Constellium (NYSE:CSTM): Valuation Check After New Singen Battery Foil Investment Goes Live

Constellium (NYSE:CSTM) has flipped the switch on its new finishing lines at Singen in Germany, completing a EUR30 million battery foil investment with Lotte Infracell that tightens its grip on Europe’s EV supply chain.

See our latest analysis for Constellium.

That operational step up seems to be catching investors’ attention, with the share price at $18.38 after a strong 30 day share price return and powerful year to date and one year total shareholder returns, suggesting positive momentum rather than a one off pop.

If this EV focused move has you thinking about where else growth could come from in transport, it might be worth scanning auto manufacturers for other potential opportunities.

But with the shares already up strongly this year and trading below, yet not far from, analyst targets, is Constellium still flying under the radar or are investors now fully pricing in its next leg of growth?

Most Popular Narrative: 8.7% Undervalued

With Constellium last closing at $18.38 against a narrative fair value of $20.12, the story points to modest upside built on improving fundamentals.

Analysts are assuming Constellium's revenue will grow by 9.3% annually over the next 3 years.

Analysts assume that profit margins will increase from 0.4% today to 4.5% in 3 years time.

Curious how modest revenue growth, rising margins and shrinking share count can still point to meaningful upside. The projected earnings step change is striking. Want to see which future profit multiple holds this whole valuation together.

Result: Fair Value of $20.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering demand softness in key auto and aerospace markets, along with elevated capex needs, could squeeze margins and free cash flow, challenging that upbeat earnings path.

Find out about the key risks to this Constellium narrative.

Another Lens On Value

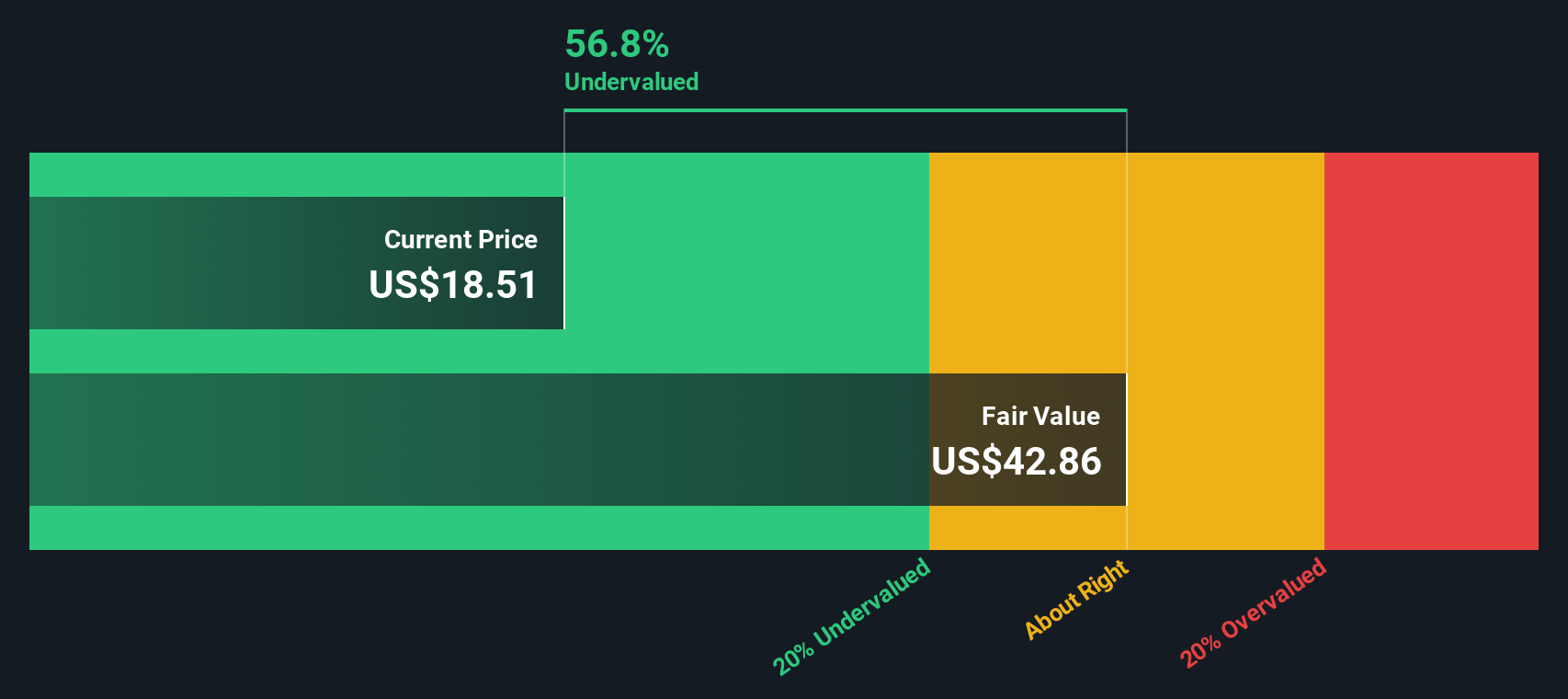

Step away from the narrative fair value and our SWS DCF model paints a far bolder picture, with Constellium trading around 57% below its estimated fair value of $42.79, implying much deeper upside but also a bigger gap for the business to grow into.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Constellium Narrative

If you see the story differently or want to stress test the assumptions with your own numbers, you can build a fresh narrative in just a few minutes: Do it your way.

A great starting point for your Constellium research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at Constellium, you could miss other powerful setups. Use the Simply Wall Street Screener to spot your next edge before everyone else.

- Capture potential multi baggers early by targeting growth at a sensible price through these 908 undervalued stocks based on cash flows that may be overlooked by the wider market.

- Ride structural tailwinds in automation and machine learning by focusing on these 26 AI penny stocks positioned to benefit from accelerating demand for intelligent software and infrastructure.

- Lock in reliable income streams while searching for capital gains using these 13 dividend stocks with yields > 3% that can strengthen returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報