Assessing Bristol Myers Squibb After 16% Rally and New Drug Approvals in 2025

- If you are wondering whether Bristol-Myers Squibb at around $54 is a bargain or a value trap, you are not alone. This article is going to unpack that calmly and clearly.

- After a tough stretch, the stock has bounced with a 5.1% gain over the last week and a strong 16.4% move over the last 30 days, even though it is still down year to date and only modestly up over 1 year. This hints at shifting sentiment rather than a completed turnaround.

- That recent strength has come as investors refocus on Bristol-Myers Squibb's late stage drug pipeline and strategic deals that aim to offset looming patent expiries, while regulators and payers continue to scrutinize pricing and competitive dynamics in key therapeutic areas. At the same time, the broader healthcare space has seen renewed interest as a defensive play, giving established pharma names like BMY a bit more attention from long term investors.

- On our framework, Bristol-Myers Squibb scores a solid 5/6 valuation check score. This suggests it looks undervalued on most of the standard metrics we track. Next we will walk through those approaches one by one, before finishing with a deeper way of thinking about valuation that goes beyond the usual multiples and models.

Find out why Bristol-Myers Squibb's 2.0% return over the last year is lagging behind its peers.

Approach 1: Bristol-Myers Squibb Discounted Cash Flow (DCF) Analysis

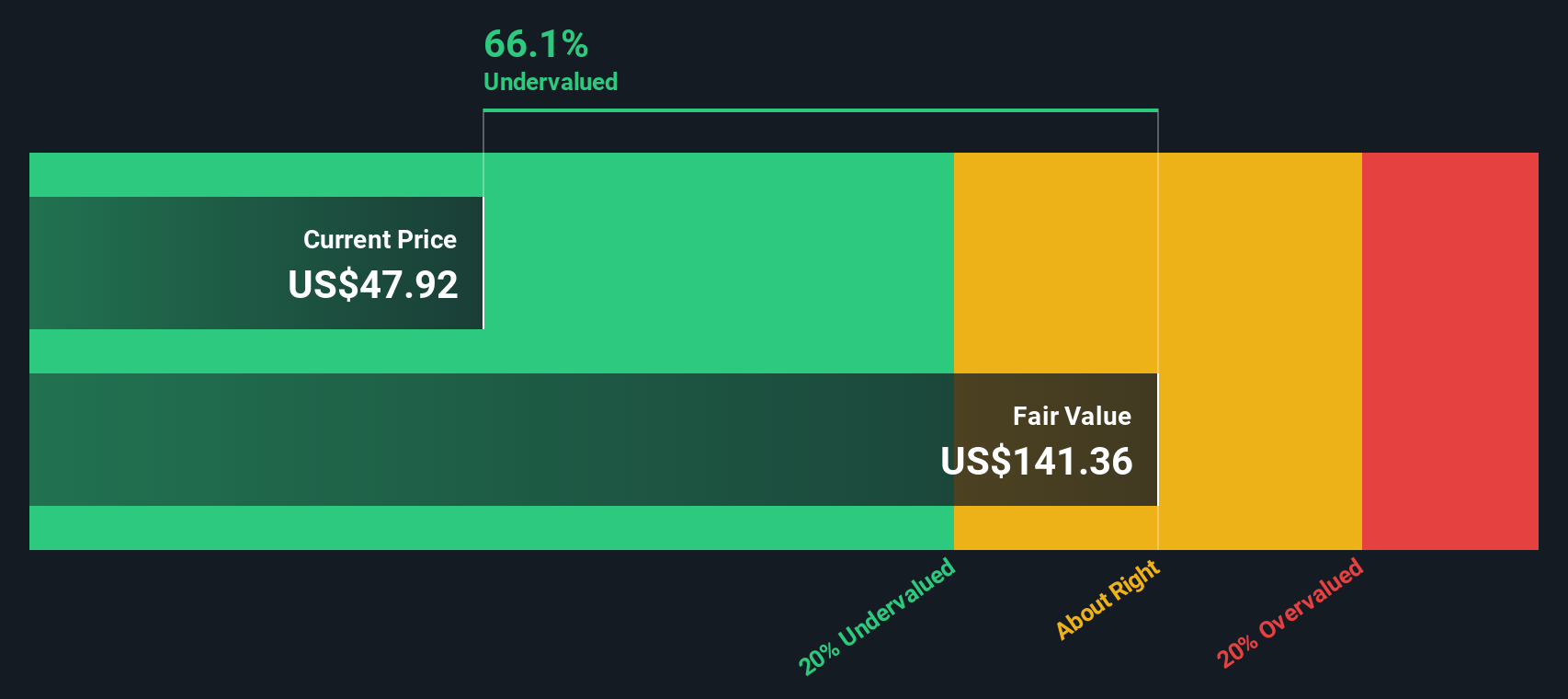

A Discounted Cash Flow model takes the cash Bristol-Myers Squibb is expected to generate in the future, then discounts those projections back into today’s dollars to estimate what the business is worth now.

On this 2 Stage Free Cash Flow to Equity model, Bristol-Myers Squibb generated trailing twelve month free cash flow of about $15.3 billion. Analysts see free cash flow easing from current levels, with projections stepping down through the late 2020s and Simply Wall St extrapolating out to around $11.1 billion by 2035 as mature products face patent pressure and newer therapies ramp up.

Adding up all those future cash flows in today’s money gives an estimated intrinsic value of roughly $117.66 per share. Against a current share price around $54, the model implies the stock is about 53.9% undervalued. This suggests the market is heavily discounting execution and pipeline risks relative to this cash flow outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bristol-Myers Squibb is undervalued by 53.9%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Bristol-Myers Squibb Price vs Earnings

