US Market's Undiscovered Gems Featuring 3 Promising Small Caps

As the United States market experiences fluctuations with technology shares impacting major indices like the Nasdaq and S&P 500, investors are keenly observing economic indicators such as employment data and retail sales for insights into small-cap performance. In this dynamic environment, identifying promising small-cap stocks can be crucial, as these companies often offer unique growth opportunities that may not yet be reflected in broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

United Fire Group (UFCS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: United Fire Group, Inc. operates as a provider of property and casualty insurance for individuals and businesses across the United States, with a market cap of approximately $937.91 million.

Operations: UFCS generates revenue primarily from its property and casualty insurance segment, which accounts for $1.35 billion.

United Fire Group, an insurance player in the U.S., has shown a robust earnings increase of 122% over the past year, outpacing the industry average of 11.6%. With a price-to-earnings ratio at 8.4x, it trades below the broader market's 19.1x, indicating potential value for investors. The company’s interest payments are well-covered by EBIT with a coverage ratio of 14.2x, suggesting financial stability despite its debt-to-equity ratio rising to 16.3% over five years. Recent dividends and strategic tech investments highlight efforts to enhance profitability amidst climate-related challenges and competitive pressures in the sector.

Transcontinental Realty Investors (TCI)

Simply Wall St Value Rating: ★★★★☆☆

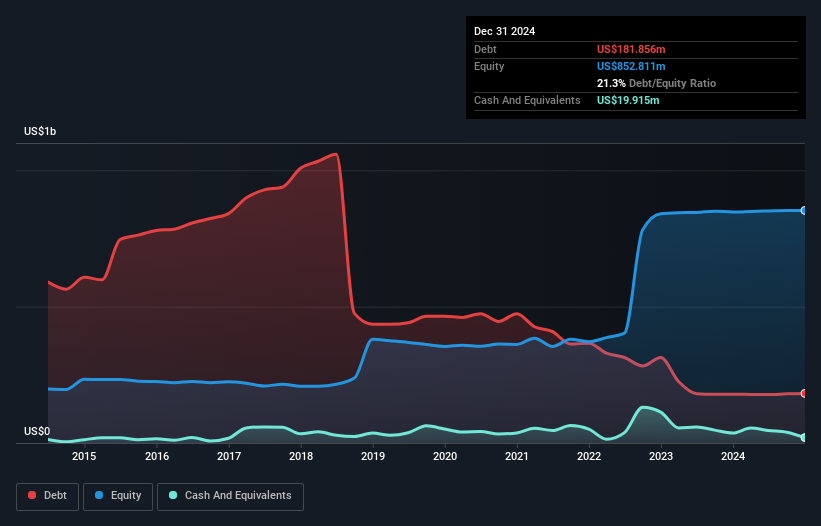

Overview: Transcontinental Realty Investors, Inc., based in Dallas, is a real estate investment company with a diverse portfolio of equity real estate across the U.S., and has a market cap of $431.27 million.

Operations: Transcontinental Realty Investors generates revenue primarily from its multifamily and commercial segments, with $34.44 million and $14.36 million respectively. The company experiences a segment adjustment of -$0.12 million in its financials.

Transcontinental Realty Investors, a small player in the real estate sector, has seen its earnings grow by 76% over the past year, outpacing the industry average of 15.5%. Over five years, its debt to equity ratio improved significantly from 122.9% to 26.1%, indicating better financial health. However, a $5M one-off gain influenced recent results. Despite this boost, earnings have decreased annually by an average of 5.2% over five years and free cash flow remains negative. Recent quarterly sales hit US$11.92M with net income at US$0.72M compared to US$1.71M last year, reflecting mixed performance dynamics.

- Click here to discover the nuances of Transcontinental Realty Investors with our detailed analytical health report.

Learn about Transcontinental Realty Investors' historical performance.

