Asian Undervalued Small Caps With Insider Action Featuring 3 Top Picks

As global markets react to interest rate adjustments and economic indicators, small-cap stocks in Asia present intriguing opportunities amidst broader market dynamics. With the Federal Reserve's recent rate cuts potentially influencing investor sentiment, particularly towards small caps like those in the Russell 2000 Index, investors may find value in exploring Asian stocks that exhibit strong fundamentals and insider activity as potential indicators of growth.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| East West Banking | 3.0x | 0.7x | 21.15% | ★★★★★☆ |

| Centurion | 3.6x | 3.0x | -53.12% | ★★★★☆☆ |

| PSC | 9.6x | 0.4x | 21.42% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.53% | ★★★★☆☆ |

| PolyNovo | 63.5x | 6.5x | 24.45% | ★★★☆☆☆ |

| Nickel Asia | 12.3x | 1.9x | 12.96% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.2x | 0.4x | -398.49% | ★★★☆☆☆ |

| Paragon Care | 20.5x | 0.1x | 7.98% | ★★★☆☆☆ |

| Betr Entertainment | NA | 1.5x | 8.24% | ★★★☆☆☆ |

| Nufarm | NA | 0.2x | -117.98% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

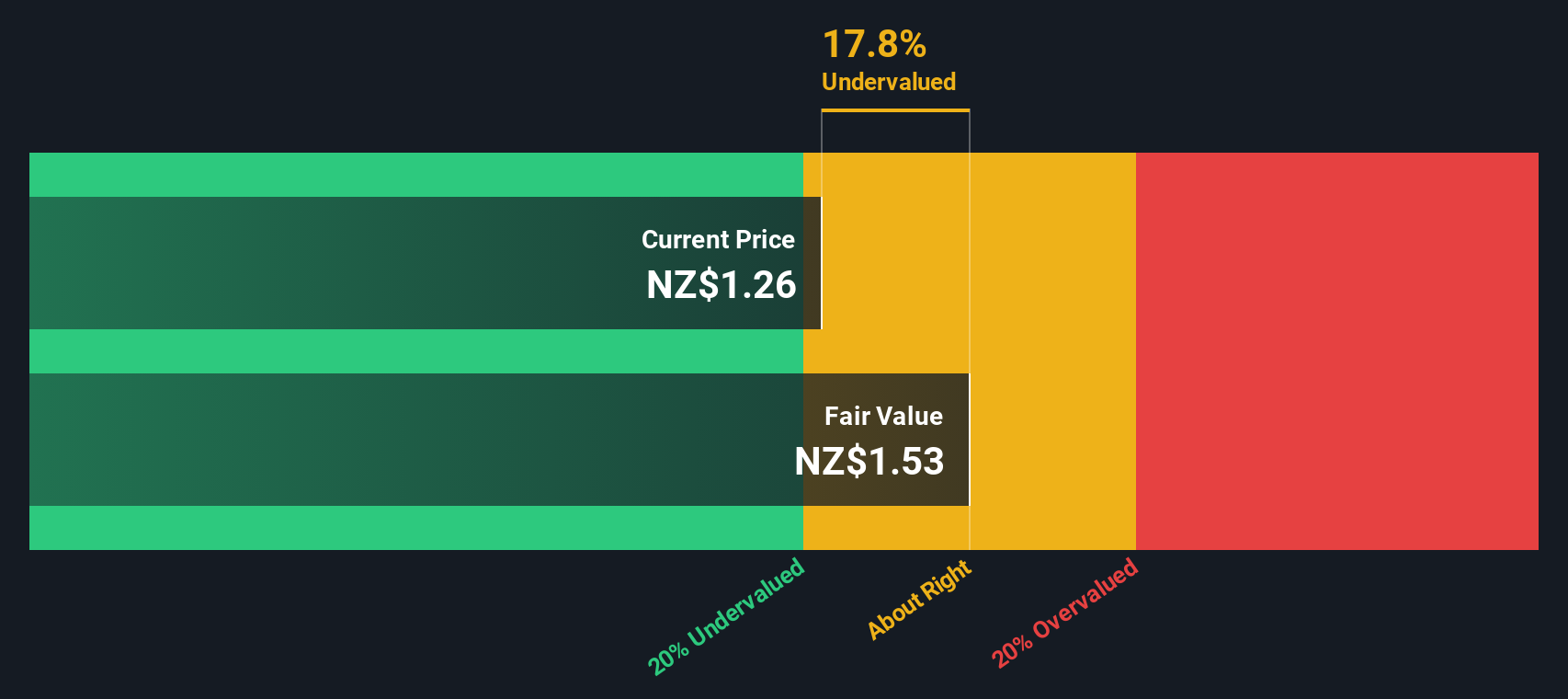

Precinct Properties NZ & Precinct Properties Investments (NZSE:PCT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Precinct Properties NZ is a real estate investment company focused on owning and managing premium office spaces, hotels, and hospitality properties, with a market capitalization of approximately NZ$1.87 billion.

Operations: Precinct Properties NZ & Precinct Properties Investments generate revenue primarily from Investment Properties, which accounts for the majority of their income at NZ$213.10 million. The company has experienced fluctuations in its net income margin, with a notable decline to -0.6887% as of June 2023, reflecting challenges in managing non-operating expenses that reached NZ$277.1 million during the same period. Gross profit margin showed a decreasing trend over recent periods, standing at 61.82% by June 2025 due to rising costs of goods sold and operating expenses.

