Income Asset Management Group Limited (ASX:IAM) Might Not Be As Mispriced As It Looks

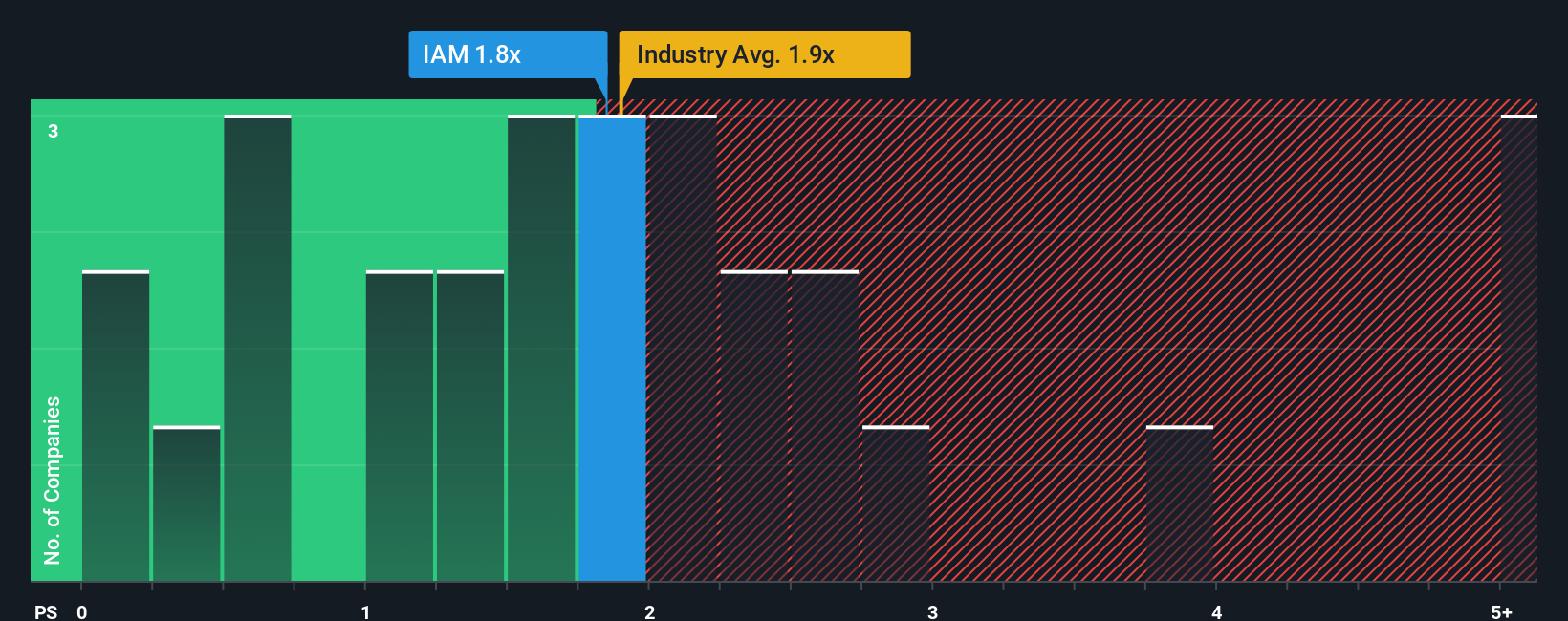

It's not a stretch to say that Income Asset Management Group Limited's (ASX:IAM) price-to-sales (or "P/S") ratio of 1.8x right now seems quite "middle-of-the-road" for companies in the Diversified Financial industry in Australia, where the median P/S ratio is around 1.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Income Asset Management Group

How Has Income Asset Management Group Performed Recently?

Recent times have been advantageous for Income Asset Management Group as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Income Asset Management Group.How Is Income Asset Management Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Income Asset Management Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. Pleasingly, revenue has also lifted 132% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 24% per annum during the coming three years according to the only analyst following the company. With the industry only predicted to deliver 4.4% per year, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Income Asset Management Group is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Income Asset Management Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Income Asset Management Group that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報