Reassessing Soleno Therapeutics (SLNO) Valuation After Wolfe Research’s Confidence Boost and Improving Fundamentals

Soleno Therapeutics (SLNO) just received a meaningful vote of confidence from Wolfe Research, which helped push the stock up about 5% as investors reassess earlier safety worries and focus on improving patient uptake and liquidity.

See our latest analysis for Soleno Therapeutics.

That fresh vote of confidence comes after a steady rebuild in sentiment, with a 1 year to date share price return of 13.76% and a remarkable 3 year total shareholder return of 2710.81%. This suggests momentum is still very much with the bulls as execution and risk perceptions improve.

If Soleno’s move has you thinking about what else is working in this space, it might be a good time to explore other promising healthcare stocks on Simply Wall St for fresh ideas.

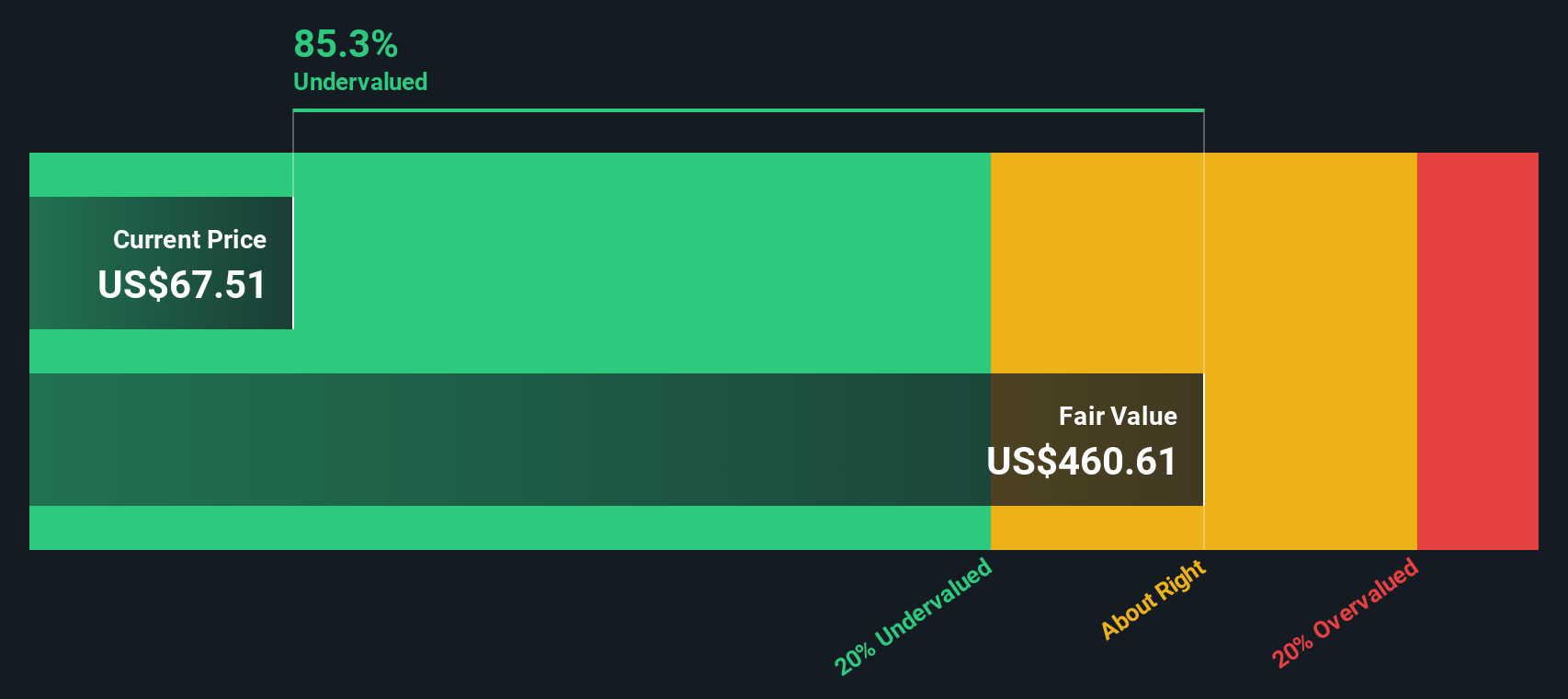

But with Soleno still loss making, yet trading at a steep discount to analyst and intrinsic value estimates, is the market underestimating its Phase III upside or already pricing in most of that future growth?

Price to Sales of 28.3x: Is it justified?

On a price to sales basis, Soleno looks richly valued at its $52 last close, especially when stacked against both peers and fair value benchmarks.

The price to sales ratio compares Soleno’s market value to its trailing revenue, a common yardstick for high growth, loss making biotechs where earnings are not yet meaningful. At 28.3 times sales, investors are clearly paying up for the prospect that today’s relatively small revenue base will compound rapidly as its lead asset progresses and commercializes.

That premium stands out when you compare it to the US biotech industry average of 12.1 times sales and a peer average of 21.6 times. This implies the market is already assigning Soleno a leadership style growth narrative rather than a typical mid tier biotech trajectory. Our fair price to sales estimate of 21.8 times suggests there is room for the multiple to compress if execution or sentiment stumble, even if the absolute story remains positive.

Explore the SWS fair ratio for Soleno Therapeutics

Result: Price to Sales of 28.3x (OVERVALUED)

However, investors still face clear risks, including potential Phase III setbacks for Diazoxide Choline and the company’s ongoing losses, which may pressure future funding and dilution needs.

Find out about the key risks to this Soleno Therapeutics narrative.

Another View: What Does Our DCF Say?

While the sales multiple appears expensive, our DCF model points the other way, suggesting Soleno is trading about 87.9% below its fair value of roughly $430 per share. In other words, the cash flow story reflects a deep value setup rather than a momentum-driven surge.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Soleno Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Soleno Therapeutics Narrative

If you are not convinced by this view or would rather dig into the numbers yourself, you can build a personalised thesis in minutes: Do it your way.

A great starting point for your Soleno Therapeutics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop building their watchlist, so now is the time to tap into fresh opportunities on Simply Wall St before others spot them.

- Capture potential multi baggers early by reviewing these 3613 penny stocks with strong financials that already back their stories with solid financial foundations.

- Position yourself ahead of the next tech wave by scanning these 26 AI penny stocks shaping real world AI adoption instead of speculative hype.

- Lock in value opportunities by targeting these 909 undervalued stocks based on cash flows where cash flows hint at upside the broader market has yet to recognize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報