surfaces. The new GSA OneGov agreement strengthens the near term federal pipeline but also heightens Tenable’s dependence on U.S. public sector spending, which remains the company’s key catalyst and its most immediate source of earnings volatility.

The OneGov deal, which makes Tenable’s FedRAMP-authorized cloud security available to federal agencies at a discount through March 2027, is the clearest recent example of this trade-off. It supports the thesis of larger, stickier multi-year platform commitments, while reinforcing the risk that slower procurement cycles or federal budget pressure could quickly ripple through renewal rates and expansion metrics.

Yet against this progress, investors should be aware that Tenable’s growing reliance on long term federal contracts could...

Read the full narrative on Tenable Holdings (it's free!)

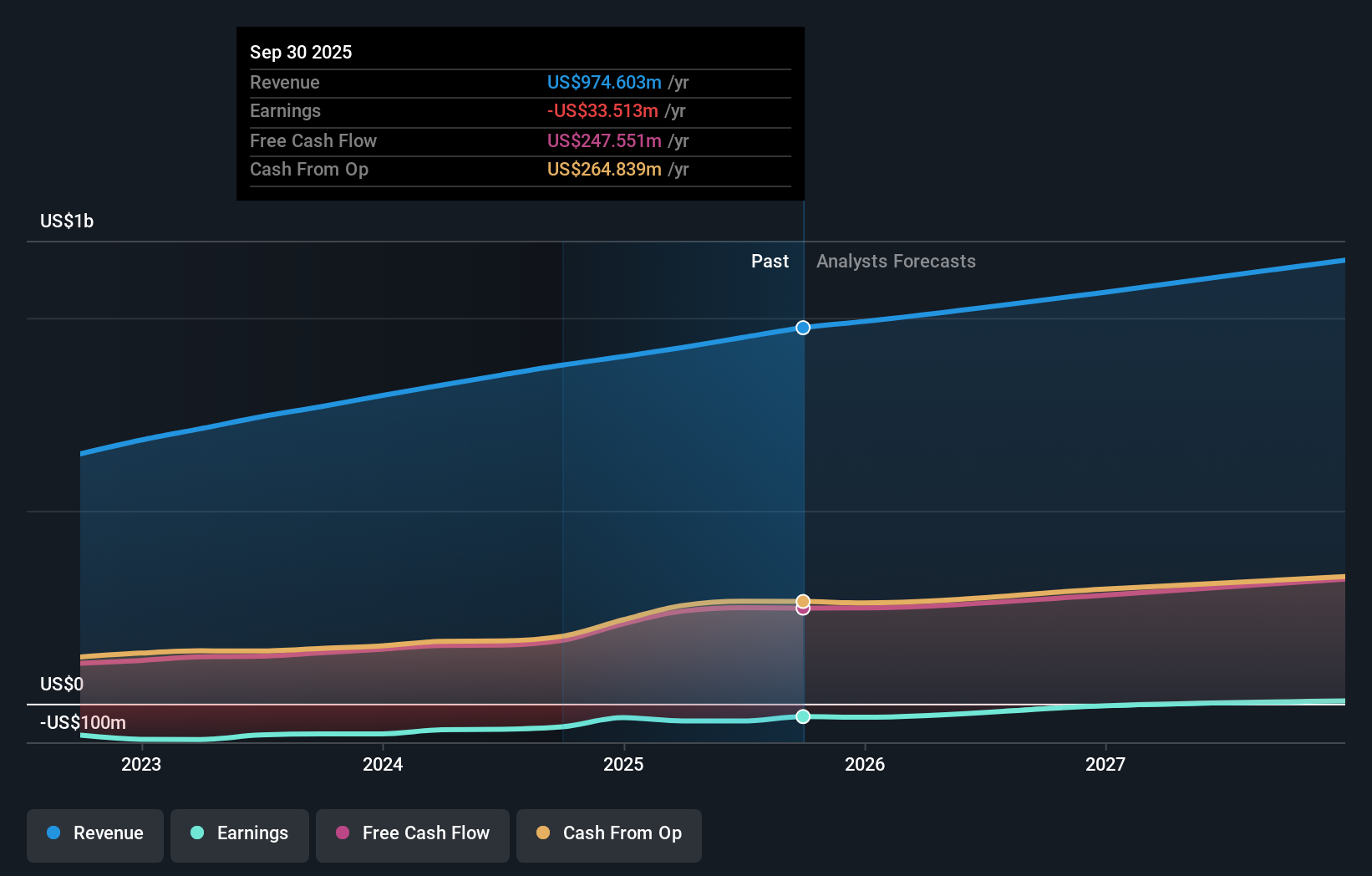

Tenable Holdings' narrative projects $1.2 billion revenue and $33.8 million earnings by 2028. This requires 8.8% yearly revenue growth and an $78.8 million earnings increase from -$45.0 million today.

Uncover how Tenable Holdings' forecasts yield a $37.89 fair value, a 53% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community see fair value between US$19.88 and about US$53.97, with views spread across that full spectrum. Against this, Tenable’s increased exposure to U.S. federal deal cycles may amplify both the benefits of renewal driven growth and the earnings sensitivity if contract scrutiny tightens, so it is worth weighing several of these perspectives before forming a view.

Explore 6 other fair value estimates on Tenable Holdings - why the stock might be worth 20% less than the current price!

Build Your Own Tenable Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tenable Holdings research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Tenable Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tenable Holdings' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報