Garmin (GRMN) Valuation Check After Brazilian Black Hawk Upgrade Win and New inReach Mini 3 Plus Launch

Garmin (GRMN) just checked two important boxes for investors, landing a Brazilian Air Force contract to modernize 24 Black Hawk cockpits and rolling out its new inReach Mini 3 Plus satellite communicator.

See our latest analysis for Garmin.

These wins come as Garmin’s share price sits at $208.36, with a solid 7-day share price return of 3.52 percent and a strong 3-year total shareholder return of 145.14 percent, suggesting longer term momentum remains intact despite recent volatility.

If contracts like the Black Hawk upgrade have you thinking about other aerospace names, it could be a good time to explore aerospace and defense stocks for more potential ideas.

With revenue and earnings still growing at mid single digit rates, and the stock trading at a modest discount to analyst and intrinsic value estimates, is Garmin quietly offering a fresh entry point, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 9.9% Undervalued

With the narrative fair value sitting around $231 versus Garmin’s $208.36 last close, the story leans toward upside if assumptions hold.

The launch of the Garmin Connect+ premium service, which offers AI based health and fitness insights, is likely to boost subscription based revenue growth and improve overall margins through higher margin services. The new vívoactive 6 smartwatch release, with advanced features like an AMOLED display and enhanced sports apps, suggests potential revenue growth in the Fitness segment, supported by strong demand for advanced wearables.

Curious how steady, mid single digit growth, resilient margins, and a rich future earnings multiple can still point to meaningful upside? The narrative’s math may surprise you.

Result: Fair Value of $231 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operating expenses and lingering softness in Marine and Outdoor could pressure margins and stall the steady mid single digit growth the story assumes.

Find out about the key risks to this Garmin narrative.

Another Way To Look At Value

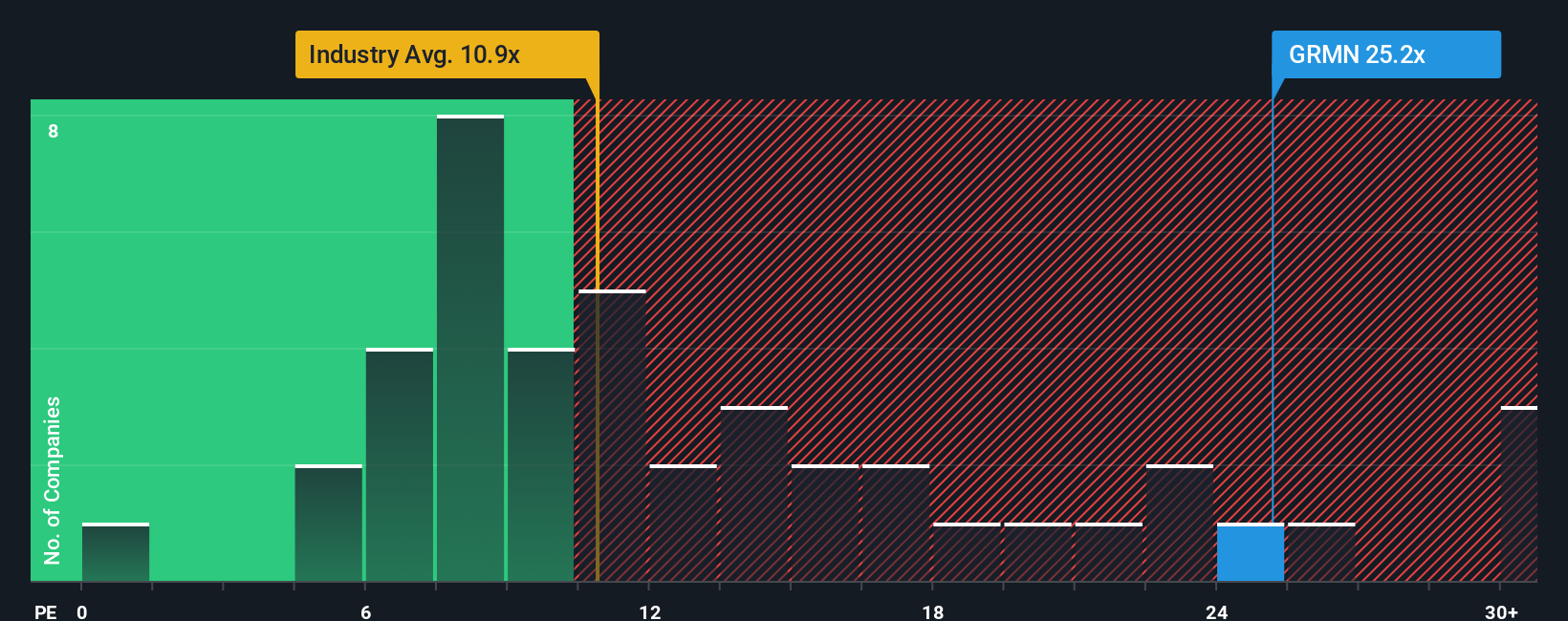

Garmin screens as undervalued against narrative fair value, but its 25.5x earnings multiple is punchy versus the Consumer Durables industry at 10.8x, peers at 23.9x, and a fair ratio of 20.8x. That premium hints at less margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Garmin Narrative

If you see the numbers differently or want to stress test the assumptions yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Garmin.

Ready for your next investing move?

Before the market’s next shift leaves you watching from the sidelines, use the Simply Wall St screener to uncover fresh opportunities that match your strategy today.

- Capture potential mispricings by checking out these 906 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has overlooked.

- Ride powerful secular trends by targeting innovation leaders through these 26 AI penny stocks at the forefront of transformative artificial intelligence.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that could bolster portfolio returns with dependable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報