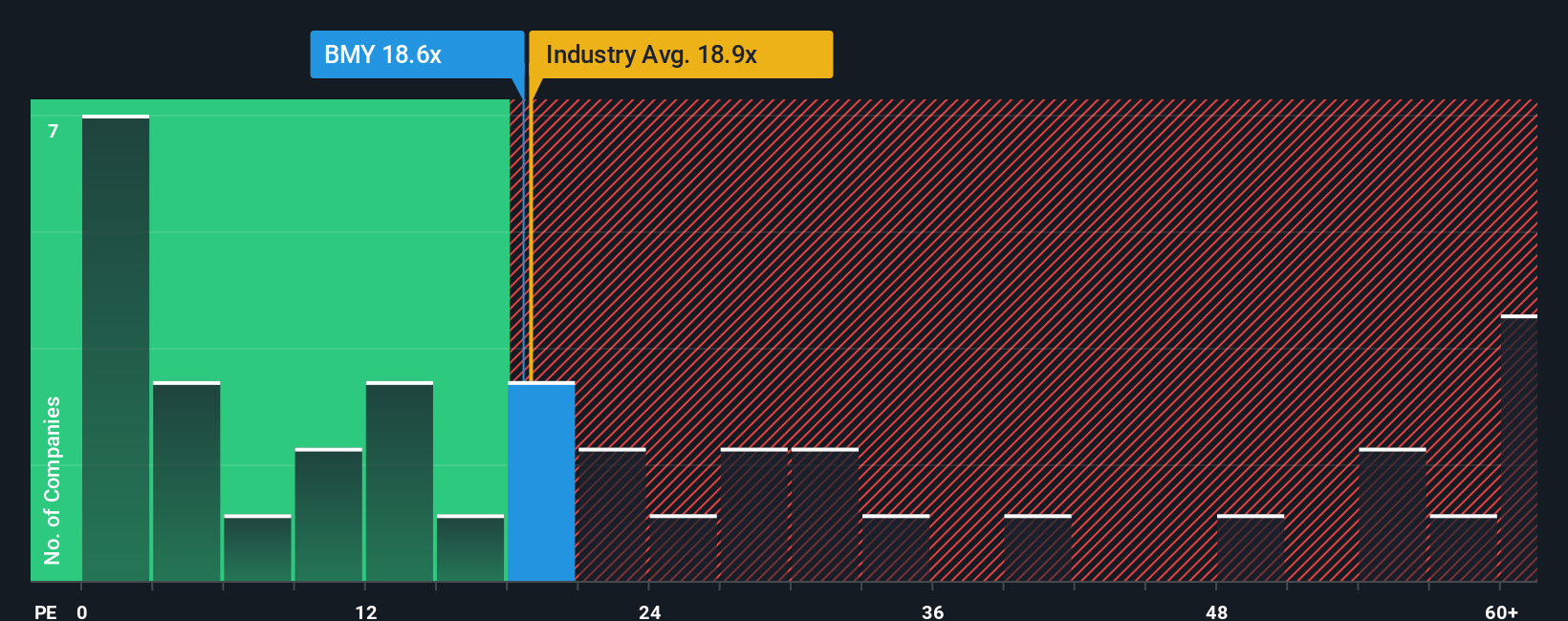

For profitable, established companies like Bristol-Myers Squibb, the price to earnings ratio is a practical way to gauge how much investors are willing to pay today for each dollar of current earnings. It ties the share price back to bottom line profitability, which is what ultimately supports dividends, buybacks and long term value.

What counts as a fair PE depends on how quickly earnings are expected to grow and how risky those earnings are. Faster, more reliable growers usually trade on a higher multiple, while slower or riskier businesses tend to trade on lower PEs. Bristol-Myers Squibb currently trades on about 18.3x earnings, a touch below the broader Pharmaceuticals industry average of roughly 19.7x and well below the peer group average near 24.3x. This suggests the market is applying a discount to its earnings compared with many competitors.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE you would reasonably expect for Bristol-Myers Squibb given its growth outlook, profitability, risk profile, industry and size. On this basis, the stock’s Fair Ratio is around 26.0x, comfortably above the current 18.3x. That gap indicates investors are paying less than what these fundamentals would justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bristol-Myers Squibb Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Bristol-Myers Squibb’s story with a concrete forecast for its future revenues, earnings and margins, and then into a Fair Value that you can directly compare to today’s share price.

A Narrative on Simply Wall St is your own investment storyline that sits behind the numbers, turning assumptions about things like new drug launches, patent cliffs, cost savings and policy changes into a structured financial outlook and a clear estimate of what the stock is really worth.

These Narratives, which live in the Community section of the platform used by millions of investors, are easy to create, automatically update as fresh news or earnings arrive, and can highlight whether your Fair Value estimate sits above or below the current market price.

