December 2025's Top Stocks Estimated To Be Trading Below Their True Worth

As the U.S. stock market grapples with volatility, driven by concerns over an AI bubble impacting technology stocks and recent interest rate decisions by the Federal Reserve, investors are keenly observing economic indicators for guidance. In such fluctuating conditions, identifying undervalued stocks becomes crucial as they can offer potential opportunities for growth when trading below their intrinsic value amidst broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.16 | $17.89 | 48.8% |

| UMB Financial (UMBF) | $118.17 | $232.81 | 49.2% |

| Sportradar Group (SRAD) | $23.11 | $45.87 | 49.6% |

| Schrödinger (SDGR) | $18.05 | $35.42 | 49% |

| Perfect (PERF) | $1.75 | $3.43 | 49% |

| Motorcar Parts of America (MPAA) | $13.77 | $26.53 | 48.1% |

| Mobileye Global (MBLY) | $11.07 | $21.30 | 48% |

| Krystal Biotech (KRYS) | $244.65 | $469.32 | 47.9% |

| FirstSun Capital Bancorp (FSUN) | $37.79 | $73.32 | 48.5% |

| Columbia Banking System (COLB) | $29.24 | $57.69 | 49.3% |

Let's uncover some gems from our specialized screener.

Crocs (CROX)

Overview: Crocs, Inc. operates globally through designing, manufacturing, and selling casual lifestyle footwear and accessories under the Crocs and HEYDUDE brands, with a market cap of approximately $4.67 billion.

Operations: The company's revenue is primarily derived from the Crocs Brand, generating $3.32 billion, and the Heydude Brand, contributing $753.29 million.

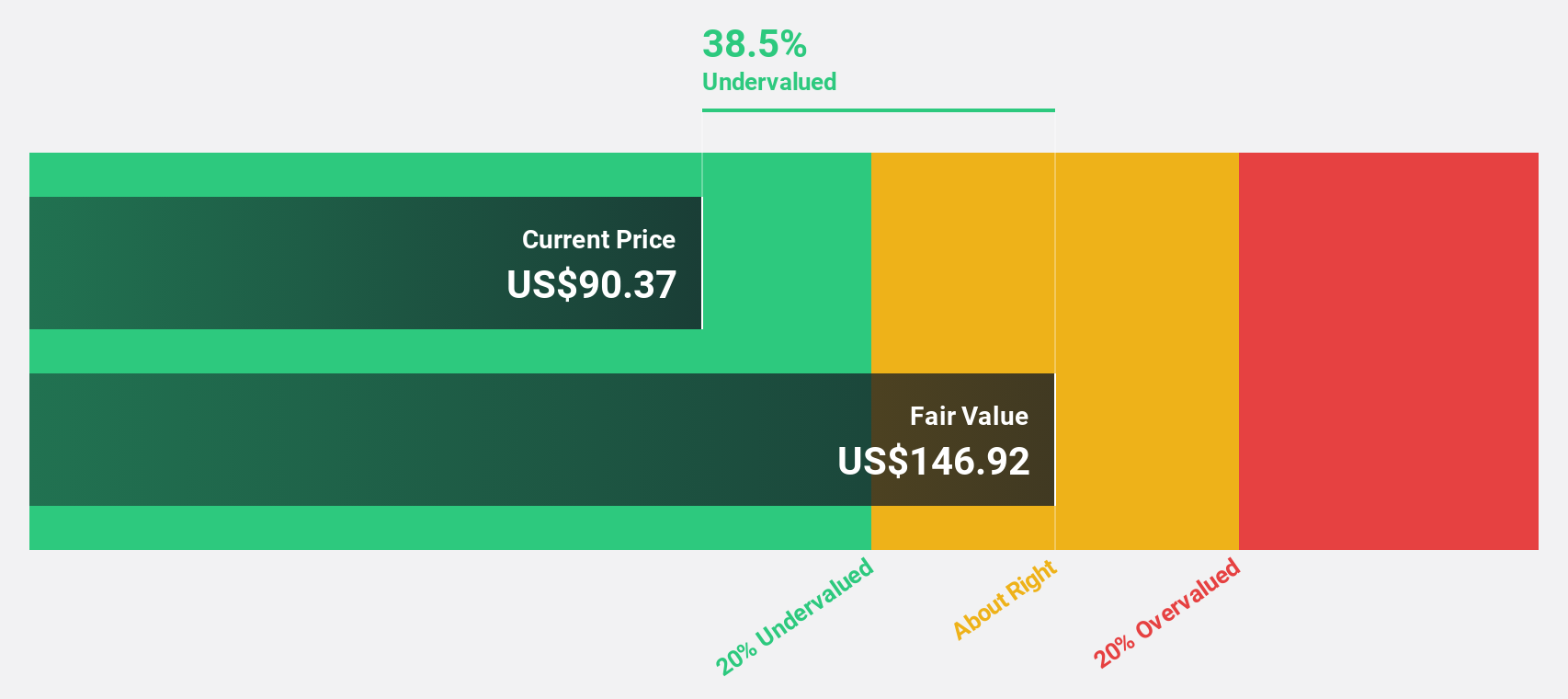

Estimated Discount To Fair Value: 43.3%

Crocs appears undervalued, trading at US$89.91, significantly below its estimated fair value of US$158.7. Despite high debt levels and a decline in revenue forecasts (-0.5% annually), the company's earnings are expected to grow substantially by 78% per year, outpacing the broader market's growth rate. Recent executive changes with Rupert Campbell leading HEYDUDE could bolster strategic initiatives despite recent profit margin declines and large one-off items impacting financial results.

