Highlighting December 2025's Growth Leaders With Insider Ownership

As the United States stock market grapples with concerns over an AI bubble, technology shares have been under pressure, causing declines in major indices like the Nasdaq and Dow Jones Industrial Average. In such a volatile environment, companies with strong growth potential and high insider ownership can offer investors a sense of stability and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 29.2% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Karman Holdings (KRMN) | 17.3% | 78.5% |

| Credo Technology Group Holding (CRDO) | 10.4% | 30.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.4% | 27.1% |

Underneath we present a selection of stocks filtered out by our screen.

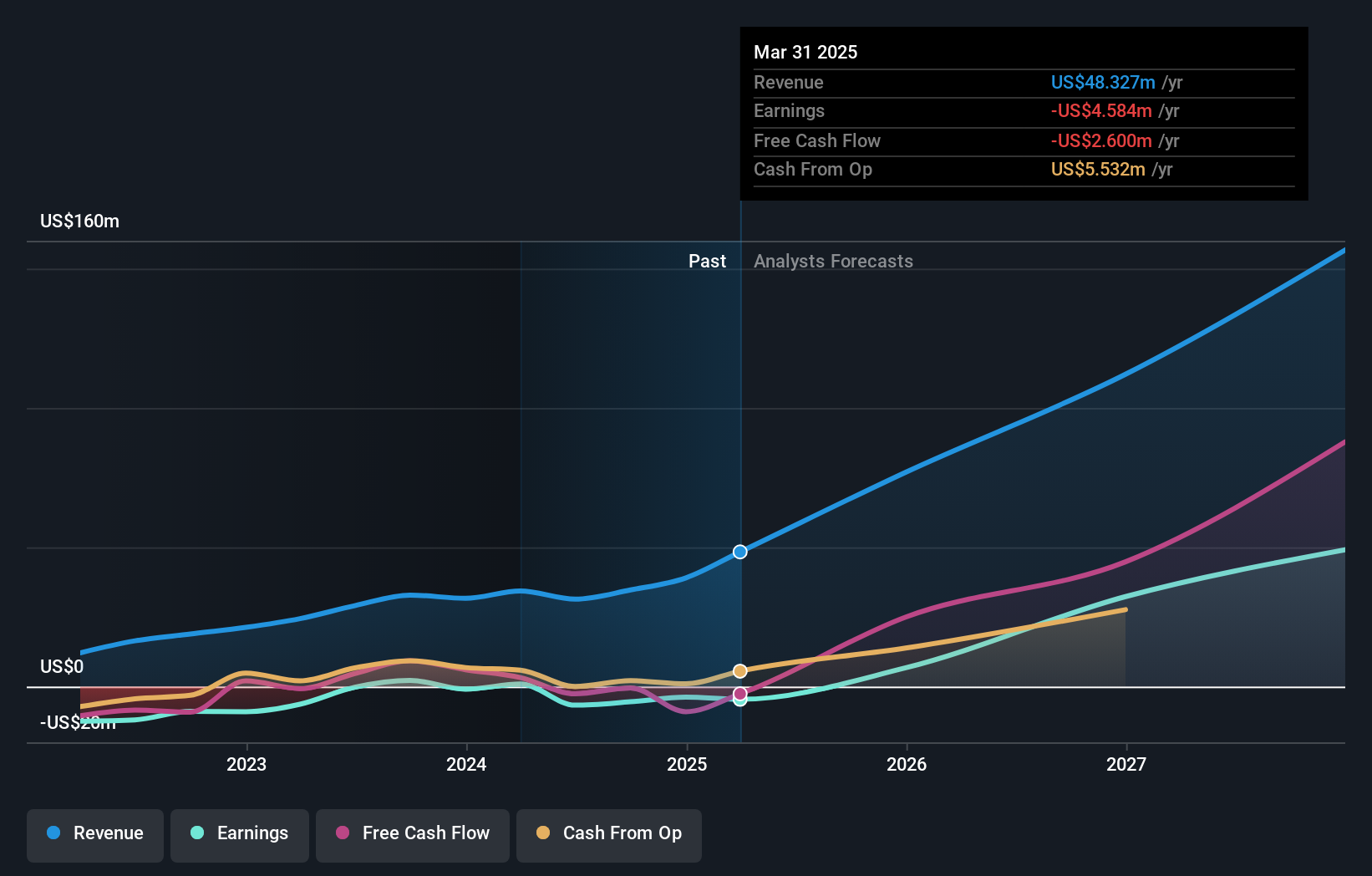

Eton Pharmaceuticals (ETON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eton Pharmaceuticals, Inc. is a pharmaceutical company dedicated to developing and commercializing treatments for rare diseases, with a market cap of $447.85 million.

Operations: The company's revenue is primarily derived from its segment focused on developing and commercializing prescription drug products, totaling $70.32 million.

Insider Ownership: 14.7%

Return On Equity Forecast: N/A (2028 estimate)

Eton Pharmaceuticals is poised for significant growth, with revenue expected to increase by 25.4% annually, outpacing the US market. Analysts anticipate a transition to profitability within three years, suggesting above-average market growth potential. Despite trading at 85.1% below estimated fair value and consensus on a 79.6% price rise, recent earnings show increased revenue but also higher net losses compared to the previous year. Recent shelf registration filings indicate potential capital raising efforts ahead.

- Click here and access our complete growth analysis report to understand the dynamics of Eton Pharmaceuticals.

- Upon reviewing our latest valuation report, Eton Pharmaceuticals' share price might be too pessimistic.

