Ichigo (TSE:2337) Valuation Check After Higher November 2025 Power Generation and Renewed Share Price Momentum

Ichigo (TSE:2337) just posted its November 2025 operating results, showing total power generation rising to 16,576,315 kWh from 16,091,159 kWh a year earlier. This clean energy uptick is something the market is watching closely.

See our latest analysis for Ichigo.

The steady increase in power generation slots neatly into Ichigo’s broader story, with a 1 month share price return of 6.06% and a robust 1 year total shareholder return of 20.12% suggesting momentum is rebuilding after recent weakness.

If this kind of clean energy driven upside has your attention, it could be a good moment to discover fast growing stocks with high insider ownership.

Yet with Ichigo trading exactly in line with analyst targets and screens flagging only moderate value, investors must decide: is this clean energy and real estate hybrid quietly undervalued, or is the market already pricing in future growth?

Most Popular Narrative: Fairly Valued

With Ichigo closing at ¥420, exactly matching the narrative fair value, the story hinges less on upside and more on whether its forecasts can stick.

The analysts have a consensus price target of ¥470.0 for Ichigo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥570.0, and the most bearish reporting a price target of just ¥410.0.

Want to see what is powering these tightly clustered targets? The narrative leans on steady growth, easing margins, and a future earnings multiple that quietly stretches sector norms.

Result: Fair Value of ¥420 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be challenged if rising interest costs squeeze margins or if the underperforming clean energy segment continues to lag expectations.

Find out about the key risks to this Ichigo narrative.

Another Angle on Value

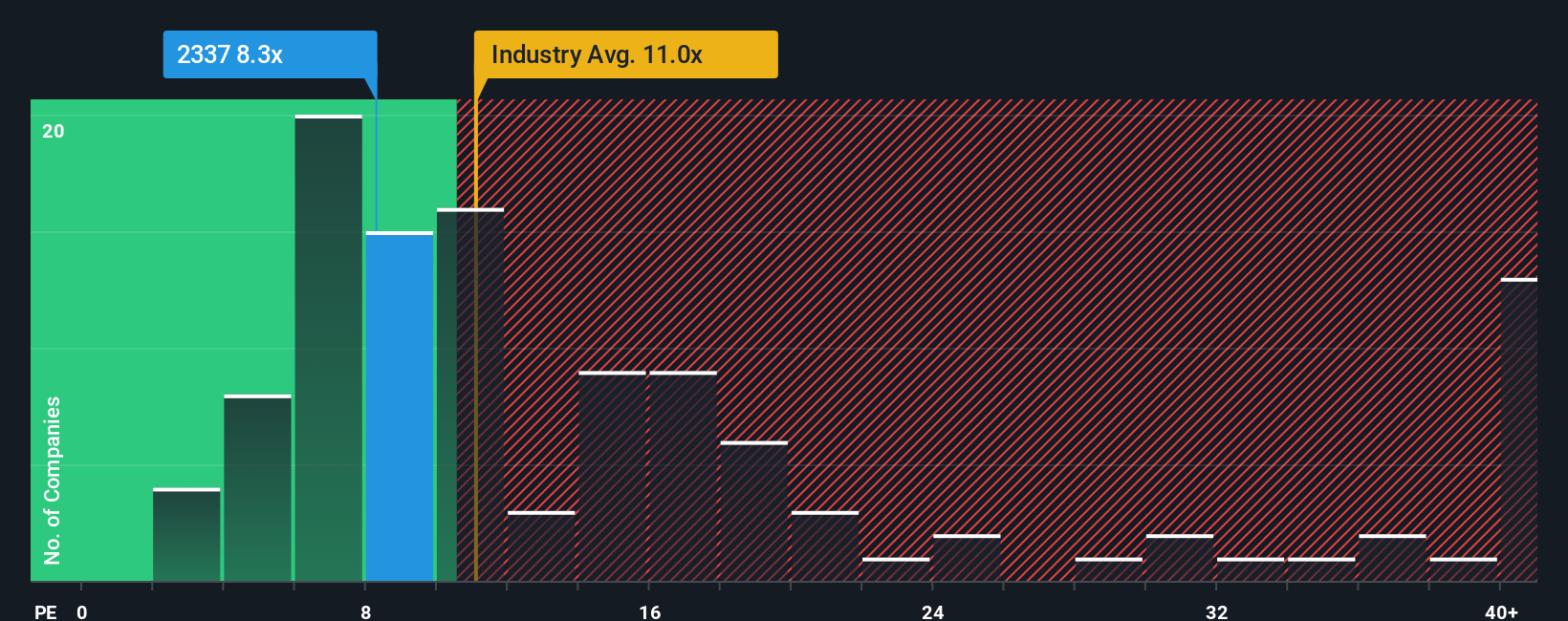

While the dominant narrative says Ichigo is fairly priced around ¥420, its 9.4x price to earnings looks strikingly low versus the JP market at 14.2x, the real estate industry at 11.5x, and even a 12.6x fair ratio. Is the market underestimating steady, if unspectacular, growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ichigo Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a fresh narrative in just minutes: Do it your way.

A great starting point for your Ichigo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Ichigo might fit your thesis, but the smartest investors always keep a strong bench of ideas ready, so let Simply Wall Street’s screener power your next pick.

- Capture potential market mispricing by targeting quality companies trading below their worth using these 908 undervalued stocks based on cash flows grounded in future cash flow strength.

- Capitalize on structural shifts in healthcare by focusing on innovators at the intersection of medicine and algorithms through these 30 healthcare AI stocks.

- Position yourself early in a fast evolving digital economy with curated opportunities from these 80 cryptocurrency and blockchain stocks tapping blockchain and cryptocurrency trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報