Nasdaq‑100 Inclusion and AI Storage Momentum Could Be A Game Changer For Seagate (STX)

- Seagate Technology Holdings recently delivered strong quarterly results with double-digit revenue growth and was selected for inclusion in the Nasdaq‑100 Index, reflecting its increased scale and role in AI and cloud infrastructure storage.

- This combination of earnings momentum and index promotion has heightened attention on Seagate’s high-capacity drive roadmap and its position in the AI data center build-out.

- We’ll now examine how Seagate’s Nasdaq‑100 inclusion may reshape its investment narrative, particularly around AI-driven mass capacity storage demand.

Find companies with promising cash flow potential yet trading below their fair value.

Seagate Technology Holdings Investment Narrative Recap

To own Seagate today, you need to believe mass capacity storage will remain essential to AI and cloud data centers, and that HAMR-based Mozaic drives can keep the company competitive despite SSD pressure. The strong earnings beat, rapid share price move, and upcoming Nasdaq‑100 inclusion sharpen that story but do not fundamentally change the near term catalyst of AI data center demand, nor the key risks around high leverage and intensifying technology competition.

The Nasdaq‑100 addition on December 22, 2025 is the announcement that most directly ties into this news, because it may pull Seagate further onto the radar of large index and ETF trackers that are rebalancing into AI and infrastructure hardware. For investors, that sits alongside the recent 21.3% revenue growth and earnings beat as part of the same short term setup, even as insider selling and balance sheet leverage invite closer scrutiny.

Yet behind the AI and index excitement, investors should be aware of how Seagate’s significant debt load could limit...

Read the full narrative on Seagate Technology Holdings (it's free!)

Seagate Technology Holdings' narrative projects $12.0 billion revenue and $2.5 billion earnings by 2028. This requires 9.5% yearly revenue growth and a $1.0 billion earnings increase from $1.5 billion today.

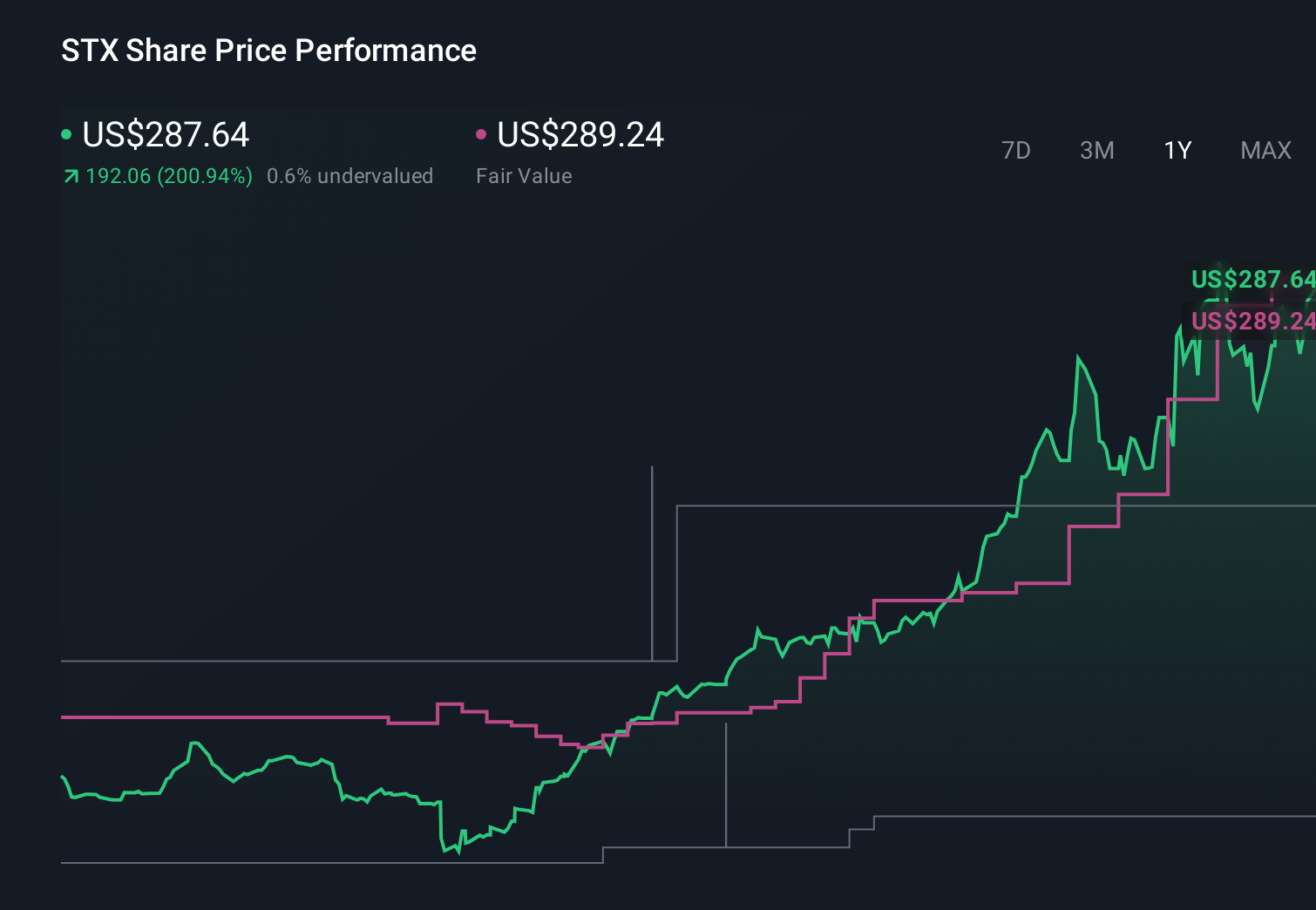

Uncover how Seagate Technology Holdings' forecasts yield a $289.24 fair value, in line with its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Seagate span roughly US$215 to US$358 per share, underlining how far opinions can diverge. You will want to weigh that spread against the thesis that AI driven mass capacity storage demand remains the primary near term catalyst for the business and what that could mean for its future performance.

Explore 3 other fair value estimates on Seagate Technology Holdings - why the stock might be worth as much as 25% more than the current price!

Build Your Own Seagate Technology Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seagate Technology Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Seagate Technology Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seagate Technology Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報