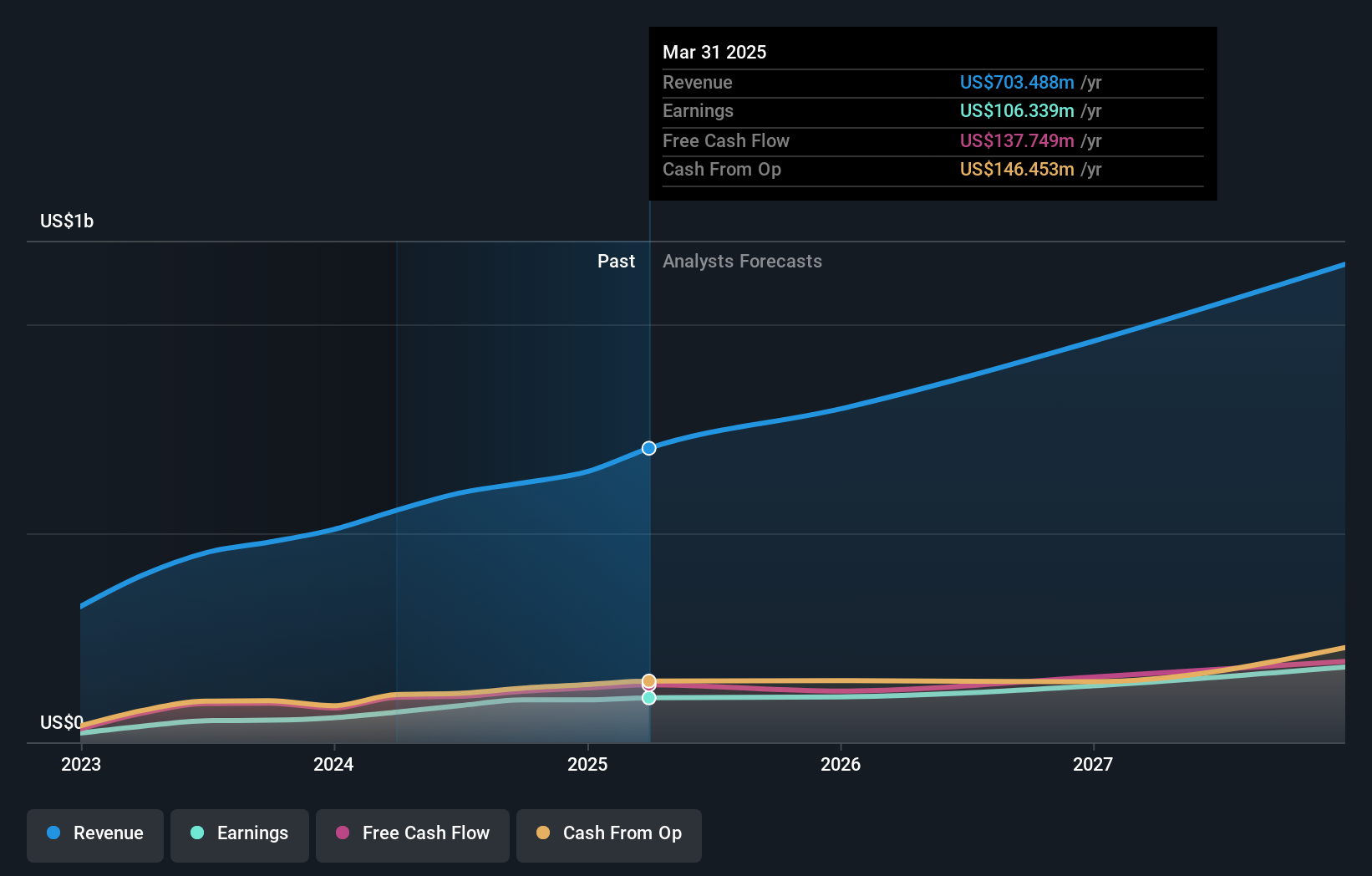

Oddity Tech (ODD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oddity Tech Ltd. is a consumer tech company that creates digital-first brands for the beauty and wellness sectors, operating in the United States and internationally, with a market cap of $2.52 billion.

Operations: The company's revenue is derived from its Personal Products segment, totaling $780.76 million.

Insider Ownership: 21.7%

Return On Equity Forecast: 31% (2028 estimate)

Oddity Tech's revenue is forecast to grow at 16.4% annually, surpassing the US market average of 10.6%. Recent guidance revisions indicate stronger-than-expected earnings for 2025, with projected net revenue between US$806 million and US$809 million. The company launched METHODIQ, a telehealth platform aimed at expanding its dermatology offerings. Despite trading below fair value estimates, Oddity shows robust growth potential with earnings expected to outpace the broader market by growing at 17.2% annually.

- Click to explore a detailed breakdown of our findings in Oddity Tech's earnings growth report.

- Our valuation report here indicates Oddity Tech may be undervalued.