- Our comprehensive growth report raises the possibility that Crocs is poised for substantial financial growth.

- Click here to discover the nuances of Crocs with our detailed financial health report.

Palomar Holdings (PLMR)

Overview: Palomar Holdings, Inc. is a specialty insurance company offering property and casualty insurance to individuals and businesses in the United States, with a market cap of approximately $3.35 billion.

Operations: The company generates revenue primarily from its Property and Casualty Insurance Business, totaling $778.36 million.

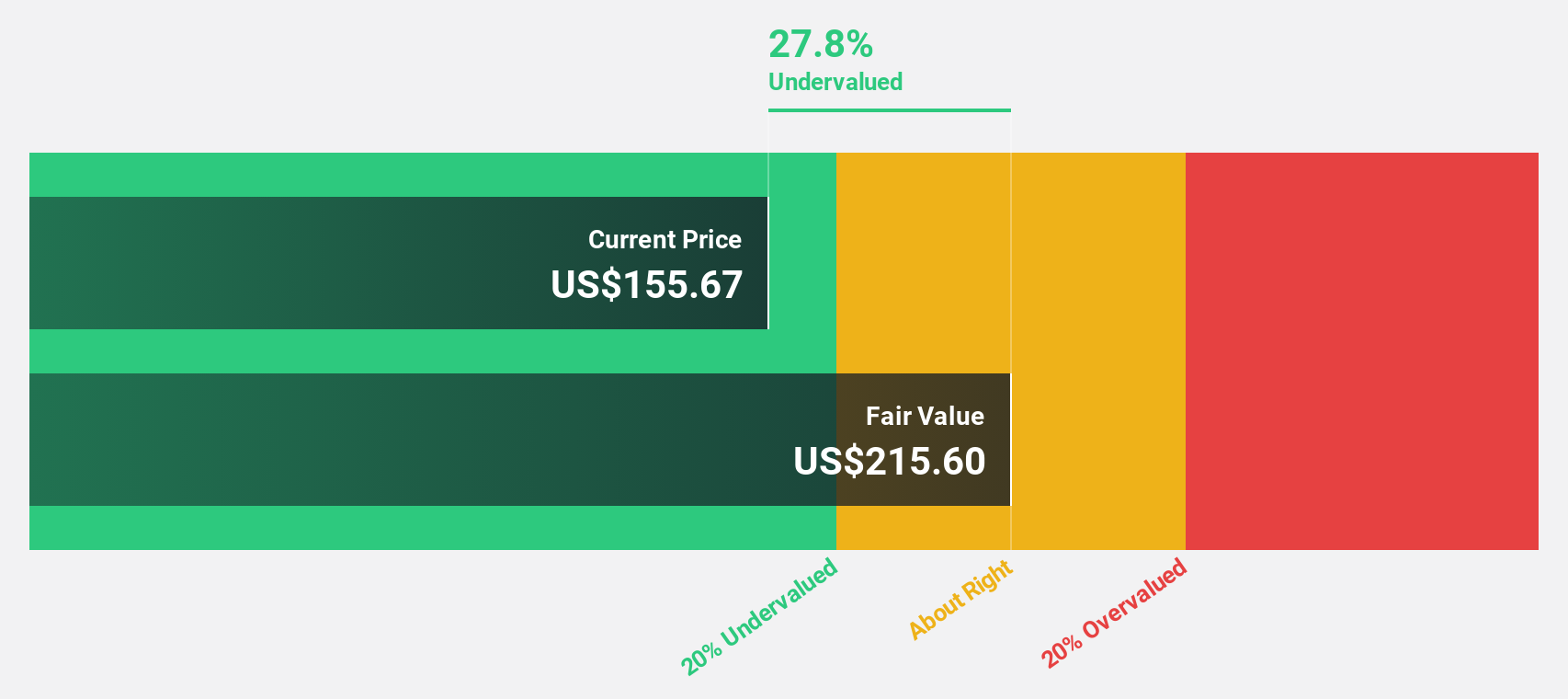

Estimated Discount To Fair Value: 43.5%

Palomar Holdings is trading at US$126.59, well below its estimated fair value of US$224.09, suggesting potential undervaluation based on cash flows. Earnings grew by 62.1% over the past year and are forecasted to increase by 15.3% annually, though slower than the market average. Revenue growth is projected at 23.3% per year, outpacing market expectations despite significant insider selling recently reported and earnings forecasts slightly trailing broader market growth rates.

