Returns On Capital Signal Difficult Times Ahead For China Harmony Auto Holding (HKG:3836)

What financial metrics can indicate to us that a company is maturing or even in decline? Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. On that note, looking into China Harmony Auto Holding (HKG:3836), we weren't too upbeat about how things were going.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for China Harmony Auto Holding:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.011 = CN¥68m ÷ (CN¥12b - CN¥5.6b) (Based on the trailing twelve months to June 2025).

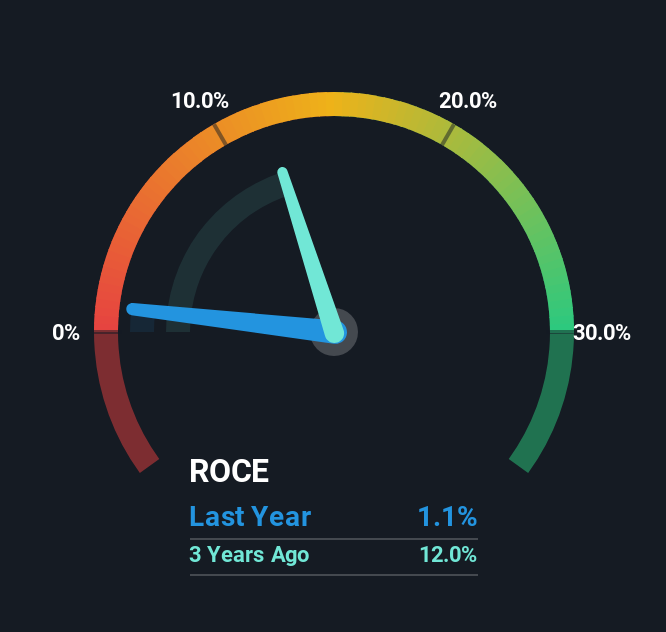

Therefore, China Harmony Auto Holding has an ROCE of 1.1%. Ultimately, that's a low return and it under-performs the Specialty Retail industry average of 9.1%.

Check out our latest analysis for China Harmony Auto Holding

Above you can see how the current ROCE for China Harmony Auto Holding compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for China Harmony Auto Holding .

What Does the ROCE Trend For China Harmony Auto Holding Tell Us?

In terms of China Harmony Auto Holding's historical ROCE trend, it isn't fantastic. To be more specific, today's ROCE was 9.7% five years ago but has since fallen to 1.1%. On top of that, the business is utilizing 21% less capital within its operations. The fact that both are shrinking is an indication that the business is going through some tough times. If these underlying trends continue, we wouldn't be too optimistic going forward.

On a side note, China Harmony Auto Holding's current liabilities have increased over the last five years to 47% of total assets, effectively distorting the ROCE to some degree. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. And with current liabilities at these levels, suppliers or short-term creditors are effectively funding a large part of the business, which can introduce some risks.

The Key Takeaway

In summary, it's unfortunate that China Harmony Auto Holding is shrinking its capital base and also generating lower returns. Long term shareholders who've owned the stock over the last five years have experienced a 66% depreciation in their investment, so it appears the market might not like these trends either. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

One more thing to note, we've identified 1 warning sign with China Harmony Auto Holding and understanding this should be part of your investment process.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報