Universal Insurance Holdings (UVE)

Simply Wall St Value Rating: ★★★★☆☆

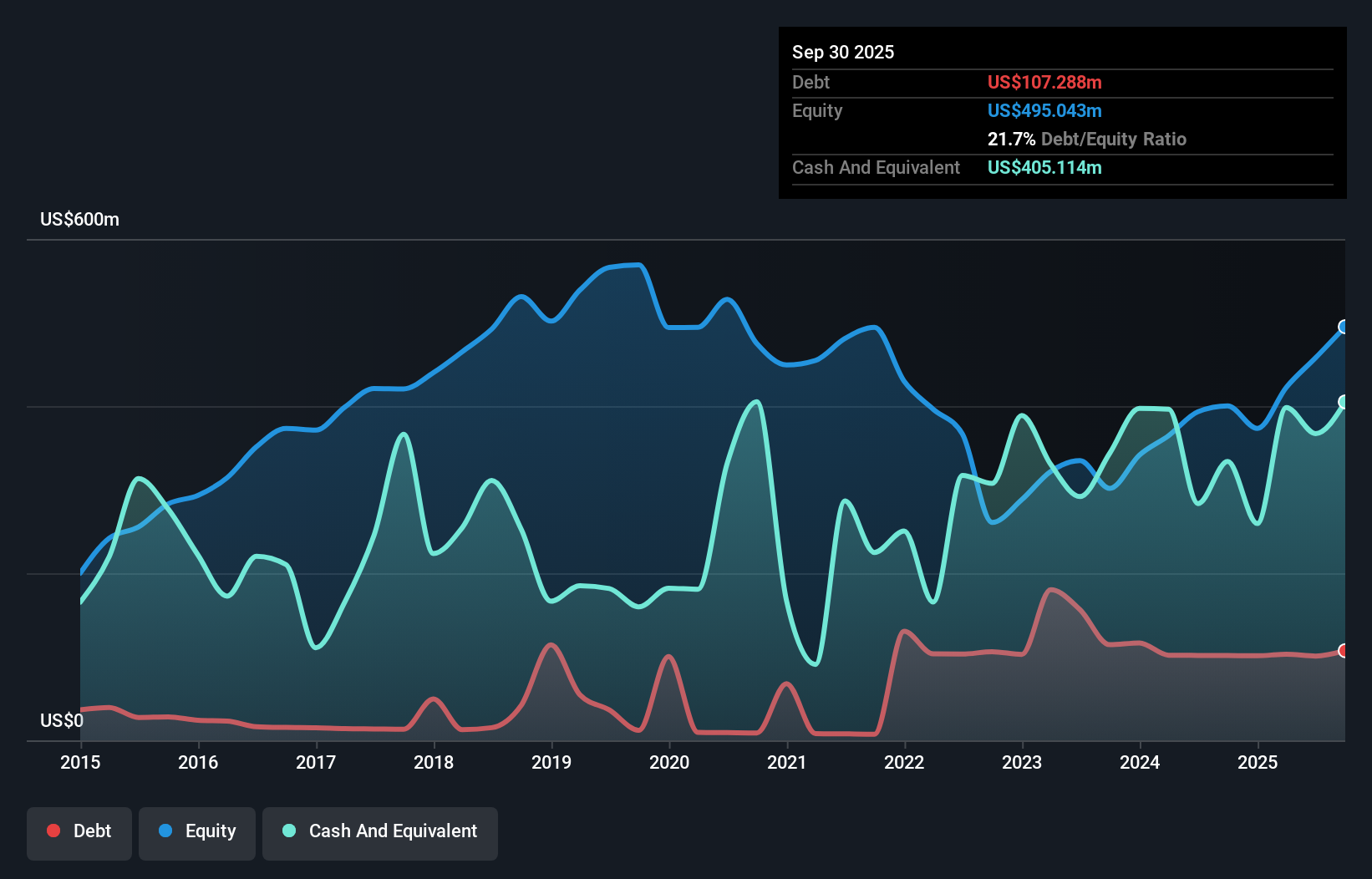

Overview: Universal Insurance Holdings, Inc. operates as an integrated insurance holding company in the United States with a market capitalization of approximately $926.17 million.

Operations: Universal Insurance Holdings generates revenue primarily from its Property & Casualty insurance segment, amounting to approximately $1.58 billion. The company's financial performance is influenced by its cost structure and operational efficiencies, with a focus on maintaining competitive margins within the industry.

Universal Insurance Holdings, a dynamic player in the insurance sector, has seen its earnings surge by 67.9% over the past year, outpacing the industry average of 11.6%. With cash reserves surpassing its total debt, this company exhibits financial robustness. Recent buybacks of 527,733 shares for US$12.9 million reflect a strategic move to enhance shareholder value. Despite facing competition and potential weather-related risks in Florida, Universal's geographic diversification and tech investments promise improved underwriting efficiency and net margins. Analysts foresee a modest revenue dip but expect profit margins to rise over time due to these strategies.

Seize The Opportunity

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 299 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報