Evaluating SL Green Realty’s valuation after strong 2025 Manhattan leasing momentum and rising investor optimism

SL Green Realty (SLG) just reported 2.3 million square feet of Manhattan office leases signed in 2025, plus a 1.2 million square foot pipeline, putting its same store occupancy target of 93% within sight.

See our latest analysis for SL Green Realty.

Even with this leasing momentum and a latest share price of $44.64, the 7 day share price return of 7.49% comes after a much steeper 90 day share price decline of 32.02%. At the same time, the 3 year total shareholder return of 66.77% shows that long term investors who rode the recovery still remain meaningfully ahead.

If SL Green’s rebound has you rethinking where momentum could build next, this might be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas for your watchlist.

With leasing demand firming and shares still sitting well below analyst targets despite a strong three year recovery, the key question now is whether SL Green is genuinely undervalued or if the market is already pricing in a full rebound.

Most Popular Narrative Narrative: 21.4% Undervalued

With SL Green Realty last closing at $44.64 against a narrative fair value of $56.79, the implied upside rests on some punchy long term assumptions.

Value add developments and transformative projects (such as One Vanderbilt and the potential Caesars Palace Times Square casino) have the potential to unlock new high margin revenue streams, increase portfolio valuation, and materially expand SL Green's income base in the medium to long term.

Curious how flat top line expectations can still justify a rich future earnings multiple and a double digit margin shift, all under a sub 10% discount rate? Unpack the full narrative to see how those moving pieces combine into that upside target.

Result: Fair Value of $56.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest costs and unpredictable asset sales could easily derail margin expansion and compress valuation multiples if refinancing and disposition plans disappoint.

Find out about the key risks to this SL Green Realty narrative.

Another Way To Look At Value

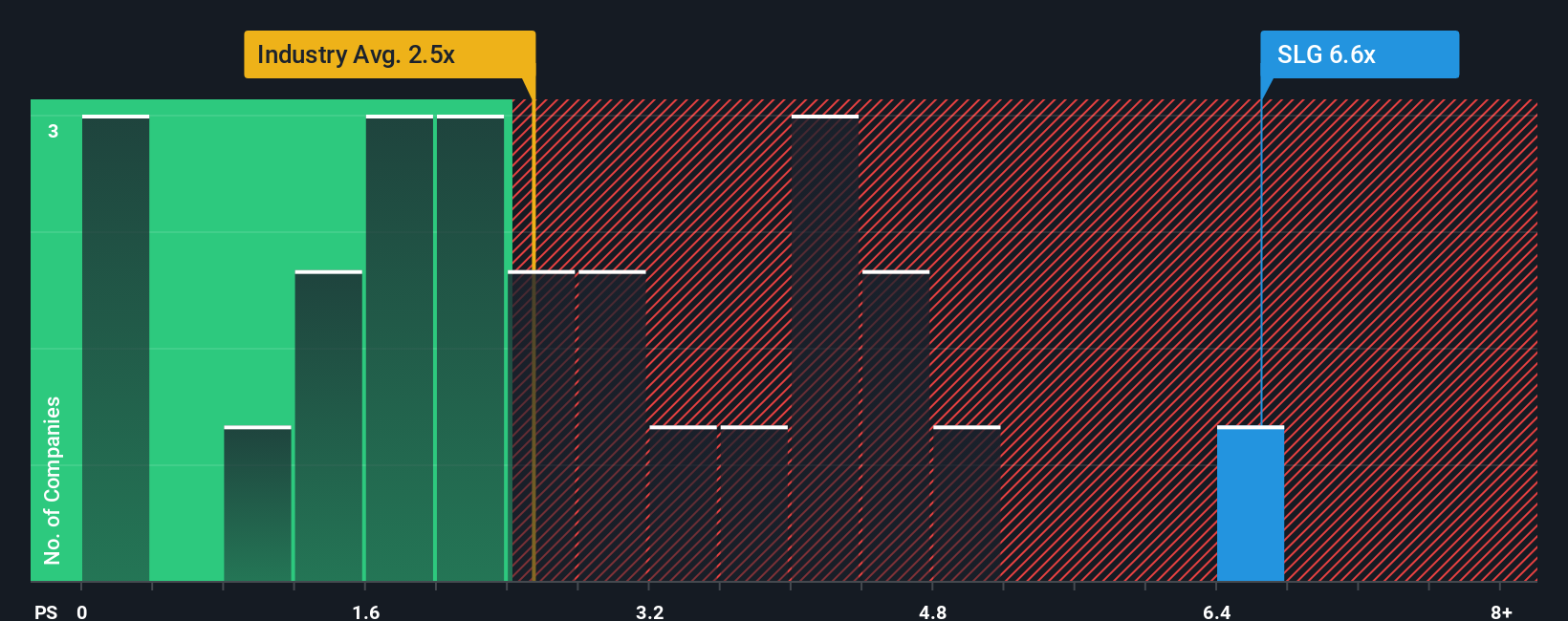

Our valuation checks flag a very different message from the narrative fair value. On a price to sales basis of 4.8 times versus an industry 2.1 times, a peer average 3.5 times, and a fair ratio of 2 times, SL Green screens as clearly expensive. Could sentiment be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SL Green Realty Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a custom narrative in minutes, Do it your way

A great starting point for your SL Green Realty research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall St Screener to spot your next move before the crowd, and keep your capital working in opportunities that match your strategy with precision.

- Lock in potential long term income by targeting reliable payouts from these 13 dividend stocks with yields > 3% that can help anchor your portfolio through shifting market cycles.

- Ride structural growth in digital assets with these 80 cryptocurrency and blockchain stocks that focus on companies building real world applications around blockchain and decentralized finance.

- Catch powerful secular trends early by scanning these 26 AI penny stocks where innovative businesses are using artificial intelligence to reshape entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報