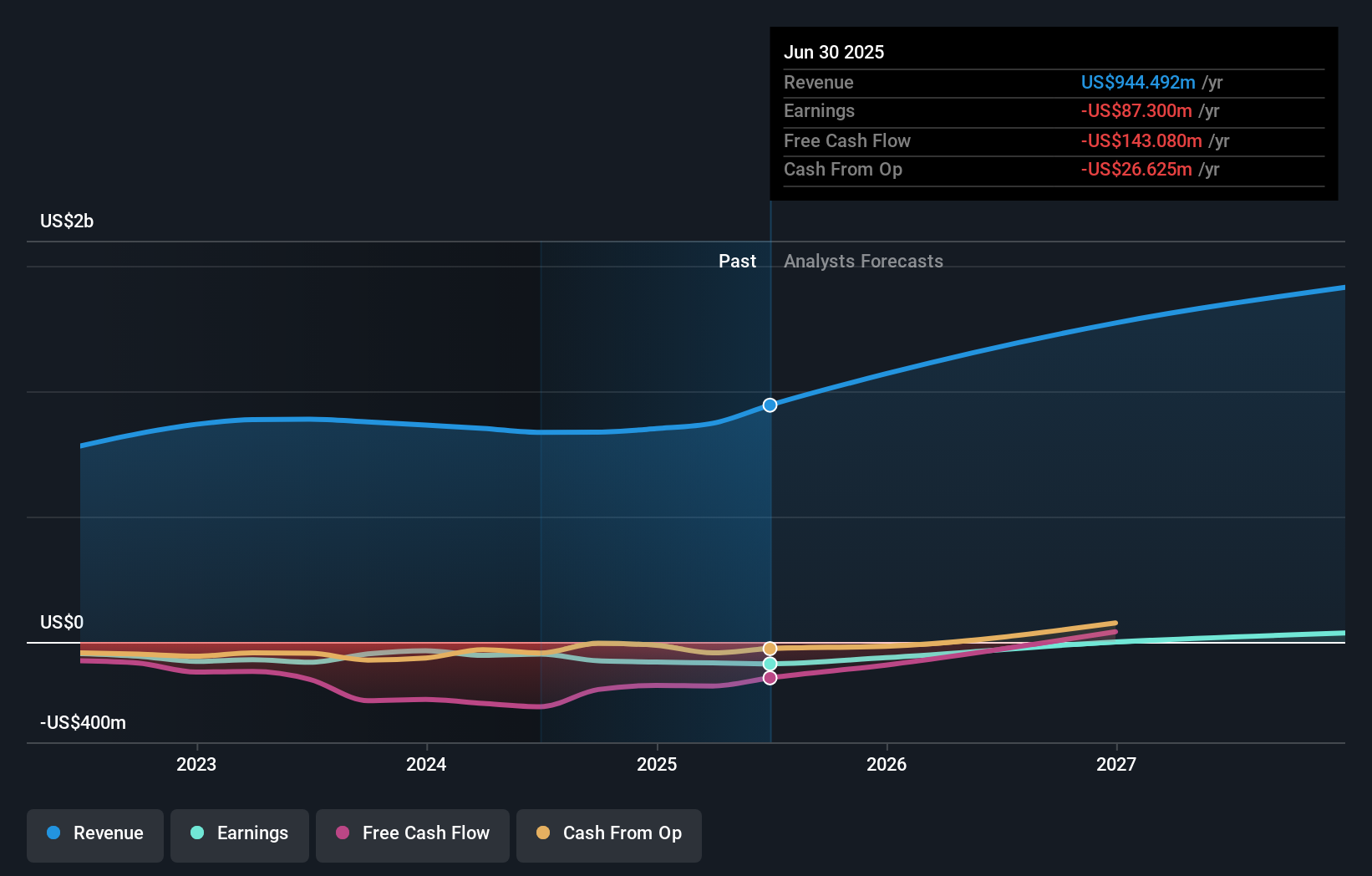

Westrock Coffee (WEST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Westrock Coffee Company, LLC is an integrated provider of coffee, tea, flavors, extracts, and ingredients solutions operating both in the United States and internationally with a market cap of $447.33 million.

Operations: The company generates revenue through its Beverage Solutions segment, which accounts for $810 million, and its Sustainable Sourcing & Traceability segment, contributing $280.67 million.

Insider Ownership: 15.4%

Return On Equity Forecast: N/A (2028 estimate)

Westrock Coffee's revenue is forecast to grow at 15.4% annually, outpacing the US market average of 10.6%. Insiders have shown confidence through substantial share purchases recently. Despite a net loss increase to US$19.1 million in Q3 2025, sales surged to US$354.83 million from US$220.86 million year-on-year, indicating strong top-line growth. The company trades significantly below its estimated fair value and aims for profitability within three years, supported by recent debt financing adjustments and private placements totaling $30 million.

- Navigate through the intricacies of Westrock Coffee with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Westrock Coffee implies its share price may be lower than expected.

Turning Ideas Into Actions

- Investigate our full lineup of 204 Fast Growing US Companies With High Insider Ownership right here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報