Alphabet (GOOGL) Valuation Check After Strong Year-to-Date Share Price Rally

Alphabet (GOOGL) has been on a strong run this year, and with shares up 63% year to date and about 23% over the past 3 months, investors are reassessing what they are really paying for.

See our latest analysis for Alphabet.

That surge in momentum, with a 30 day share price return of 11.51% and a 3 year total shareholder return of 251.14%, suggests investors are increasingly pricing Alphabet as a durable growth and AI infrastructure story rather than just a mature ad business.

If Alphabet’s run has you rethinking your tech exposure, it might be worth seeing what else is shaping the sector by exploring high growth tech and AI stocks.

With earnings still climbing double digits and the stock sitting only modestly below analyst targets, investors now face a tougher call: is Alphabet still mispriced, or is the market already baking in years of AI driven growth?

Most Popular Narrative: 9.3% Undervalued

According to oscargarcia, the narrative prices Alphabet above its last close of $308.22, implying further upside if its cash machine keeps compounding.

Google’s balance sheet is like a bunker built with gold bricks. Cash and Marketable Securities: Over $120B.

Curious how a fortress balance sheet, elevated margins and a rich future earnings multiple combine into that upside case? The levers behind this valuation may surprise you.

Result: Fair Value of $340.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory pressure and AI driven search disruption still loom, and any stumble here could quickly challenge assumptions behind that Buffett style multiple expansion.

Find out about the key risks to this Alphabet narrative.

Another Angle on Valuation

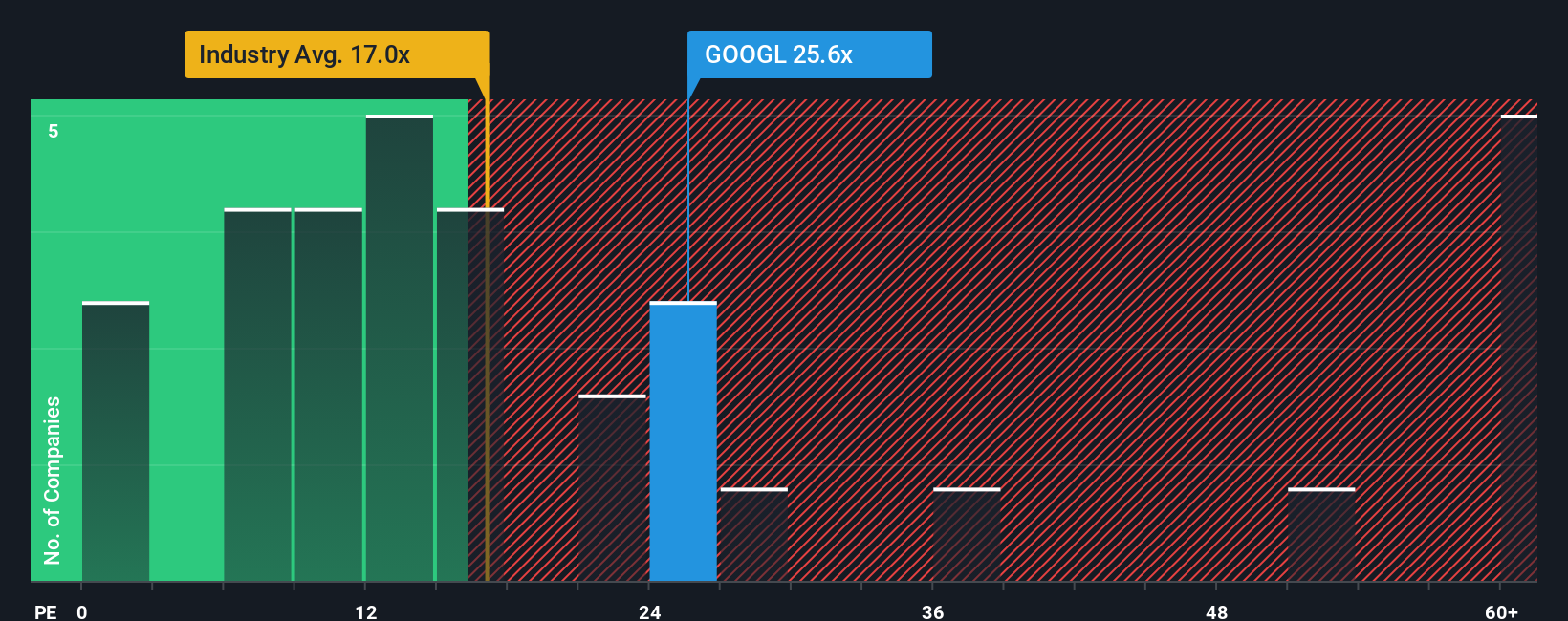

On earnings power, the story looks less forgiving. Alphabet trades at 29.9 times earnings compared with 17.4 times for the US Interactive Media and Services industry and 47.4 times for peers. Our fair ratio sits even higher at 37.3 times, leaving investors juggling upside against multiple compression risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alphabet Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a complete narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Alphabet.

Ready for more investing opportunities?

Alphabet is only one piece of the puzzle, and if you stop here you could miss other powerful ideas quietly compounding outside your portfolio.

- Capture potential income now by scanning steady payers and growth names through these 13 dividend stocks with yields > 3% before yields and prices change.

- Explore potential innovators by reviewing these 26 AI penny stocks where scalable models and real revenue traction may help small positions grow within a diversified portfolio.

- Consider companies in these 908 undervalued stocks based on cash flows that combine solid fundamentals with a focus on intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報