- In light of our recent growth report, it seems possible that Palomar Holdings' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Palomar Holdings' balance sheet health report.

Varonis Systems (VRNS)

Overview: Varonis Systems, Inc. offers AI-powered software solutions for data discovery, classification, exposure remediation, and threat detection across various regions including North America, Europe, and APAC with a market cap of approximately $3.98 billion.

Operations: The company's revenue segment is primarily derived from Data Processing, amounting to $608.68 million.

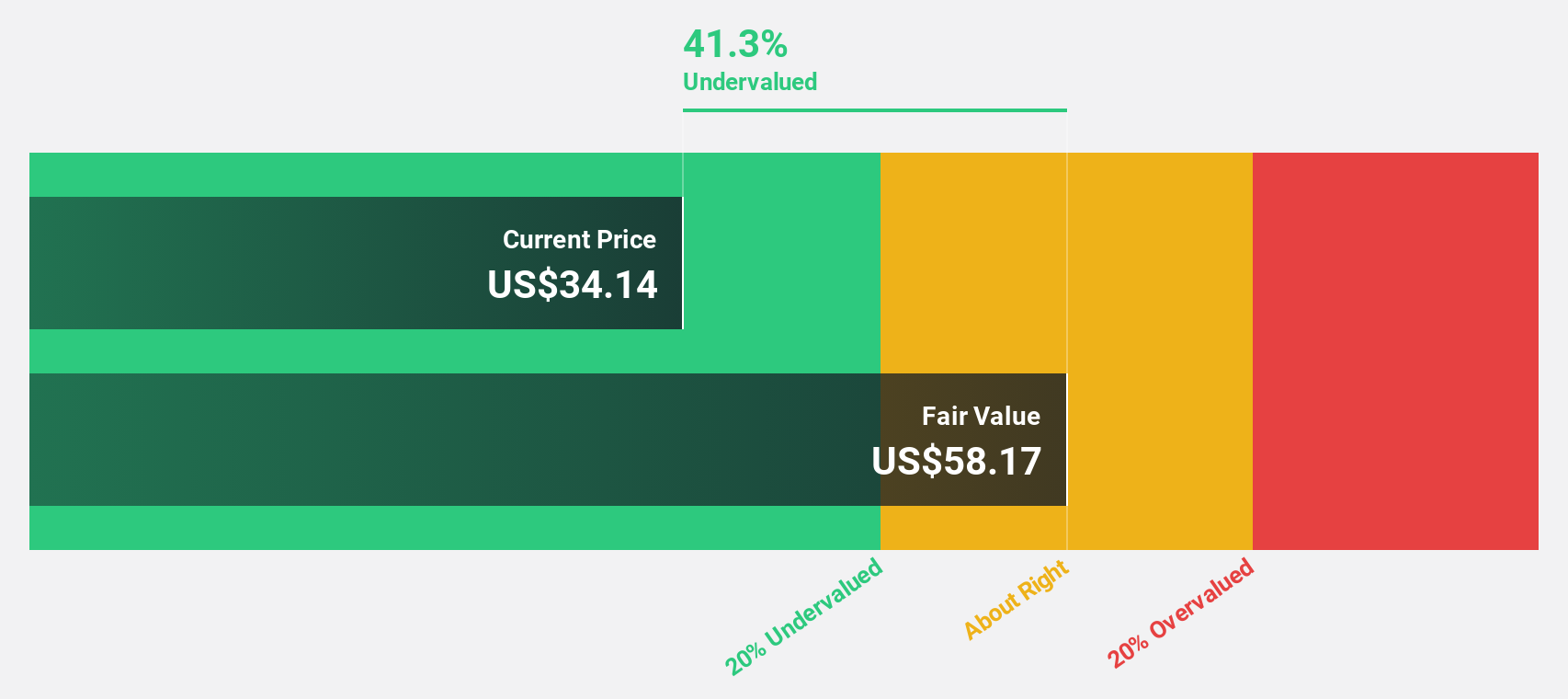

Estimated Discount To Fair Value: 41.9%

Varonis Systems, trading at US$33.79, is valued significantly below its estimated fair value of US$58.20, highlighting potential undervaluation based on cash flows. While revenue is expected to grow 13.6% annually—faster than the broader market—the company remains unprofitable but is forecasted to achieve profitability within three years. Recent integrations with AWS and Microsoft enhance its data security offerings, potentially strengthening future cash flows despite current volatility and losses reported in recent quarters.

- The analysis detailed in our Varonis Systems growth report hints at robust future financial performance.

- Dive into the specifics of Varonis Systems here with our thorough financial health report.

Key Takeaways

- Unlock our comprehensive list of 211 Undervalued US Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報