For Bristol-Myers Squibb, one investor Narrative might emphasize portfolio trends and cost savings to arrive at a Fair Value near $65 per share, while a more cautious Narrative focused on patent cliffs and pricing pressure might sit closer to $54, illustrating how different perspectives can coexist and be compared in one place.

For Bristol-Myers Squibb however we will make it really easy for you with previews of two leading Bristol-Myers Squibb Narratives:

🐂 Bristol-Myers Squibb Bull Case

Fair Value: $65.00 per share

Implied Upside vs Last Close: approximately 16.5% undervalued

Revenue Growth Assumption: 2.43%

- Views 2024 as a solid year with 7% revenue growth to $48.3 billion and particularly strong 17% growth from the newer Growth Portfolio products.

- Emphasizes recent approvals like Opdivo Qvantig and Cobenfy plus a $2 billion cost saving program through 2027 as key drivers of future earnings power.

- Arrives at a Fair Value near $65 per share using a blend of Morningstar style valuation, historical 8x to 10x P/E ranges on 2025 EPS guidance, and DCF work pointing toward the mid $60s.

🐻 Bristol-Myers Squibb Bear Case

Fair Value: $53.55 per share

Implied Downside vs Last Close: approximately 1.4% overvalued

Revenue Growth Assumption: -5.34%

- Sees a mixed setup where an aging population and genomics driven innovation support demand, but patent cliffs, pricing pressure and intense competition cap long term growth.

- Builds in analyst assumptions for declining revenues, rising margins and modest EPS growth to 2028, alongside slightly higher discount rates and only gradual multiple compression to a 15.2x future P/E.

- Aligns with a consensus style Fair Value just above $53 per share and argues that, at around the mid $50s, Bristol-Myers Squibb offers only limited upside without clearer evidence of a sustainable growth reacceleration.

Do you think there's more to the story for Bristol-Myers Squibb? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報