PE: 197.1x

Precinct Properties, a smaller player in the Asian market, presents a compelling case with its 23% projected annual earnings growth. Despite past shareholder dilution and reliance on external borrowing, insider confidence is evident through recent share purchases. The company has announced dividends totaling 6.75 cents per security for fiscal year 2026, maintaining a payout ratio of up to 92%. This revised dividend policy aligns with their focus on recurring earnings from operations, offering potential value for investors seeking income stability.

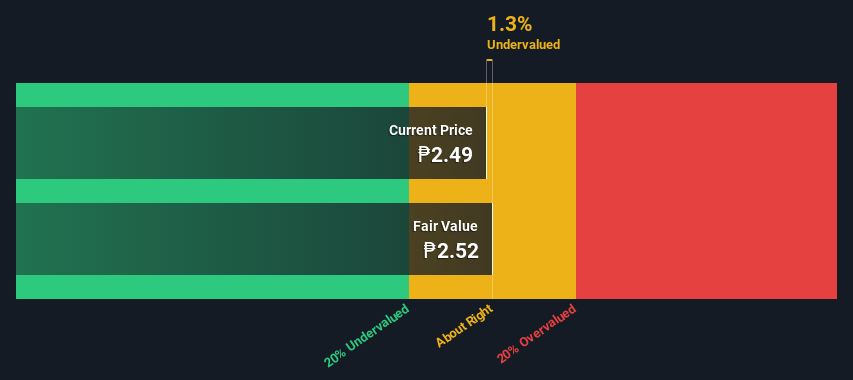

Nickel Asia (PSE:NIKL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nickel Asia is a leading mining company primarily engaged in the extraction and sale of nickel ore, with additional operations in power generation and services, boasting a diverse revenue stream in the Philippines.

Operations: Nickel Asia's revenue is primarily derived from its mining operations, particularly from TMC and RTN segments, with significant contributions also coming from CMC and HMC. The company's gross profit margin has shown variability but was recorded at 46.48% as of September 2025. Operating expenses are a notable component of the cost structure, with general and administrative expenses being a consistent part of this category.

PE: 12.3x

Nickel Asia, a smaller player in the mining sector, recently declared a special dividend of PHP 0.07 per share, reflecting strong financial health despite earnings forecasts predicting an 8% annual decline over the next three years. The company's third-quarter revenue surged to PHP 11 billion from PHP 7.7 billion last year, with net income doubling to PHP 3.1 billion. Recent board meetings introduced key executive changes effective January 2026, potentially influencing strategic direction and operational efficiency moving forward.

