Assessing Sinopec (SEHK:386)’s Valuation as Gas Demand Recovers and CCUS Expansion Shapes Its Transition Story

China Petroleum & Chemical (SEHK:386) is back in focus as China’s natural gas demand is projected to grow 5% next year, while Sinopec scales up carbon capture projects and explores new CCUS partnerships.

See our latest analysis for China Petroleum & Chemical.

Those CCUS moves and the improving gas demand backdrop seem to be nudging sentiment in Sinopec’s favor, with the share price at HK$4.42 and a 90 day share price return of 4.74%. The five year total shareholder return of 102.74% suggests long term momentum has quietly been building.

If this mix of energy transition and steady cash generation appeals to you, it could be worth exploring aerospace and defense stocks as another way to find large, strategically important businesses shaping global trends.

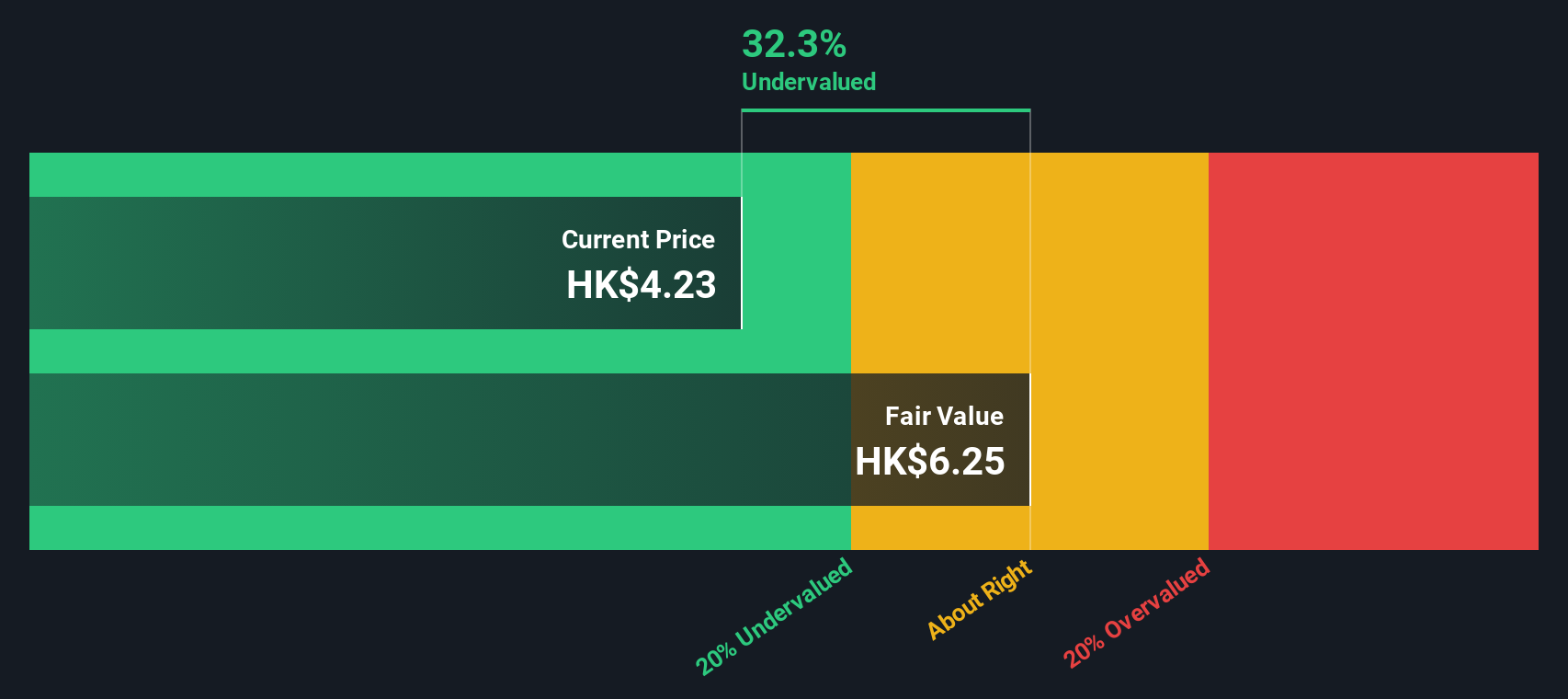

With earnings growing faster than revenue and shares still trading at a sizeable intrinsic discount, investors now face a key question: is Sinopec a rare value opportunity, or is the market already pricing in this next leg of growth?

Price-to-Earnings of 13.5x: Is it justified?

On a price-to-earnings basis, China Petroleum & Chemical looks expensive at 13.5x earnings versus both its Hong Kong oil and gas peers and the wider market.

The price-to-earnings ratio compares the current share price with the company’s earnings per share, making it a quick gauge of how much investors are paying for today’s profits.

In Sinopec’s case, the market is paying more per unit of earnings than for the average Hong Kong oil and gas stock. Revenue growth is expected to trail the broader market and returns on equity are forecast to remain modest. However, when this is set against our estimated fair price-to-earnings ratio of 15.8x and a DCF fair value of around HK$8.71 per share, that premium looks less stretched and could instead reflect expectations of solid, though not explosive, earnings growth ahead.

Compared with the Hong Kong oil and gas industry average of 9x earnings and a peer group average of 8.8x, Sinopec’s 13.5x multiple stands out as meaningfully richer. This suggests investors are already baking in a more resilient earnings profile than many domestic rivals.

Explore the SWS fair ratio for China Petroleum & Chemical

Result: Price-to-Earnings of 13.5x (ABOUT RIGHT)

However, softer commodity prices or a setback in China’s gas demand recovery could quickly deflate sentiment and challenge the current valuation premium.

Find out about the key risks to this China Petroleum & Chemical narrative.

Another View: SWS DCF Model Signals Deeper Value

While the 13.5x price to earnings ratio looks merely fair on a relative basis, our DCF model paints a different picture. With shares at HK$4.42 versus an estimated fair value of about HK$8.71, Sinopec appears meaningfully undervalued. Is the market underestimating its future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Petroleum & Chemical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Petroleum & Chemical Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your China Petroleum & Chemical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities in minutes with targeted stock lists built to highlight powerful momentum and undervalued potential.

- Capture potential multi-baggers early by reviewing these 3612 penny stocks with strong financials with the financial strength to support sustained growth instead of speculative hype.

- Position yourself at the heart of the AI surge by focusing on these 26 AI penny stocks where real revenue traction backs the innovation story.

- Strengthen your portfolio’s long term return engine by filtering for these 901 undervalued stocks based on cash flows that trade below their estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報