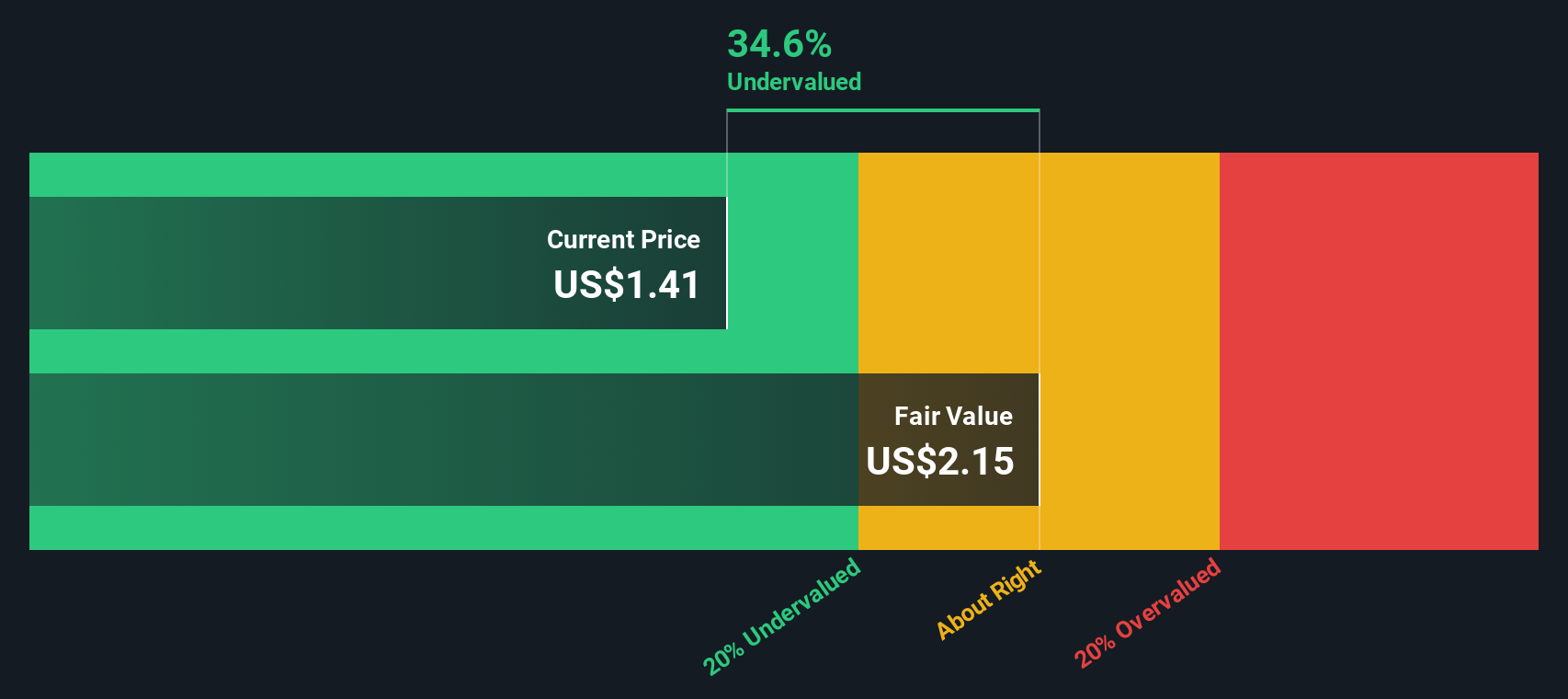

UltraGreen.ai (SGX:ULG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: UltraGreen.ai focuses on providing advanced diagnostic solutions globally, with a market capitalization of $2.45 billion.

Operations: UltraGreen.ai generates revenue primarily from DxG - Americas and DxG - Rest of World, with a smaller contribution from Ultralinq. The company's gross profit margin has shown an upward trend, reaching 84.77% by mid-2025. Operating expenses are largely driven by general and administrative costs, followed by sales and marketing expenses.

PE: 28.9x

UltraGreen.ai recently completed a US$400 million IPO, offering shares at a discounted price of US$1.45 each. Despite its high debt levels and reliance on external borrowing, the company is positioned for growth with earnings projected to increase by 26% annually. Shares remain illiquid, but insider confidence is evident as they continue purchasing more stocks, suggesting belief in future potential. This dynamic suggests both challenges and opportunities within its industry context.

- Dive into the specifics of UltraGreen.ai here with our thorough valuation report.

Explore historical data to track UltraGreen.ai's performance over time in our Past section.

Next Steps

- Access the full spectrum of 47 Undervalued Asian Small Caps With Insider Buying by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報